IMS – ITC Summary

If you are on TallyPrime Release 7.0 and later, it is recommended to download the latest invoices, set IMS Action status, and then view the IMS ITC Summary report.

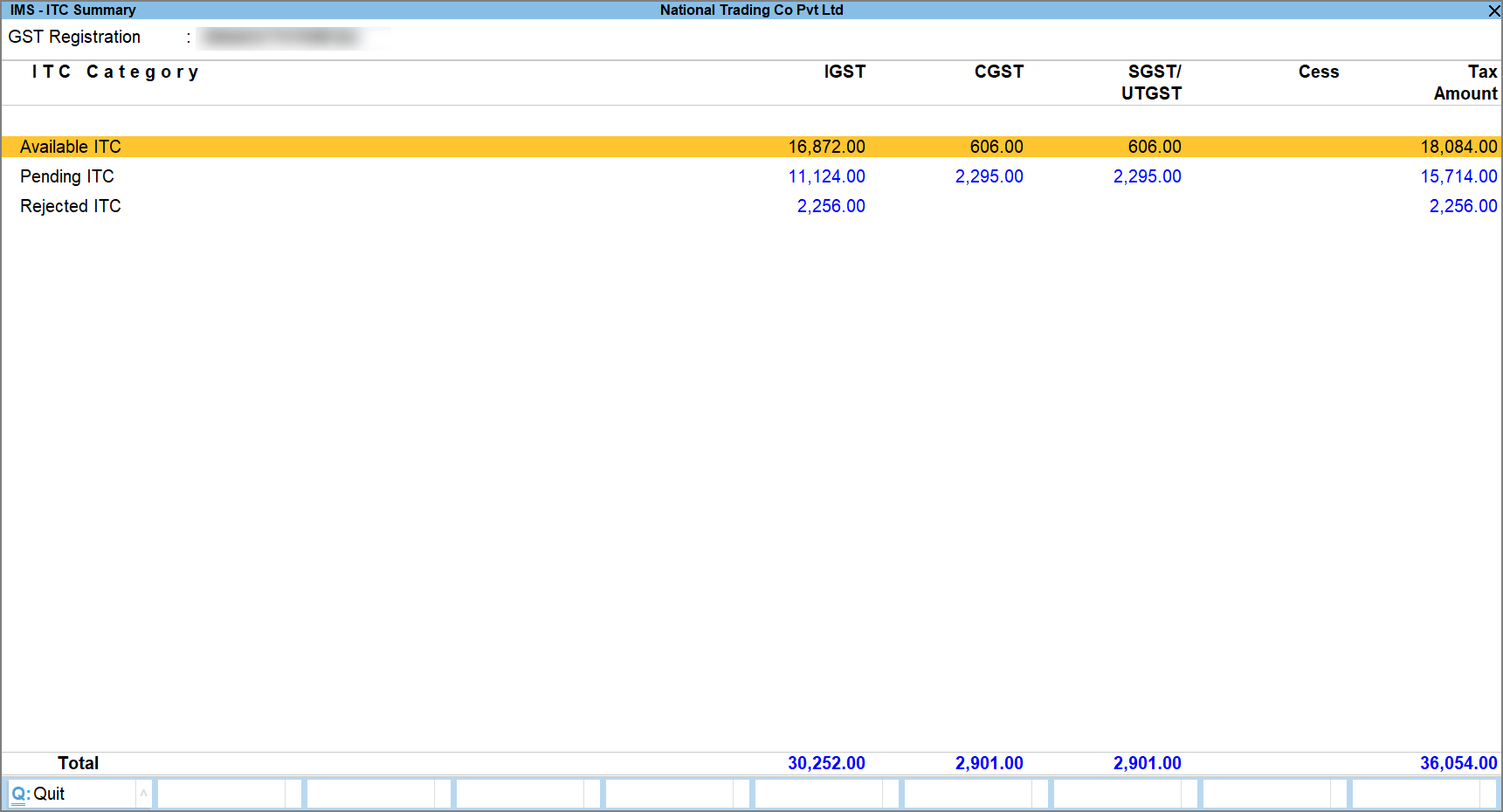

The IMS-ITC Summary report provides a consolidated view of your Input Tax Credit (ITC) status across all GST registrations in one place. As per the Action status in the invoices, this report categorises ITC into three distinct sections, Available ITC, Pending ITC, and Rejected ITC.

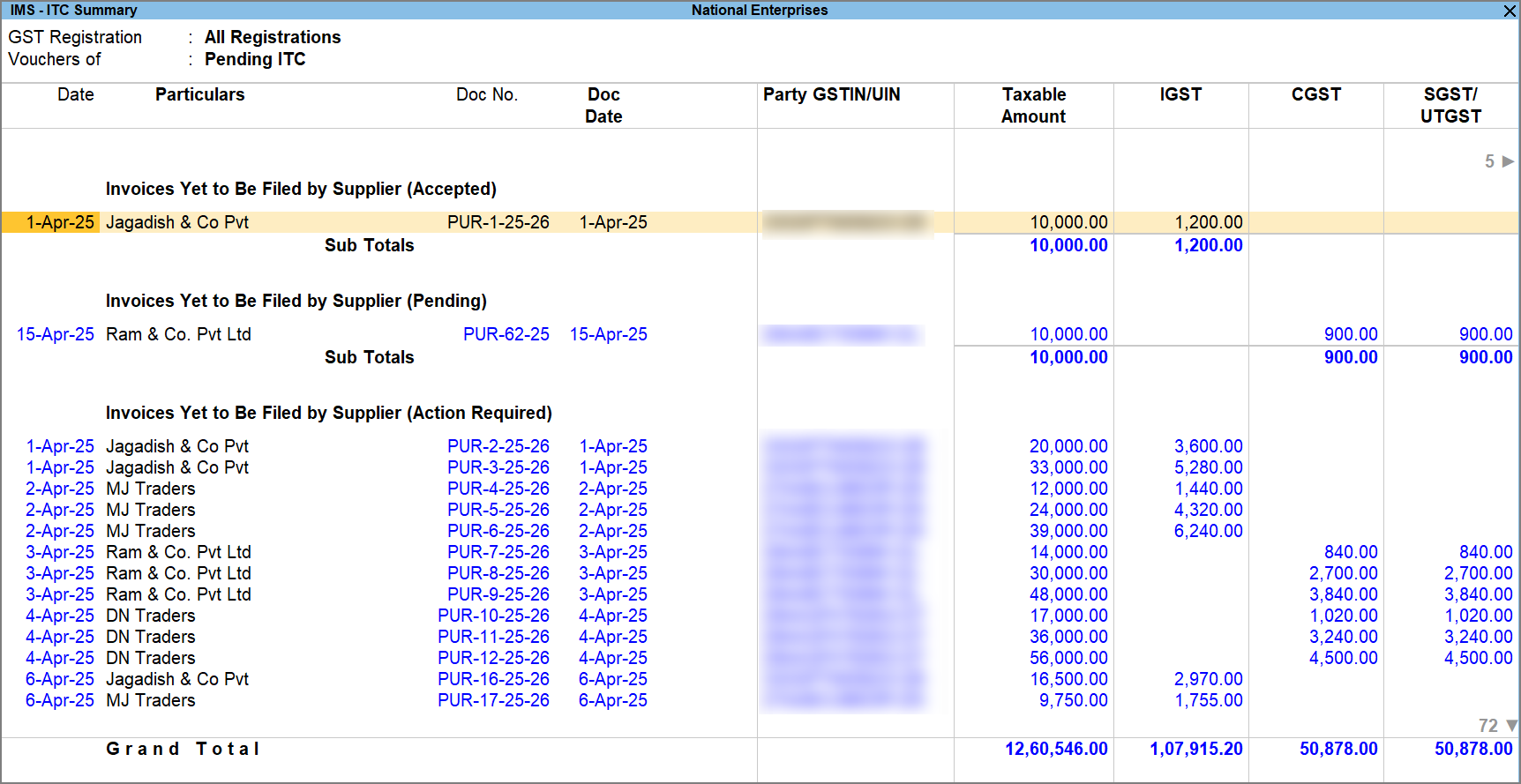

Each bucket offers an invoice-wise drill-down, giving you detailed insights into the underlying transactions and their corresponding statuses, as per the data fetched from the IMS Inward report.

-

Press Alt+G (Go To) > type and select IMS – ITC Summary and press Enter.

-

Available ITC: Available ITC includes the ITC from invoices marked as Accepted and as No Action. In line with the ITC reduction rule specified by the GST department, reduced ITC and the B2BCN values are deducted from the total available ITC. Hence, the remaining balance is displayed as Available ITC in the IMS ITC Summary report. These amounts are eligible to be claimed in GSTR-2B.

If you are on TallyPrime Release 6.2 or earlier, Available ITC includes the ITC from invoices marked as Accepted and as No Action. -

Pending ITC: Displays the ITC from invoices marked as Pending, which are excluded from the current period’s GSTR-2B but can be accepted and claimed later.

-

Rejected ITC: Shows the ITC from invoices marked as Rejected, which are not considered for input credit in the current or future periods.

Each section is further broken down into IGST, CGST, SGST/UTGST, Cess, and the overall Tax Amount, giving you clarity about the tax components as well.

-

-

Drill down from the respective section for a detailed view of the selected ITC Category.

You can view the list of invoices along with the tax details.