View Updated Income Tax Slabs as per Finance Bill 2025-26

The Income Tax Computation report now reflects the latest tax slabs for employees under the new tax regime.

As per the Finance Bill 2025-26, the following changes take effect from April 1, 2025:

- New Tax Slabs (Section 115BAC): Revised tax slabs apply to the new tax regime, while the old tax regime remains unchanged.

- Rebate & Marginal Relief (Section 87A):

- The rebate limit increases from ₹ 7,00,000.00 to ₹ 12,00,000.00, with the maximum rebate amount rising from ₹ 20,000.00 to ₹ 60,000.00.

- If income is ₹ 12,00,000.00, no tax is due. However, at ₹ 12,10,000.00, tax liability jumps to ₹ 61,500.00. To ease this, marginal relief is provided under Section 87A. With this, one has to pay Income Tax as ₹ 10,000.00 instead of ₹ 61,500.00.

The Income Tax Computation report ensures compliance with these updates.

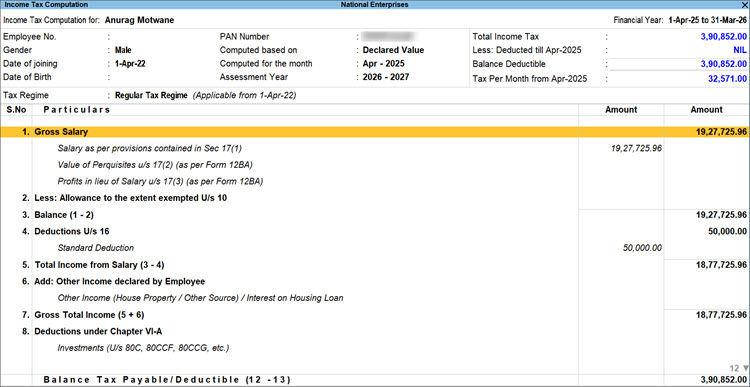

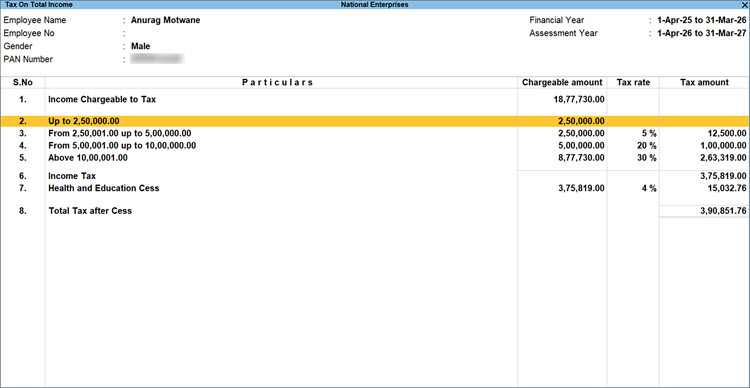

View Income Tax Slab Rates for Employees Under Regular Tax Regime

As per Finance Bill 2025-26, there is no change in the income tax slab rates for employees under the regular tax regime. You can view the details of the existing tax slab rates in the Income Tax Computation report.

- Press Alt+G (Go To) > Computation, and select the Employee.

The Income Tax Computation report appears.

- Drill down from the 10. Tax on Total Income section.

The Tax On Total Income screen appears, where you can view the income slabs and the respective tax rates.

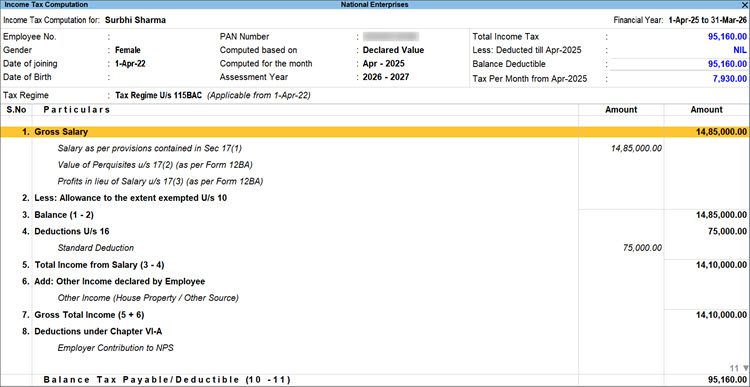

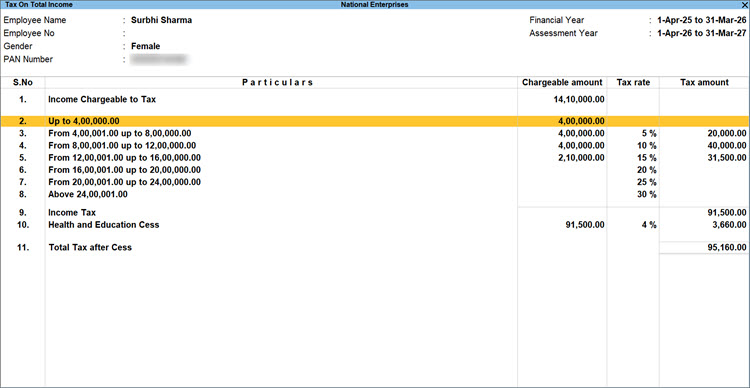

View Income Tax Slab Rates for Employees Under New Tax Regime

As an employer, you need to process the payroll transactions for all employees at the end of every month. The Income Tax Computation report will help you to remain compliant with the latest budget changes and ensure precise tax computation for your employees who are under the new tax regime

- Press Alt+G (Go To) > Computation, and select the Employee.

The Income Tax Computation report appears.

- Drill down from the 10. Tax on Total Income section.

The Tax On Total Income screen appears, where you can view the income tax as per the latest slab rates.

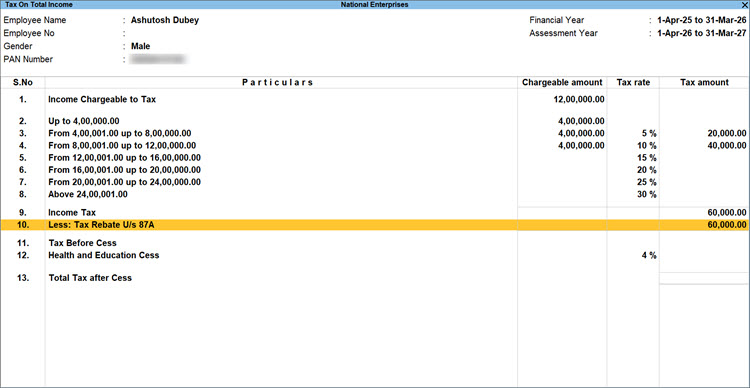

Rebate U/s 87A for Employees with taxable income up to ₹ 12 lakhs

Previously in the new tax regime, the rebate value of ₹ 20,000 was applicable to the employees with taxable income up to ₹ 7 lakhs.

In Finance Bill 2025-26, the department has amended the income tax slab rates to ₹ 12 lakhs and the rebate amount is amended to ₹ 60,000.

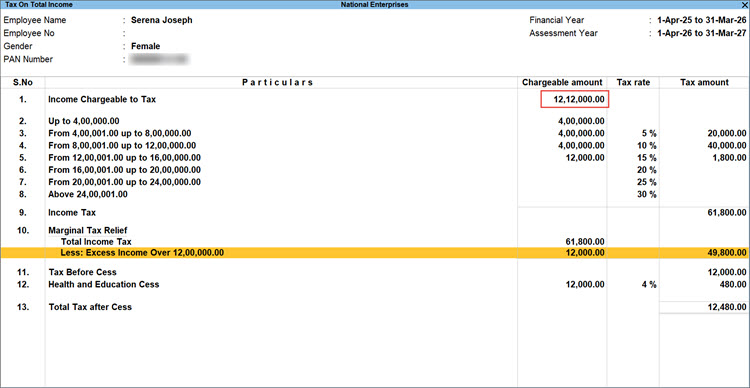

Marginal Tax Relief for Employees with Taxable Income Between ₹ 12,00,010 and ₹ 12,70,590

Previously, in the new tax regime, when the taxable income crossed the rebate limit even by a rupee, employees had to pay the complete tax as per the slab rate.

In Finance Bill 2023, the government introduced marginal relief if income exceeded ₹ 7 lakhs. Now, in Finance Bill 2025, marginal relief is applicable if income exceeds ₹ 12 lakh.

As per the Finance Bill 2025, if the annual income of an employee is up to ₹ 12 lakhs, then the tax payable is zero.

However, if the income becomes ₹ 12,00,100, then the tax liability becomes ₹ 60,015, as per calculation. Even when the income exceeds ₹ 12 lakhs by only ₹ 100, the tax will be calculated as ₹ 60,015, as per the income tax slab rate. To reduce the tax burden on employees, the department has provided a marginal tax relief.

If the taxable income after standard deduction of the employees is between ₹ 12,00,001 to ₹ 12,70,594, then they will get a marginal tax relief.

However, if the taxable income after standard deduction is beyond ₹ 12,70,594, then the employee is liable to pay income tax as per the slab rate. As per the calculation, the breakeven income is ₹ 12,70,588, but as per Section 288A, total income should be a multiple of 10. Therefore, round it off to ₹ 12,70,590. In the same way, ₹ 12,70,594 will round off to ₹ 12,70,590; therefore, marginal relief is not available beyond this.

In the screen below, when you drill down from the 10. Tax on Total Income section of the Income Tax Computation report, you can see that the Income Chargeable to Tax is ₹ 12,12,000, exceeding ₹ 12 lakhs by ₹ 12,000.

Therefore, the employee avails a marginal tax relief, as displayed in the row Less: Excess Income Over 12,00,000.00. The amount that exceeds ₹ 12,00,000 gets deducted from the Total Income Tax as a marginal tax relief.

The calculated Income Tax in row 8 is the Total Income Tax under row 9.

When you deduct the amount that exceeds ₹ 12,00,000 from the Total Income Tax under row 9, you get the Tax Amount that needs to be deducted from the Total Income Tax.

As a result, you get Tax Before Cess.

It is important to note that rebate u/s 87A is not applicable to the employees eligible for the marginal tax relief.