Record Purchase Returns under GST in TallyPrime

When you have to return goods to the supplier, you can record such returns using a Debit Note. Further, you can also reverse the tax liability for the amount of the return using a Journal voucher.

The topic Purchases with GST in TallyPrime further showcases the business scenarios that TallyPrime handles with ease.

Let us proceed using the sample company, National Electronics, which has to return appliances to the supplier.

Before you begin | Prerequisites

- Ensure that the Stock Items and Service ledgers are configured as Applicable for Reverse Charge.

- Make sure you are familiar with creating Debit Notes and Journal vouchers.

Create Debit Note for Purchase Return Under GST

- Press Alt+G (Go To) > Create Voucher > press Alt+F5 (Debit Note).

- In Party A/c name, select the party from whom the purchase was made.

- In Dispatch Details, under Original Invoice Details, enter the Original Invoice No. and Date against which you are recording the purchase return.

- Enter the Name of Stock Item, Quantity, Rate, and tax ledgers.

- In Additional Details, enable Provide GST details.

- Select 01-Sales Return as the reason from the List of Reasons.

- Supplier’s Debit/Credit Note No.: Enter the credit note number provided by the supplier for the sales return.

- Date: Enter the date as per the credit note provided by the supplier.

- Complete the entries, and save the voucher by pressing Ctrl+A.

You can view the transaction in GSTR-3B under Included in Return. It will also appear as Purchase Returns in GSTR-3B – Voucher Register.

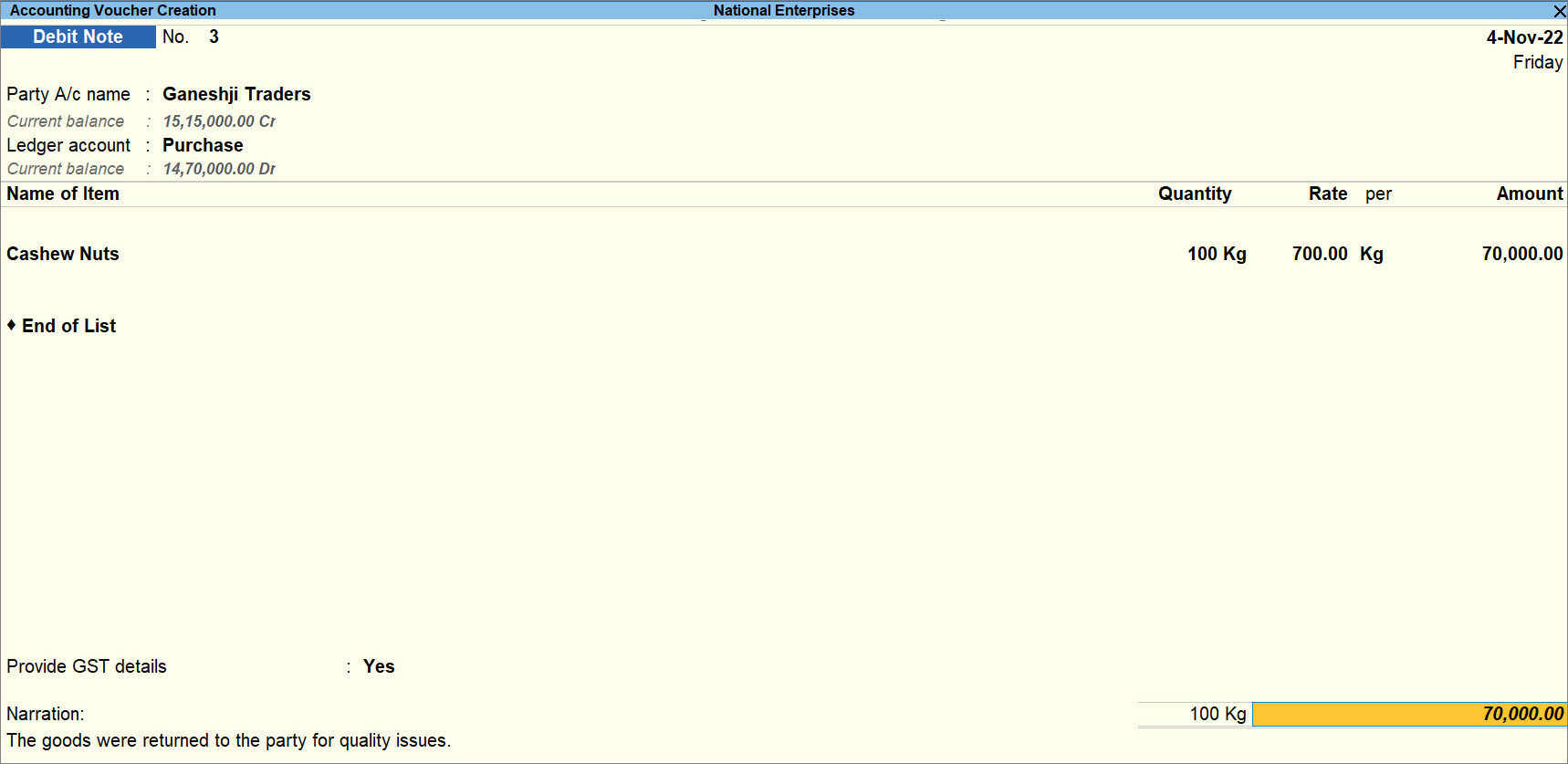

Create Debit Note for Purchase Return with RCM

- Press Alt+G (Go To) > Create Voucher > press Alt+F5 (Debit Note).

- In Party A/c name, select the party from whom the purchase was made.

- In Dispatch Details, under Original Invoice Details, enter the Original Invoice No. and Date against which you are recording the purchase return.

- Select the items you are returning to the supplier.

- Provide details related to the purchase return.

- Provide GST Details: Yes

- Reason for Issuing Note: Sales Return

- Supplier’s Debit/Credit Note No.: Enter the credit note number provided by the supplier for the sales return.

- Date: Enter the date as per the credit note provided by the supplier.

- Complete the entries, and save the voucher by pressing Ctrl+A.

You can view the transaction in GSTR-3B under Included in Return. It will also appear as Purchase Returns in GSTR-3B – Voucher Register.

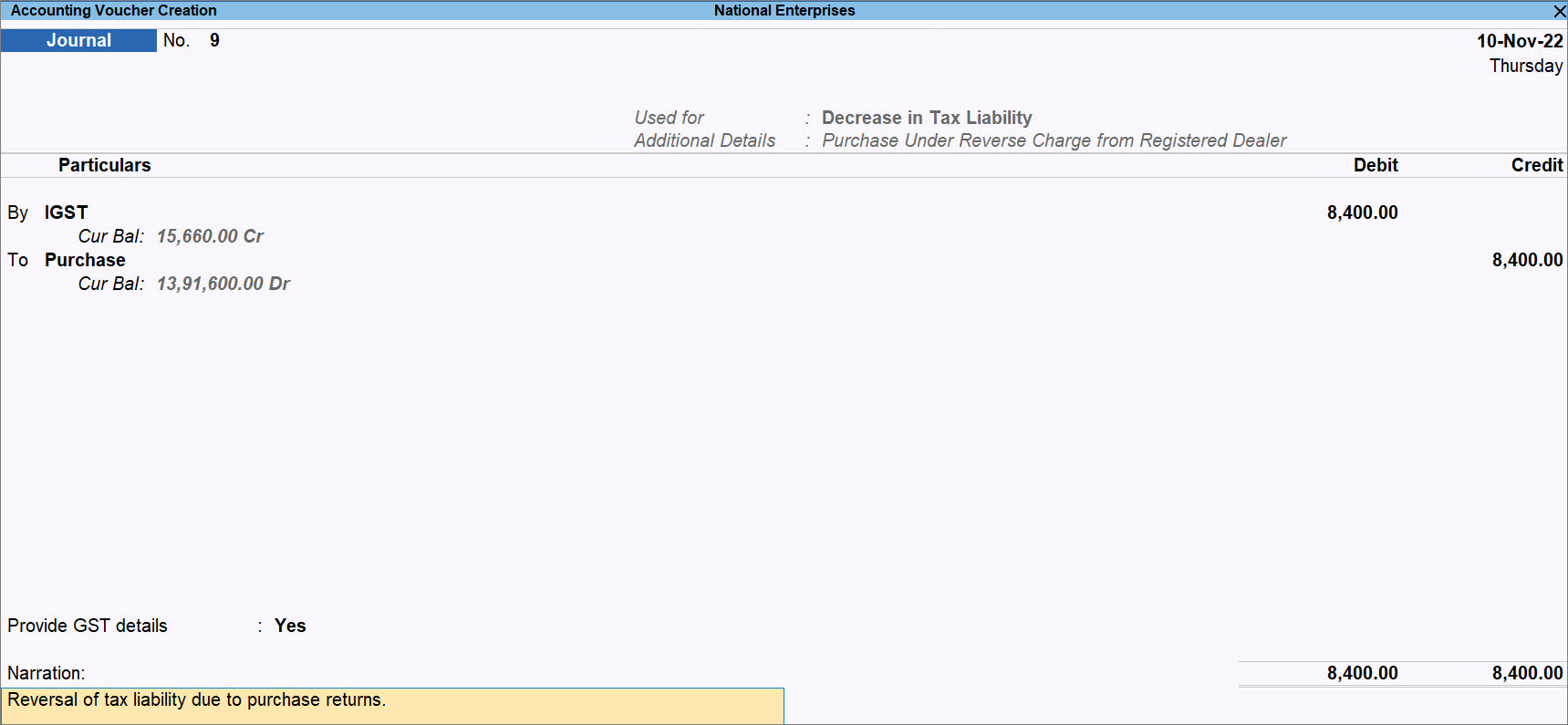

Reverse Tax Liability for Purchase Return

Using a single Journal voucher, you can record the reversal of tax liability for a period of time, say, a month.

- Press Alt+G (Go To) > Create Voucher > press F7 (Journal).

- Press Alt+J to update the Stat Adjustment Details:

- Type of duty/tax: GST

- Nature of Adjustment: Decrease in Tax Liability

- Additional Nature of Adjustment: Purchase Under Reverse Charge from Registered Dealer.

If the purchase was from an unregistered dealer, then select Purchase Under Reverse Charge from Unregistered Dealer.

- Debit the tax ledgers.

- Under By (Debit), select the tax ledgers.

- Enter the Rate and Taxable Value.

The Amount gets calculated, and can be updated, if needed.

- Credit the expense ledger and enter the Amount.

- Save the voucher by pressing Ctrl+A.

Once you record the journal voucher, it appears in GSTR-3B under Other Adjustments. As a Journal voucher is created, the Debit Note created for the same purchase return will not be relevant for the return and appear in GSTR-3B – Voucher Register under Transactions of Other GST Returns.

Good to know

- After reversing the tax liability, make your tax payments as usual.

- Similarly, address ITC/Penalty/Late Fee, as needed.