Reasons for Rejection of e-Way Bill and Resolutions

The following are the error descriptions and error codes for e-Way Bill provided by NIC. Error descriptions are self explanatory. Wherever additional explanation is required we have added those under resolutions column.

Error description: Ship to details are mandatory for export transactions to generate EWB.

This error might occur while recording an export transaction for the generation of e-Way Bill along with e-Invoice.

Cause

This error occurs when a foreign party is selected in both the Bill to and Ship to sections of the Party Details or Additional Details screen.

Moreover, in the Ship to section, you may have specified the Pincode as 999999 and the State as Other Territory, or you may have skipped the necessary Ship to details.

Resolution

You can easily fix this error by updating the necessary details in the Party Details or Additional Details screen of the recorded transaction.

Depending on whether you want to generate only e-Way Bill or both e-Invoice and e-Way Bill, you can refer to one of the following procedures.

For both e-Invoice and e-Way Bill

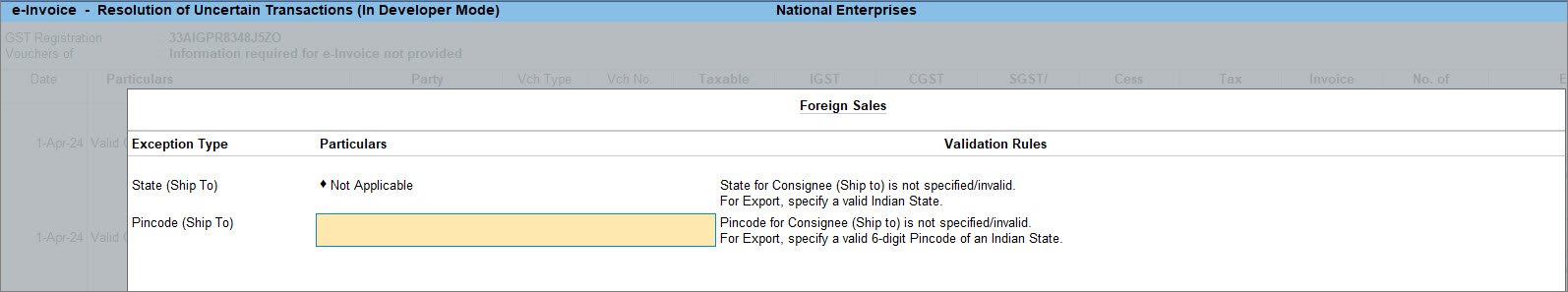

- Open the e-Invoice report.

- Drill down from Information required for e-Invoice not provided under Missing/Invalid Information section.

The e-Invoice – Resolution of Uncertain Transactions screen appears.

- Update the State (Ship To) and Pincode (Ship To).

You can update the Indian state and pincode at the time of recording transaction so that the transaction does not appear under Missing/Invalid Information section.

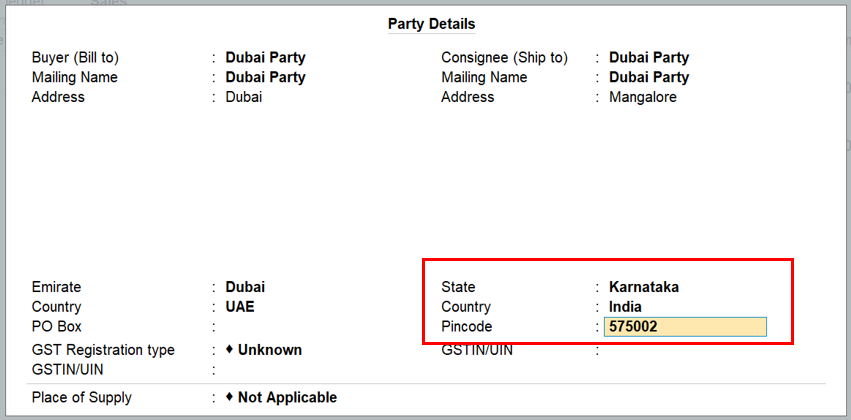

- Open the Sales Voucher.

- In the Party Details screen, update the State and pincode under Consignee (Ship to).

- In the Consignee (Ship to) section, specify the Country as India, and then specify the local State and the local Pincode.

For example, if goods are exported from a port in Mangalore, Karnataka, specify the Pincode of Mangalore.

- Press Ctrl+A to accept the details and then save the transaction.

The e-Way Bill will get generated successfully along with e-Invoice.

For only e-Way Bill

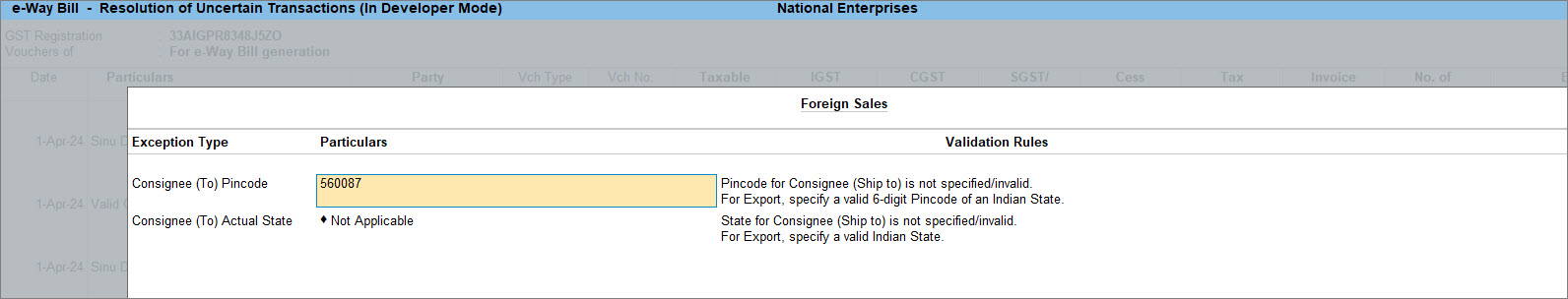

- Open the e-Way Bill report.

- Drill down from Information required for e-Way Bill not provided under Missing/Invalid Information section.

The e-Way Bill – Resolution of Uncertain Transactions screen appears.

- Update the Consignee (To) Pincode and Consignee (To) Actual State.

You can update the Indian state and pincode at the time of recording transaction so that the transaction does not appear under Missing/Invalid Information section.

- Open the Sales Voucher.

- In the Party Details screen, update the State and pincode under Consignee (Ship to).

If the Consignee (Ship To) is left blank or is updated with foreign country, then the e-Way Bill sub-form will not be updated.

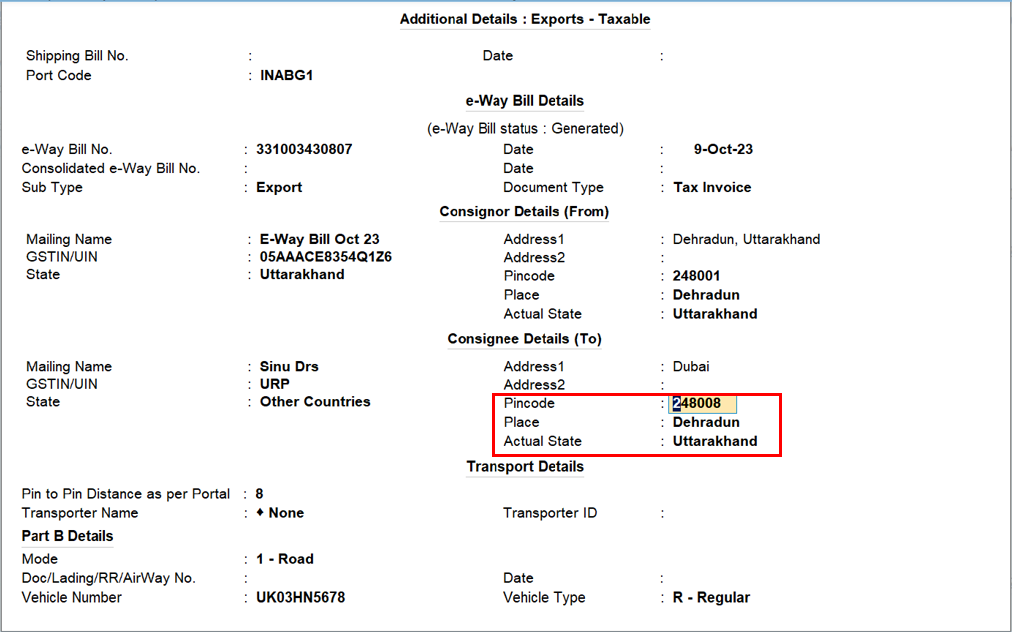

Or, - Update the Actual State and pincode in the e-Way Bill Sub-form.

- In the Consignee Details (To) section, specify the local state as Actual State, and accordingly, specify the local Place and the local Pincode.

For example, if the goods are exported from Dehradun in the Actual State of Uttarakhand, then specify the Pincode for Dehradun.

- Press Ctrl+A to accept the details and then save the transaction.

The e-Way Bill will get generated successfully.

To know more, refer to the e-Way Bill FAQ issued by the GSTN on export transactions.

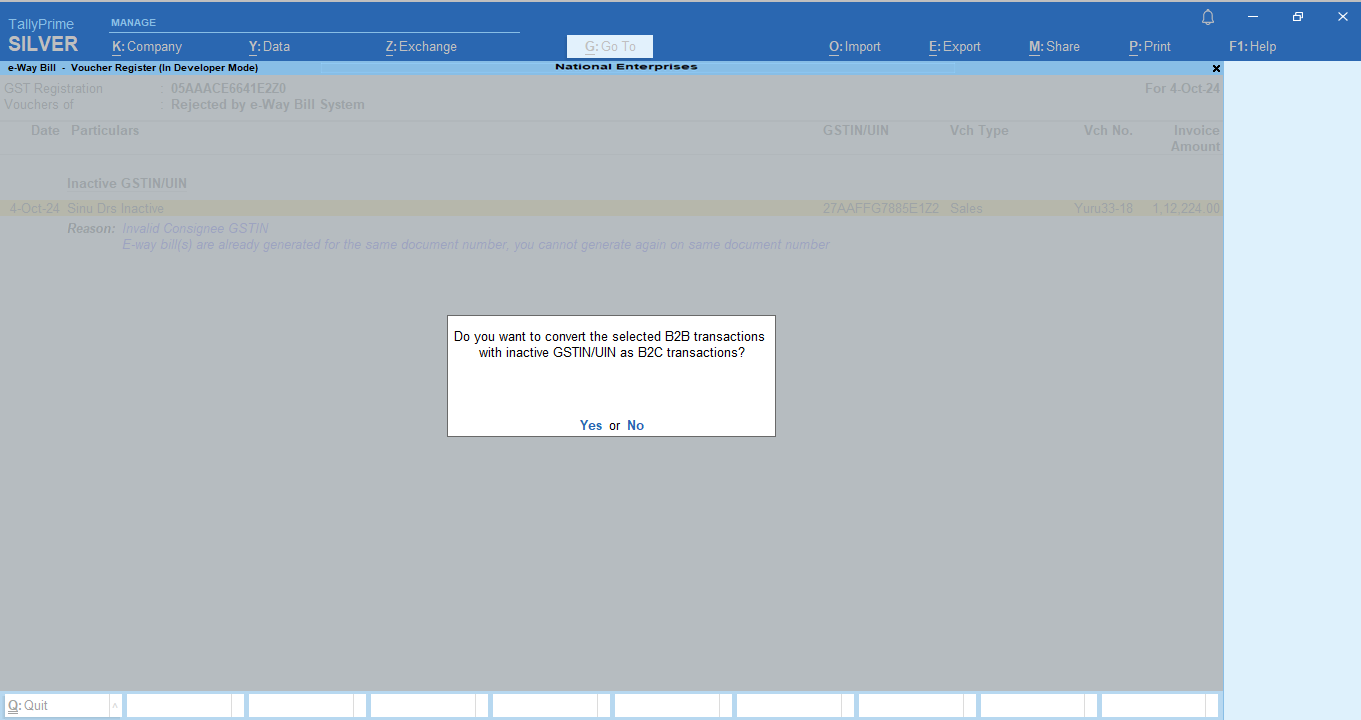

Error description: Invalid Consignee GSTIN

This error occurs when while uploading e-way bill on portal, GSTN reject the voucher with reason as Invalid GSTIN.

Cause

This error occurs when GSTIN of the party gets Cancelled or Suspended or become Invalid due to some reason.

When we try to upload the vouchers of such parties on e-Way Bill portal, system reject e-way bill with reason as Invalid GSTIN.

Resolution

You can easily fix this error by converting the voucher from B2B to B2C. As the GSTIN of the is invalid, you need to convert the voucher to B2C from B2B.

- Press Alt+G (Go To) > type or select e-Way Bill.

- Drill down from Rejected by e-Way Bill System.

From TallyPrime Release 5.1, Inactive GSTINs will be grouped separately for easy identification. - Select one or more vouchers using Spacebar.

- Press Alt+V (Convert to B2C).

TallyPrime will convert the vouchers from B2B to B2C. Now when you reupload the voucher for e-way bill, it will get accepted on e-way bill system.

Error Description: Distance between the Pincodes is too high or low.

Cause: If the distance is either more than or less than 10% of the Pin to Pin Distance as per Portal, a message will be displayed as the distance between Pincode is too high or low.

Resolution: If you are in TallyPrime Release 5.1 and later, you can leave the Pin to Pin distance blank for the the portal to calculate and update it when the e-Way Bill is generated.

If you are in TallyPrime Release 4.1 or later versions, press Alt+L (Calculate Distance on Portal) and you will be redirected to the NIC website to calculate the distance. If you are in any version earlier to TallyPrime Release 4.1, then you have to check the distance between two Pincodes and then update the distance in TallyPrime.

| Error Description | Error Code | Resolutions |

| Invalid login credentials | 108 | The entered username/password may be incorrect or may contain special characters, please provide the correct one and try again. |

| GSTIN is not registerd to this GSP | 111 | The entered GSTIN is not registered using Tally as a GSP. Register this GSTIN for e-way bill with Tally as a GSP. To know more, refer to Prerequisites to Generate e-Way Bill Directly from TallyPrime. |

| Invalid Supply Type | 201 | Functional input required |

| Invalid Sub-supply Type | 202 | Enable the configuration ‘Show sub type’ in F12 and select the appropriate sub supply type for the transaction from the e-Way Bill Details screen. |

| Invalid Document type | 204 | Enable the configuration ‘Show Document type’ in F12 and select the appropriate Document type for the transaction from the e-Way Bill Details screen. For document types master and their mapping, visit the following link and refer the Document Type section – https://docs.ewaybillgst.gov.in/apidocs/sub-docType-mapping.html. |

| Document type does not match with transaction & Sub trans type | 205 | Selected Document type does not match the transaction and the sub transaction type. Enable ‘Show Document type and ‘Show sub type’ under F12 and ensure that the appropriate sub type and document type are selected on the e-Way Bill Details screen. For supply type – document type mapping, refer to the following link https://docs.ewaybillgst.gov.in/apidocs/sub-docType-mapping.html |

| Invalid Supplier GSTIN | 208 |

Provide the correct GSTIN Verify the GSTIN in TallyPrime from Gateway of Tally → Alter → Ledger→ Get GSTIN/UIN info |

| Invalid or Blank Supplier PIN Code | 210 | Pass the correct pin code for the Supplier, In TallyPrime this could refer to either consignor or consignee Pincode based on Voucher Type (sales or purchase). For the State pin code master state wise, visit the following link and select Pincodes https://einvoice1.gst.gov.in/Others/MasterCodes |

| Invalid or Blank Supplier state Code | 211 | Pass the correct State Name for the Supplier Details. For the selected party ledger or Company, select the appropriate state in the e-Way Bill Details Screen by enabling “Show Consignor Details (From) and Consignee Details (To)”. |

| Invalid Consignee GSTIN | 212 |

Provide the correct GSTIN for the Consignee Verify the GSTIN in TallyPrime from Gateway of Tally → Alter → Ledger(Select the required party) → Get GSTIN/UIN info |

| Invalid Consignee PIN Code | 214 |

Pass the correct Pincode based on the State. For the State Pincode master state wise, visit the following link and select Pincode https://einvoice1.gst.gov.in/Others/MasterCodes. |

| Invalid Consignee State Code | 215 |

Pass the correct State Name in the Consignee details on the e-Way Bill Details screen. |

| Invalid HSN Code | 216 |

Pass the correct HSN code. Verify the HSN code in tally from Gateway of Tally → Alter → Stock Item(Select the required item) → Set/Alter GST details → Enable ‘Allow HSN/SAC details’ under F12→ Get HSN/SAC Info If HSN code provided is not valid then please search for HSN/SAC code from below link : https://services.gst.gov.in/services/searchhsnsac. |

| Invalid Tax Rate for Intra State Transaction | 218 |

Pass the Correct Tax rate for the required item. For tax rates refer the below link : https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html . |

| Invalid Tax Rate for Inter State Transaction | 219 |

Pass the Correct Tax rate for the required item. For tax rates refer the below link : https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html . |

| Invalid Trans mode | 220 |

Pass the correct Trans mode. Select the appropriate trans mode in Tally on the e-Way Bill Details screen under Transport Details section. In case New mode is selected that the codes are limited to 1,2,3,4. |

| Invalid Approximate Distance | 221 |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

| Invalid Transporter Id | 222 |

Provide a valid 15 Char Transporter GSTIN/TRANSIN |

| Invalid Vehicle Number Format | 225 |

In e-way bill details screen in tally, pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Supplier name is required | 229 |

Pass Consignee Name on e way Bill Details screen |

| Supplier place is required | 230 |

Pass Ship To place on e way Bill Details Screen |

| Consignee name is required | 231 |

Pass the consignee name after enabling “Show Consignor Details (From) and Consignee Details (To)” on the e way bill details screen |

| Consignee place is required | 232 |

Pass the consignee Place after enabling “Show Consignor Details (From) and Consignee Details (To)” on the e way bill details screen |

| Tax rates for Intra state transaction is blank | 235 |

Pass the Correct Tax rate for the required item. For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| Tax rates for Inter state transaction is blank | 236 |

Pass the Correct Tax rate for the required item. For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| Invalid or Blank Actual Vehicle Number Format | 244 |

In e-way bill details screen ,pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Invalid CGST Tax Rate | 252 |

Pass the Correct Tax rate for CGST. For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| Invalid SGST Tax Rate | 253 |

Pass the Correct Tax rate for SGST. For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| Invalid IGST Tax Rate | 254 |

Pass the Correct Tax rate for IGST. For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| Invalid CESS Rate | 255 |

Pass the Correct Tax rate for Cess value . For tax rates refer the below link: https://docs.ewaybillgst.gov.in/apidocs/tax_rates.html |

| User Gstin does not match with Transporter Id | 278 |

User GSTIN and Transporter id should be same |

| Description not available | 283 |

To fix error code 283, at least 6 digits HSN code is mandatory for taxpayers with turnover more than 5cr. and above |

| Invalid eway bill number | 301 |

Provide the correct e-way bill number |

| Invalid transporter mode | 302 |

Pass the correct Trans mode. Select the appropriate trans mode in Tally on the e-Way Bill Details screen under Transport Details section. In case New mode is selected ensure that the codes are limited to 1,2,3,4. |

| Invalid vehicle format | 304 |

In e-way bill details screen ,pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Place from is required | 305 |

Pass value for Dispatch from Field on e-Way Bill Details screen |

| Invalid from state | 306 |

Select the correct state for the consignor from the List of States Table provided from Tally on the e-Way Bill Details screen |

| Invalid reason | 307 |

Pass the correct reason code. For valid reason code and their mapping, visit the following link: |

| Invalid place to | 321 |

Pass the value for Ship To on the e-Way Bill Details Screen. |

| Could not retrieve GSTIN details for the given GSTIN number | 326 |

Provide the correct GSTIN Verify the GSTIN in tally from Gateway of Tally → Alter → Ledger(Select the required party) → Get GSTIN/UIN info |

| Could not retrieve data from hsn | 327 |

Pass the correct HSN code. Verify the HSN code in tally from Gateway of Tally → Alter → Stock Item(Select the required item) → Set/Alter GST details → Enable ‘Allow HSN/SAC details’ under F12→ Get HSN/SAC Info If HSN code provided is not valid then please search for HSN/SAC code from below link: |

| Could not retrieve HSN details for the given HSN number | 337 |

Pass the correct HSN code. Verify the HSN code in tally from Gateway of Tally → Alter → Stock Item(Select the required item) → Set/Alter GST details → Enable ‘Allow HSN/SAC details’ under F12→ Get HSN/SAC Info |

| This e-way bill is cancelled | 343 |

You are using a cancelled e-way bill. |

| Invalid eway bill number | 344 |

Provide a valid eway bill number. |

| Validity period lapsed, you cannot reject the e-way bill | 345 |

You can reject the e-way bill only within 72 hours from generated time |

| Invalid state code | 351 |

Pass the correct State Name for the Supplier Details. For the selected party ledger or Company, select the appropriate state in the e-Way Bill Details Screen. For state code masters, visit the following link: |

| Invalid Vehicle Number Format | 355 |

In e-way bill details screen ,pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Invalid Vehicle Type | 361 |

Pass the correct Vehicle type. For vehicle type masters, visit the following https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Transporter document date cannot be earlier than the invoice date | 362 |

Transporter document date should be later than the invoice date |

| The Consignee pin code should be 999999 for Sub Supply Type- Export | 374 |

999999 as PIN code should be passed under consignee pin code for specified type of transactions. Enable ‘Show consignee details’ from F12 in Additional details of e-way bill and pass this PIN code in the respective field. |

| The Supplier pin code should be 999999 for Sub Supply Type- Import | 376 |

999999 as PIN code should be passed under supplier ship from state code for specified type of transactions. |

| The supplier or conginee belong to SEZ, Inter state tax rates are applicable here | 378 |

Pass the correct Inter state tax rate, refer the tax rate section under the following link for master tax rates: |

| Eway Bill can not be extended.. Already Cancelled | 379 |

This e-way bill has already been cancelled. Use a valid e-Way Bill number. |

| Eway Bill Can not be Extended. Not in Active State | 380 |

This e-way bill is in inactive state. Use a valid e-Way Bill number. |

| There is No PART-B/Vehicle Entry.. So Please Update Vehicle Information.. | 381 |

Update the vehicle details before proceeding for this activity |

| You Cannot Extend as EWB can be Extended only 8 hour before or after w.r.t Validity of EWB..!! | 382 |

The validity of EWB can be extended between 8 hours before expiry time and 8 hours after expiry time. Try again within that time. You are not allowed to extend your e-way bill after 8 hours of generation. |

| For Rail/Ship/Air transDocDate is mandatory | 385 |

Provide trans doc date if trans mode is rail/ship/air |

| Reason Code, Remarks is mandatory. | 386 |

Reason code and Remarks is mandatory during update part B |

| Remaining Distance Can not be greater than Actual Distance. | 390 |

In the e-way bill extension details page, Provide a remaining distance which is lesser than the provided actual distance during e-way bill generation |

| Invalid GSTIN | 393 |

Provide the correct GSTIN Verify the GSTIN in tally from Gateway of Tally → Alter → Ledger(Select the required party) → Get GSTIN/UIN info |

| Eway Bill Item List is Empty | 398 |

There should be at least one item in the item list |

| Unit Code is not matching with any of the Unit Code from eway bill ItemList | 399 |

Provide the correct unit code. For unit code master, visit the following link: |

| Invalid old vehicle number format | 407 |

In e-way bill details screen ,pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Invalid new vehicle number format | 408 |

In e-way bill details screen ,pass the correct vehicle format. For Valid Formats of Vehicle Numbers, refer the ‘vehicle format’ section in the following link: https://docs.ewaybillgst.gov.in/apidocs/master-codes-list.html |

| Invalid pincode | 421 |

Provide a valid pincode as per the state provided. Check the pincode for the provided state by referring to the following link under Pincodes section: https://einvoice1.gst.gov.in/Others/MasterCodes |

| Invalid mobile number | 422 |

Provide the correct mobile number, Incase the number has changed, may update it in GSTN Common Portal and try after some time. If issue still persists, contact helpdesk with complete details of the issue. |

| Invalid Consignee ship to State Code for the given pincode | 436 |

Provide a valid consignee ship to state code as per the pin code provided |

| Invalid Supplier ship from State Code for the given pincode | 437 |

Provide a valid consignee ship to state code as per the pin code provided |

| E-way bill(s) are already generated for the same document number, you cannot generate again on same document number | 604 |

E-way bill has been generated for the provided transaction. Please check the voucher number |

| invalid ship to from gstin | 609 |

Provide the correct GSTIN Verify the GSTIN in tally from Gateway of Tally → Alter → Ledger(Select the required party) → Get GSTIN/UIN info |

| invalid dispatch from gstin | 610 |

Provide the correct GSTIN Verify the GSTIN in tally from Gateway of Tally → Alter → Ledger(Select the required party) → Get GSTIN/UIN info |

| invalid document type for the given supply type | 611 |

Enable ‘Show Document type’ and ‘Show sub type’ under F12 and ensure that the appropriate sub type and document type are selected on the e-Way Bill Details screen. |

| Invalid transaction type | 612 |

Enable ‘Show Document type’ and provide the appropriate Document Type for the Voucher |

| Total invoice value cannot be less than the sum of total assessible value and tax values | 620 |

Pass the appropriate tax value in the transaction and try generating again. Select the appropriate tax ledger based on transaction. |

| Transport mode is mandatory since vehicle number is present | 621 |

Provide transmode as road since vehicle number is present |

| Transport mode is mandatory as Vehicle Number/Transport Document Number is given | 638 |

Pass the correct Trans mode. Select the appropriate trans mode in Tally on the e-Way Bill Details screen under Transport Details section. In case New mode is selected that the codes are limited to 1,2,3,4. |

| This GSTIN has generated a common Enrolment Number. Hence you are not allowed to generate Eway bill | 654 |

This is applicable for transporter GSTIN. Pass the common enrollment Number under Party Alteration screen→ Tax Registration Details → Set/Alter GST Details→ set “Is a Transporter” to Yes and specify the Common enrollment number |

| The distance between the pincodes given is too high | 702 |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

| Pin to pin distance is not available for the given pin codes | 709 |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

| Invalid state code for the given pincode | 710 |

Select the pincode state mapping pattern under the following link and pass the state code accordingly. |

| The Consignor GSTIN is blocked from e-waybill generation as Return is not filed for past 2 months | 715 |

If the tax payer wants to generate the e-way bills immediately, after filing the GSTR 3B Returns (on GST Portal), then they can login to the e-way bill portal and select the option <“Search Update Block Status” and then enter his/her GSTIN and see the status. |

| The Consignee GSTIN is blocked from e-waybill generation as Return is not filed for past 2 months | 716 |

If the tax payer wants to generate the e-way bills immediately, after filing the GSTR 3B Returns (on GST Portal), then they can login to the e-way bill portal and select the option <“Search Update Block Status” and then enter his/her GSTIN and see the status. |

| The Transporter GSTIN is blocked from e-waybill generation as Return is not filed for past 2 months | 717 |

If the tax payer wants to generate the e-way bills immediately, after filing the GSTR 3B Returns (on GST Portal), then they can login to the e-way bill portal and select the option <“Search Update Block Status” and then enter his/her GSTIN and see the status. |

| The User GSTIN is blocked from Transporter Updation as Return is not filed for past 2 months | 718 |

If the tax payer wants to generate the e-way bills immediately, after filing the GSTR 3B Returns (on GST Portal), then they can login to the e-way bill portal and select the option <“Search Update Block Status” and then enter his/her GSTIN and see the status. |

| The Transporter GSTIN is blocked from Transporter Updation as Return is not filed for past 2 months | 719 |

If the tax payer wants to generate the e-way bills immediately, after filing the GSTR 3B Returns (on GST Portal), then they can login to the e-way bill portal and select the option <“Search Update Block Status” and then enter his/her GSTIN and see the status. |

| The distance between the given pincodes are not available in the system. Please provide distance. | 721 |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

| HSN code of at least one item should be of goods to generate e-Way Bill | 724 |

HSN should not start with 99 Verify the details from below link |

| Vehicle type can not be regular when transportation mode is ship | 726 |

When transmode is ship, vehicle type should be ODC |