View Updated Income Tax Slabs as per Finance (No. 2) Bill 2024-25

For employees under the new tax regime, the Income Tax Computation report now covers the latest income tax slabs.

As per Finance (No. 2) Bill for 2024-25, the following changes are applicable from 1st April 2024.

- Under section 115BAC, new tax slabs have been announced for employees opting for the new tax regime, while the regular/old tax regime remains unchanged.

- Under section 16, the Standard Deduction has been raised from Rs. 50,000 to Rs. 75,000 for employees under the new tax regime.

- Under section 80CCD, the Employer Contribution to NPS has increased from 10% to 14% for employees under the new tax regime, while the Employer Contribution for the old regime remains at 10%. Employee contributions stay at 10% in both the regimes.

In this way, the Income Tax Computation report will help you comply with the latest income tax slabs.

View Income Tax Slab Rates for Employees Under Regular Tax Regime

As per Finance (No. 2) Bill 2024-25, there is no change in the income tax slab rates for employees under the regular tax regime. You can view the details of the existing tax slab rates in the Income Tax Computation report.

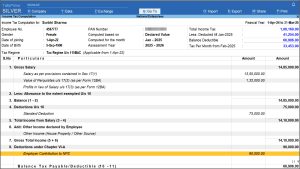

- Press Alt+G (Go To) > Computation, and select the Employee.

The Income Tax Computation report appears.

- Drill down from the 10. Tax on Total Income section.

The Tax On Total Income screen appears, where you can view the income slabs and the respective tax rates.

View Income Tax Slab Rates for Employees Under New Tax Regime

As an employer, you need to process the payroll transactions for all employees at the end of every month. The Income Tax Computation report will help you to remain compliant with the latest budget changes and ensure precise tax computation for your employees who are under the new tax regime.

- Press Alt+G (Go To) > Computation, and select the Employee.

The Income Tax Computation report appears.

- Drill down from the 10. Tax on Total Income section.

The Tax On Total Income screen appears, where you can view the income tax as per the latest slab rates.

View updated Standard Deduction

- Press Alt+G (Go To) > Computation, and select the Employee.

The Income Tax Computation report appears, where you can view the under 4. Deductions U/s 16

View updated Employer Contribution to NPS