The following is a list of frequently asked questions (FAQs) on TCS.

TCS FAQs for Release 1.1.4

As per the provision by Department, TCS collection is not applicable on sales of ‘Any Other Goods’. However, certain businesses collect TCS on sales invoice. Therefore, TallyPrime supports collection of TCS on sales of ‘Any other Goods’. Click here to know more.

As per provision by Department, TCS collection is applicable above the set threshold limit. However, certain businesses practice collection of TCS Rs 1 onward. In TallyPrime, you can apply TCS for sales transaction value Rs 1 onward. Click here to know more.

In the PAN not available for party screen of Form 27EQ – Uncertain Resolution, keep the cursor on PAN No. field. Enter one of the terms given below, based on the corresponding reason:

- PANAPPLIED – If the party has given a declaration stating that he/she has applied for PAN, but are yet to receive the same.

- PANINVALID – If the PAN format provided by the party is incorrect.

- PANNOTAVBL – If the party has not given any declaration or PAN number.

The cursor will skip the PAN Status column. Once you save this screen, the voucher will be included in the return.

Yes. In TallyPrime Release 1.1.4, you can record collection of TCS on Advance Receipt for subsequent sale of goods. Click here to know more.

As per provision by Department, sales return, cancellation, or any adjustment in sales is not required as TCS collection is based on receipt. However, TallyPrime facilitates recording adjustments likes sales return or cancellation of goods.

As per provision by Department, TCS is exempted for the listed collectees or buyer – State Government, Central Government, and so on. The same can be configured in Tally for TDS exemption and accordingly generated return with relevant remarks.

TCS is not supposed to be collected when the buyer is liable to deduct TDS for the sales payment. You can configure the transactions for TCS exemption where TDS id deducted by the buyer and generate the Return with specific remarks.

No, it is not mandatory. If you have a multiple stock items where TCS is applicable, you can configure the Sales Ledger. While recording a sales invoice for the stock items using the same sales ledger, TallyPrime automatically calculates the TCS.

No. You can configure only your stock items and ledgers for TCS applicability.

TallyPrime has the flexibility of automatically adjusting the Advance Receipt in the subsequent sales transactions. Therefore, there is no option to select the Advance Receipt for adjustment.

No. At a given point, you can configure your party ledger for either TCS or TDS. However, you can have two different party ledgers, one configured for TCS and the other configured for TDS.

In TallyPrime, auto-calculation of TCS is supported only in the Accounting or Item mode. In the Voucher mode, you will need to provide the TCS value manually for calculation.

There is no provision to specify the Threshold Limit or upper limit for lower deduction in the party ledger. You will need to keep a track of the payments made to the party for a nature of payment and set the Application To date accordingly in the party ledger.

Add the TAN in the Company address and configure your Sales voucher to print along with the address. The TAN will appear in the printed invoice. Currently, there is no option to show TAN provided in Company TCS details while printing a sales voucher.

TallyPrime supports TCS computation for a specific period through the Auto-fill feature available in Journal voucher. The same cannot be done using Debit Note.

No. You will need to configure each party ledger separately for TCS applicability.

While recording the transaction, once the amount exceeds the Threshold Limit, TallyPrime automatically takes care of the TCS computation. Using Form 27EQ, you can view the list of parties for which the TCS has been calculated based on the Threshold Limit.

Scenario

In Release 1.1.4, while saving a purchase order, sales order, sales voucher or any voucher type, TallyPrime displays the following error message:

“Error in TDL Field TCSExp LedONG” Incorrect storage!

How to resolve such crash/TDL error in Sales Order, Purchase Order, delivery note, receipt note & other related vouchers?

Resolution

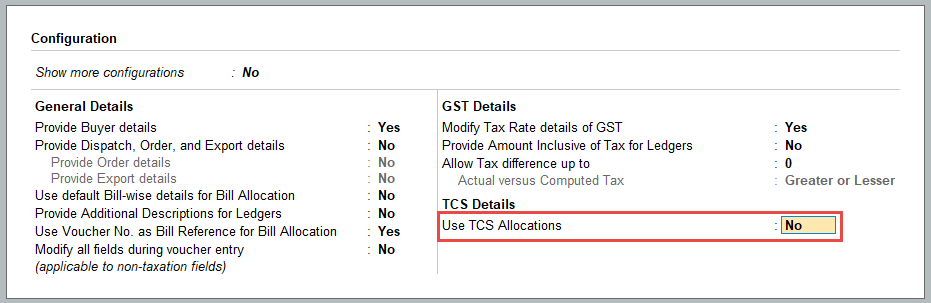

To resolve such an error, you need to disable the Use TCS Allocations option, under Sales Voucher > F12 (Configure).

When needed under Sales or receipt voucher, you can enable the same & later disable after use.

- A seller (Collector) provides services to the buyer (Collectee).

- The Collector collects the amount towards TCS prior to the services or the bills raised.

- The Collector issue a certificate of Collection of Tax at Source in the new form no. 27D to the Collectee and deposits the collected amount in the Authorised Bank (Treasury).

- The Seller files the Annual Returns electronically to the Income Tax department.

You can file your TCS returns at any of the TIN-FCs managed by NSDL. TIN-FCs are set-up at specified locations across the country. The details are given in the NSDL-TIN website. These can also be furnished directly at NSDL-TIN web-site.

No. Physical TCS returns/statements will be received at TIN-FCs.

The following information must be included in the E-TCS return for successful acceptance. If any of these essential details are missing, the returns will not be accepted at the TIN-FCs:

- Correct Tax-deduction/collection Account Number (TAN) of the collector should be clearly mentioned in Form No. 27B and also in the E-TCS return, as required by sub-section (2) of section 203A of the Income-tax Act.

- The particulars related to the deposit of tax collected at source in the bank should be correctly and properly filled.

- The data structure of the E-TCS return should be as per the structure prescribed by the e-Filing Administrator.

- The Control Chart in Form No. 27B (enclosed in paper form with the E-TCS return on CD/floppy) should be duly filled and signed.

The due dates for filing the quarterly TCS returns, both electronic and paper are as under:

|

Quarter |

Due Date for Form No.27EQ |

| April to June | 15 July |

| July to September | 15 October |

| October to December | 15 January |

| January to March | 30 April |

The procedure for filing of E-TCS return is the same as those of E-TDS return except the forms to be used are different. The relevant forms for filing the E-TCS returns are:

- Annual return: Form No. 27E, 27B (Control Chart)

- Quarterly statement: Form No 27EQ, 27B (Control Chart).

The E-TCS returns are also to be filed with NSDL at the various TIN-FCs.

No, you need not file TCS certificates and Bank Challans for tax deposited along with the E-TCS return.

No, each E-TCS return should be on a separate CD/floppy along with separate Form No. 27B for each return.

Yes, if an E-TCS return file is filed in a compressed form, it should be compressed using Winzip 8.1 or ZipItFast3.0 (or higher version compression utility only), so as to ensure the quick and smooth acceptance of the file.

Yes, you should affix a label on the E-TCS CD/floppy for identification purpose. You should mention your PAN, TAN, name, Form No., Financial Year and period to which return pertains on the label affixed on the e-TCS return CD/floppy.

In case the PANs of some of the deductees are not mentioned in your E-TCS return, the Provisional Receipt will contain the count of missing PANs in the E-TCS return. You may file the details of the missing PANs within seven days of the date of Provisional Receipt to TIN-FC as a corrected E-TCS return.

The details regarding the help required for the filing of E-TCS are available on both, the Income-Tax Department website and the NSDL-TIN website. The TIN-FCs are also available for all related help in the E-filing of TCS returns.

Follow the procedure given below and then take a print out of Form 27D.

- Book the Sales with full amount (Sales Voucher) including TCS to be collected.

- Use TCS Helper (Alt+S) for TCS payment entry.

- Reconcile the TCS Account

- Print Form 27D. While printing the Form, select the appropriate TCS ledger, Date (From & To) and the Challan Till Date.

An E-TCS return is prepared in the data format and issued by an E-Filing Administrator. It is available on both the Income Tax Department website (www.incometaxindia.gov.in) and NSDL-TIN website (www.tin-nsdl.com). There is a validation software (File Validation Utility) available along with the data structure which should be used to validate the data structure of the E-TCS return prepared.

The E-TCS return should have the following features:

- Each E-TCS return file should be in a separate CD/floppy.

- Each E-TCS return file should be accompanied by a duly filled and signed (by an authorised signatory) physical Form No. 27B

- Each TCS return file should be on one CD/floppy. It should not span across multiple floppies.

- In case the size of an E-TCS return file exceeds the capacity of one floppy, it should be filed on a CD.

- In case an E-TCS return file has to be compressed, it should be compressed using Winzip 8.1 or ZipItFast 3.0 compression utility (or higher version thereof) to ensure the quick and smooth acceptance of the file.

- Labels should be affixed on each CD/floppy mentioning the name of the Collector, TAN, Form no. (i.e. 27E or 27EQ) and period to which the return pertains.

- There should not be any overwriting/striking off on Form No. 27B. If there is any, then the same should be rectified by an authorised signatory.

- No bank challan or copy of TCS certificate should be filed along with the E-TCS return file.

- The E-TCS return file should contain the TAN of the deductor/collector without which, it will not be accepted.

- The CD/floppy should be virus-free.

In case these requirements are not met, the E-TCS returns will not be accepted at TIN-FCs.

NSDL has made available a freely downloadable return preparation utility for the preparation of E-TCS returns. Additionally, you can develop your own software for this purpose or you may acquire the software from various third party vendors. A list of vendors, who have informed NSDL that they have developed a software for preparing E-TCS returns, is available on the NSDL-TIN website.

The forms used for filing the TCS returns are notified by CBDT. These forms are the same irrespective of whether the returns filed are electronic or physical. However, an E-TCS return is to be prepared as a clean text ASCII file in accordance with the specified data structure (file format) prescribed by ITD.

No, if the size of the return is more than what can be stored in one floppy then it should be stored in a CD.

Form No. 27B is a control chart of the quarterly E-TCS statements to be filed in a paper form by collectors with the quarterly statements. It is a summary of the E-TCS returns which contains the Control Totals of the ‘amount paid’ and ‘Income Tax collected at source’ as mentioned on Form No. 27B which should match with the corresponding Control Totals in the E-TCS return. A separate form No. 27B is to be filed for each E-TCS return.

In case of Annual Returns the relevant control charts for E-TCS are Form 27B.

While submitting Form No. 27B, one should ensure that:

- There is no overwriting/striking on Form No. 27B. If there is any, then the same should be ratified (signed) by the authorised signatory.

- Name and TAN of deductor and Control Totals of the ‘amount paid’ and ‘Income Tax deducted at source’ mentioned on Form No. 27B should match with the respective totals in the E-TCS return.

- All the fields in Form No. 27B are duly filled.

An E-TCS return should be prepared in accordance with the data structure (File Format) prescribed by the E-filing administrator. A separate data structure has been prescribed for each type of form irrespective of whether it is an Annual Return (up to FY 2004-05)or Quarterly Return (FY 2005-06 onwards).

The Bank Challan Number is a receipt number given by the bank branch where TCS is deposited. A separate receipt number is given for each challan deposited. You are required to mention this challan number in the E-TCS return and not the pre-printed numbers on the bank challan form i.e. ITNS 269 or ITNS 271.

The Reserve Bank of India has allotted a unique seven-digit code to each bank branch. You are required to mention the code of the bank branch where TCS is deposited in the E-TCS return. This code can be obtained from the bank branch where TCS amount is deposited.

Yes, it is mandatory to mention the 10 digit reformatted (new) TAN in your E-TCS return.

The following are the list of forms filed for TCS returns and their periodicity:

| Form No. | Particulars | Periodicity |

| Form No. 27E | Annual return of collection of tax under section 206C of Income Tax Act, 1961 | Annual |

| Form No. 27EQ | Quarterly statement of collection of tax at source | Quarterly |

Form 27B is the summary of the TCS statement. It has to be signed by the same person who is authorized to sign the TCS Statement in paper format.

The Bank Branch code or BSR code is a 7-digitcode allotted to banks by RBI. This is different from the branch code, which is used for bank drafts etc. This number is given in the OLTAS challan or can be obtained either from the bank branch or from the search facility at NSDL-TIN website. It is mandatory to quote the BSR code both in the challan and deductee details. Hence, this field cannot be left blank. Government deductors however, transfer their tax by a book entry system, in which case the BSR code can be left blank.

In case the PANs of some of the deductees are not mentioned in the E-TCS return, the Provisional Receipt will mention the count of missing PANs in the E-TCS returns. The details of missing PANs (to the extent that it is collected from the deductees) may be filed within seven days of the date of Provisional Receipt to TIN-FC. The E-TCS returns filed will be accepted even with missing PANs. However, if the PAN of the collectees is not given in the TCS return, then the tax collected from the payment received cannot be posted to the statement of TCS issued u/s 206C.

Yes. It is necessary to state the Challan Identification Number for all Non-Government deductors.

The PAN of the collectors has to be given by non-Government collectors. It is essential to quote the PAN of all the collectees because without it, the Credit of Tax collected cannot be given.

You can file a consolidated E-TCS return for all offices/branches, if you have more than one office/branch. In this case however, you should quote the same TAN. You can also file E-TCS returns office/branch-wise individually. In such cases you need to have a separate TAN for every branch. In case you do not have separate TANs for each branch then you should apply for a TAN for each of the branches and then file the E-TCS returns individually.

Suppose the receipt from the parties (on which TCS has been collected) has been made actually i.e. by cash, cheque, demand draft or any other acceptable mode, then ‘otherwise’ has to be mentioned in the specified field. But if the receipt has been actually received and merely a provision has been made on the last date of the accounting year, then the option ‘Paid by Book Entry’ is to be selected.

The Income Tax Department has made it mandatory for all corporate and government Collectors to furnish their TCS returns in an electronic form (E-TCS return) from the financial year 2004-2005 onwards. Collectors (other than government and corporates) may file their TCS returns in an electronic form through the TIN facilitation centres established by NSDL or by using a physical form to file their Returns at respective Income Tax Offices.

An Annual E-TCS return is the TCS return under section 206C of the Income Tax Act (prepared in Form No. 27E),which is prepared by the electronic media according to the prescribed data structure. Furnished in a CD/floppy, these returns filed should be accompanied by a signed verification in Form No. 27B in case of Annual TCS return.

The TCS returns filed in an electronic form as per section 206C, as amended by the Finance Act, 2005 are Quarterly TCS statements. As per the Income Tax Act, these quarterly statements are required to be furnished from FY 2005-06 onwards. The form used to file the Quarterly E-TCS statements is Form No. 27EQ.These statements filed in a CD/floppy should be accompanied by a signed verification in Form No. 27B in case of E-TCS statements.

As per the Income Tax Act, 1961, all corporate and government deductors/collectors are compulsorily required to file their TCS returns on electronic media (i.e. E-TCS returns). However, collectors other than corporate/government can file either a physical or electronic form.

All Drawing and Disbursing Officers of the Central and State Governments come under the category of Government Collectors.

An E-TCS return should be filed under Section206C of the Income Tax Act in accordance with the scheme dated March30, 2005 for the electronic filing of TCS returns as notified by CBDT for this purpose.

As per section 206C, as amended by the Finance Act 2005, collectors are required to file their quarterly TCS statements from the FY 2005-06onwards.

CBDT has appointed the Director General of Income Tax (Systems) as the E-Filing Administrator for the purpose of the electronic filing of TCS returns.

Yes, E-TCS return can be filed online using a digital signature.

TCS Certificate number cannot be automatically generated since, TCS certificate is a report and not a record.

Yes, after you have prepared your E-TCS return you can check/verify the same by using the File Validation Utility(FVU). This utility is freely downloadable from the NSDL-TIN website.

FVU is a program developed by NSDL, which is used to ascertain whether the E-TCS return file contains any format level error(s). When you pass an E-TCS return through FVU, it generates an ‘error/response file’. If there are no errors in the E-TCS return file, the error / response file will be display the control totals. If there are errors, the error/response file will display the error location and error code along with the error code description. Incase you find an error, you can rectify it and pass the E-TCS returns file again through the FVU till you get an error-free file.

Earlier the E-TCS return file had to be filed with the TIN-FVU by using the File Validation Utility (FVU).Now the ‘Upload File’ that is generated by the FVU when the return is validated can directly be filed with the TIN-FC. This ‘upload file’ is a file with the same filename as the ‘input file’ but with extension .fvu. Example ‘input file’ name is 27EQGov.txt, the upload file generated will be 27EQGov.fvu.

For the Annual Returns, FVU can be executed on any of the Windows platforms mentioned below: Win 95/Win 98/Win 2KProfessional/Win 2K Server/Win NT 4.0 Server/Win XP Professional. For the Quarterly Returns however, Java has to be installed to run FVU. These details are given in the FVU section of the NSDL-TIN website.

The Control Totals in Error/Response File are generated only when a valid file is generated. Otherwise, the Error/Response File shows the nature of error. The control totals are as under:

- Number of Collectee/Party records: In case of Form 27B/27D/27EQ/27E, it is equal to the total number of records of tax collection. 10 collection from 1party would mean 10 collectee records.

- Amount Paid: This is the Total Amount of all payments made on which tax was collected. Incase of Form 27B/27D/27EQ/27E, this is equal to the total of all the amounts on which tax has been collected at source.

- Tax Collected: This is the Total Amount of tax actually collected at source for all sales.

- Tax Deposited: This is the total of all the deposit challans. It is normally the same as Tax Collected but at times may be different due to the interest or other amount.

Yes, the Control Totals in Form 27B and in the Error/Response File are the same.

CBDT has appointed the National Securities Depository Limited, (NSDL), Mumbai, as the E-TCS Intermediary. NSDL has established TIN Facilitation Centres (TIN-FCs) across the country to facilitate deductors/collectors file their E-TCS returns.

In such a case the E-TCS return will not be accepted by the TIN-FC. You should ensure that the Control Totals generated by FVU and those mentioned on Form No. 27B match. In case of any difficulties/queries, you should either contact the TIN-FC or the TIN Call Centre at NSDL.

Yes, corrected E-TCS returns can be filed. You can file a corrected E-TCS return on account of any rectification or after incorporating missing PAN(s) details with any TIN-FC.

The procedure of correcting a quarterly E-TCS statement is yet to be notified by ITD.

In case you are submitting corrected annual E-TCS return, you should file the entire E-TCS return (and not only the amendments to the E-TCS returns) with all the documents submitted at the time of filing the original. You should also file a copy of the Provisional Receipt issued earlier for the original E-TCS return along with the corrected E-TCS return. You should also mention on the top right hand corner of Form 27B that eETCS return being filed is on account of any rectification other than missing PAN(s) or on account of incorporation of missing PAN(s).

You can file a corrected E-TCS return with any TIN-FC.

Yes. An upload fee is payable for each and every E-TCS return accepted by the TIN-FC, irrespective of whether it is a corrected e-TCS return or an original E-TCS return.

Yes, TIN-FC will issue a Provisional Receipt incase corrected E-TCS return file is valid and accepted by the TIN-FC. The Provisional Receipt issued by TIN-FC is deemed to be the proof of corrected E-TCS return filed by you.