Identify, Track, Pay, and Report Payments to MSME Businesses

In this topic we will also look into the provisions made by the Government to support MSME businesses and how the use of TallyPrime will improve the visibility in their business transactions and accelerate the movement of funds.

Have questions? Refer to our FAQ page.

Read More...Micro and small businesses registered under the MSMED Act, 2006, get benefits such as loans at a lower interest, payment guarantees from buyers, and so on. The payment guarantee provision protects these businesses from delays in payment from their buyers. As per this act, any buyer of goods or services from registered MSMEs must make the payment on or before the agreed date or within 45 days. In case of a delay in payment beyond the specified date, buyers must pay interest on the amount. Generally in such cases, the interest rate is three times more than the rate that is notified by the Reserve Bank of India.

Additionally, the Ministry of Corporate Affairs (MCA) has notified that companies having outstanding dues to the MSME (Micro & Small) enterprises have to file the details of all the current outstanding dues to MSMEs in MSME Form-1 with the ROC (Registrar of Companies).

Despite all these facilities, the micro and small businesses are not fully benefitting from the provisions in the MSMED Act. This is primarily due to the absence of an identification for MSME Suppliers, which allows the buyers to omit/miss the MSME status of the supplier in their annual statement of accounts. As a result, the auditors do not detect such omissions because of the non-availability of any identification for MSME status.

The MSMEs should mention/print their MSME status on their invoices, bills and other relevant documents. The visibility provided to buyers and their accountants will help in the release of the payments on time and it will be also easy to file for compensation in case of delay in payments.

With TallyPrime:

- MSME Enterprises will be able to update their UDYAM Registration details and print the same in business documents. Click here to know more on how to update MSME Registration of your company in TallyPrime.

- Buyers from MSME can update UDYAM Registration details in ledgers and filter bill payables for MSMEs to ensure timely payment. They can also readily get details for MSME Form 1 for all overdues to MSME suppliers.

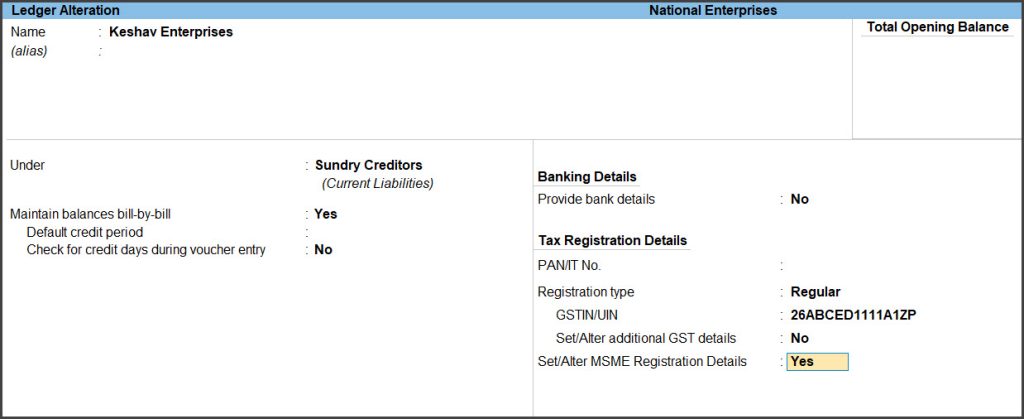

Buyers Update MSME Party’s UDYAM Details in Ledgers

The businesses purchasing goods and services from MSMEs can set up the status of the supplier as MSME. This sets reminders to make payments on time to all such parties and avoid paying interest for late payments. This also enables you to create and file returns quickly with all the details of payments to MSMEs.

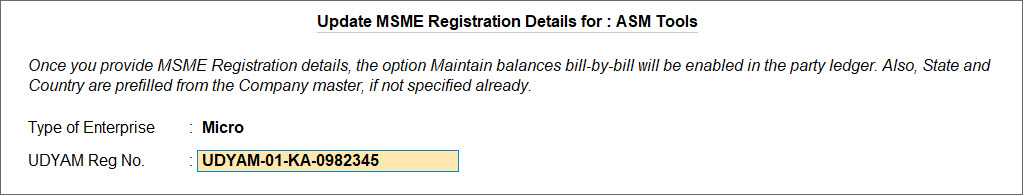

Set/Update MSME UDYAM details for a Single Party

You can update the UDYAM details of MSME suppliers in the ledger master.

- Press Alt+G (Go To) > Create Master or Alter Master > Ledger.

- Enter basic party details like Name, Group, Address, if you are creating a new ledger.

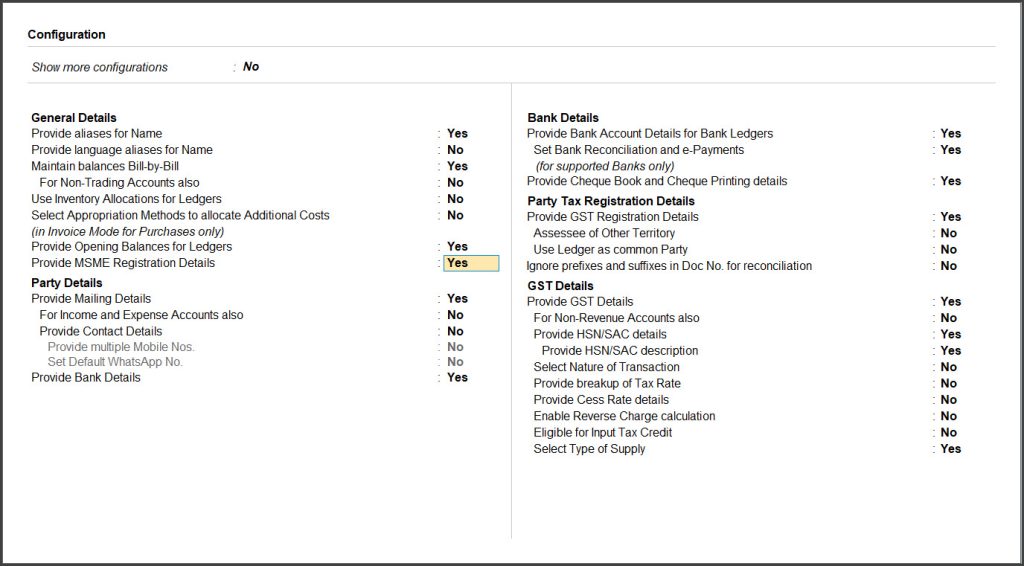

- Press F12 (Configure).

- Enable Set/Alter MSME Registration Details.

- Press Enter.

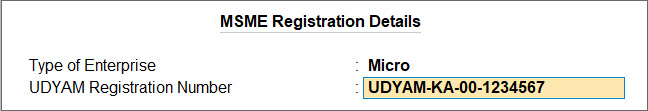

In the MSME Registration Details screen - Press Ctrl+A to save the ledger master.

MSME Registration Details History

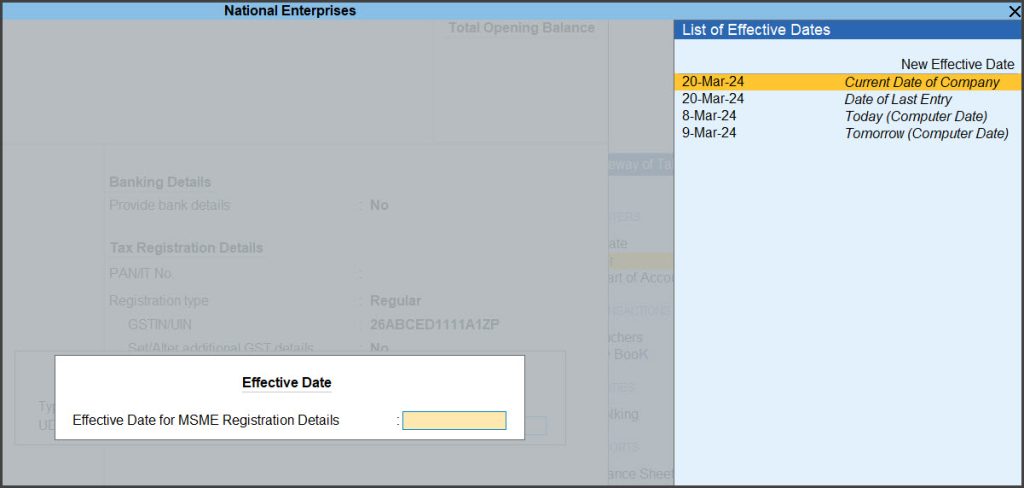

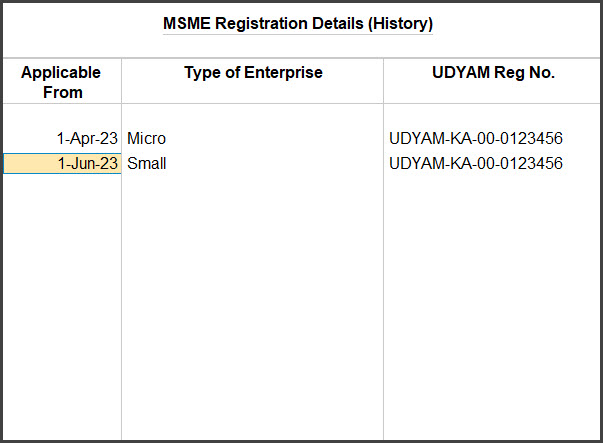

In case you make the change to you registration details due to change in the enterprise type or other such updates, and provide effective date for such changes to be applicable from, then all such changes are recorded and can be accessed from the history.

You can view the history of changes made to MSME registration details.

- Press Ctrl+I (More Details).

- Select MSME Registration Details (History)

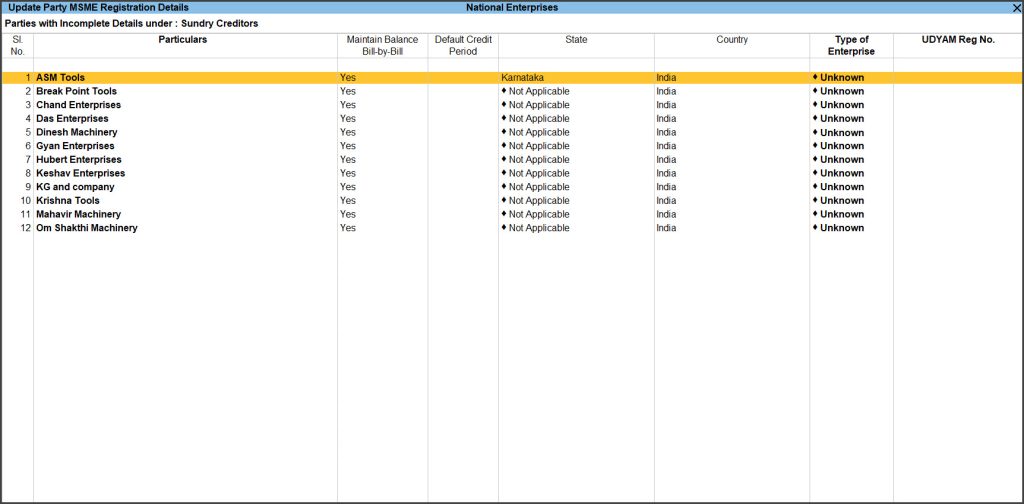

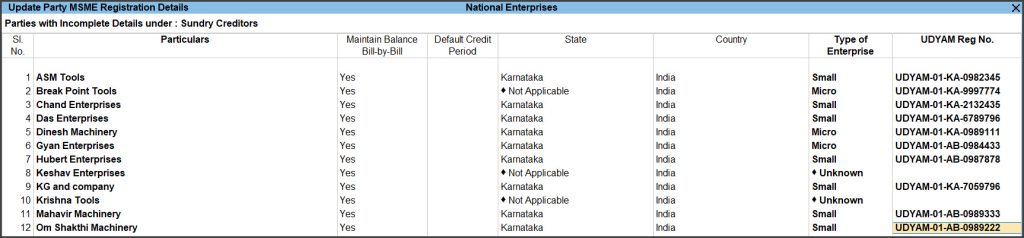

Update UDYAM Details for Multiple MSME Suppliers

TallyPrime provides option to update the UDYAM Details of multiple suppliers at once. This will help you update MSME details of all your MSME suppliers in one go.

- Press Alt+G (Go To) > type or select Update Party MSME Details.

Alternatively, Gateway of Tally > Display More Reports > Statutory Reports > MSME Reports > Update Party MSME Details. - Select a specific group or All items in the Name of Group field.

- Select a specific ledger or All items in the Name of Ledger field.

- Select the party to update the UDYAM details and Alt+H or Enter.

- Select the Type of Enterprise and enter UDYAM Reg No. of the party.

- Press Enter.

- Press Enter or Y to save the UDYAM Details for the party.

You can also enter the UDYAM details for all parties in the same screen.

- Press Alt+R (Multi Alter).

- You can enter Default Credit Period, Type of Enterprise, and UDYAM Reg No. in the respective columns for any party.

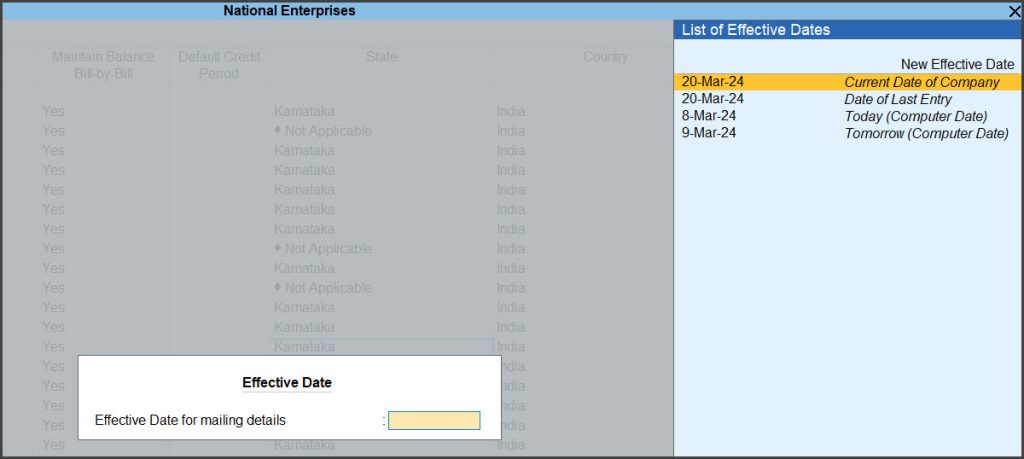

- Enter Effective Date for each party that you alter.

- Press Ctrl+A to save the details.

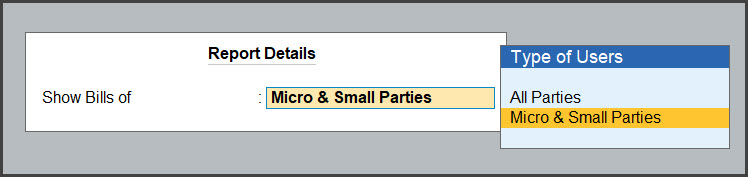

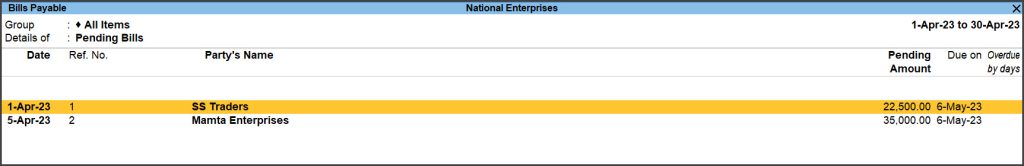

Check Upcoming Due Dates for Payables

As a buyer, you need to identify and track the payments related to MSME suppliers or service providers to avoid exceeding the date agreed upon between you and the supplier. You need to consider all bills from MSMEs and cannot afford to miss out on any bill. The penal interest chargeable for delayed payment to an MSME enterprise is three times the bank rate notified by the Reserve Bank of India.

In case of delayed payments, MSME can file a complaint with MSME Samadhaan to get the payment along with interest.

- Press Alt+G (Go To) > type or select Group Outstanding > Sundry Creditors.

Alternatively, Gateway of Tally > Display More Reports > Statement of Accounts > Outstandings > Payables.

- Press Ctrl+B (Basis of Values).

- Select Show Bills of and press Enter.

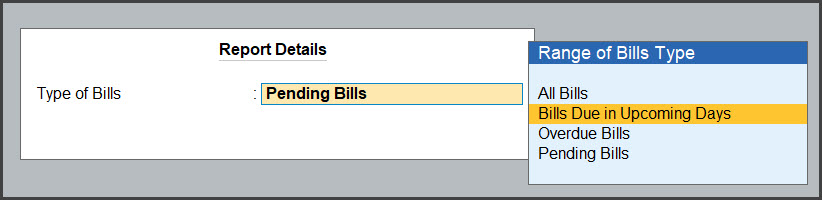

- Select Type of Bills and press Enter.

Select the following based on:

-

- All Bills, to view all the payable bills.

- Bills Due in Upcoming Days, to see bills that upcoming in a specific number of days. You can specify the number of days in Show bills due in the next.

- Overdue Bills, to see only the bills that are overdue.

- Pending Bills, to only the pending bills.

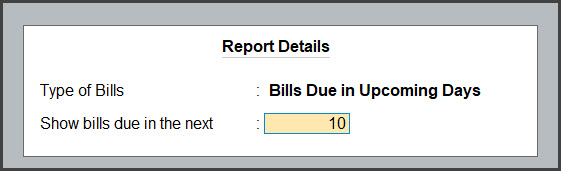

- In the Show bills due in the next field, enter the number of days to see bills that become due within the given number of days. This option appears only when you select Bills Due in Upcoming Days.

- Press Enter.

- Press Ctrl+A to save.

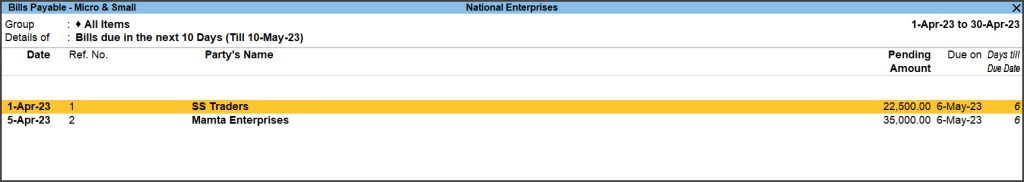

The report shows the bills based on the selection in Basis of Value. In case you had selected Bills Due in Upcoming Days and set the number of days as 10, the bills that are due in the next 10 days are shown.

By default, the report displays the Due on date for all the bills. You can change this to days until due date, overdue days, and overdue days from bill date.

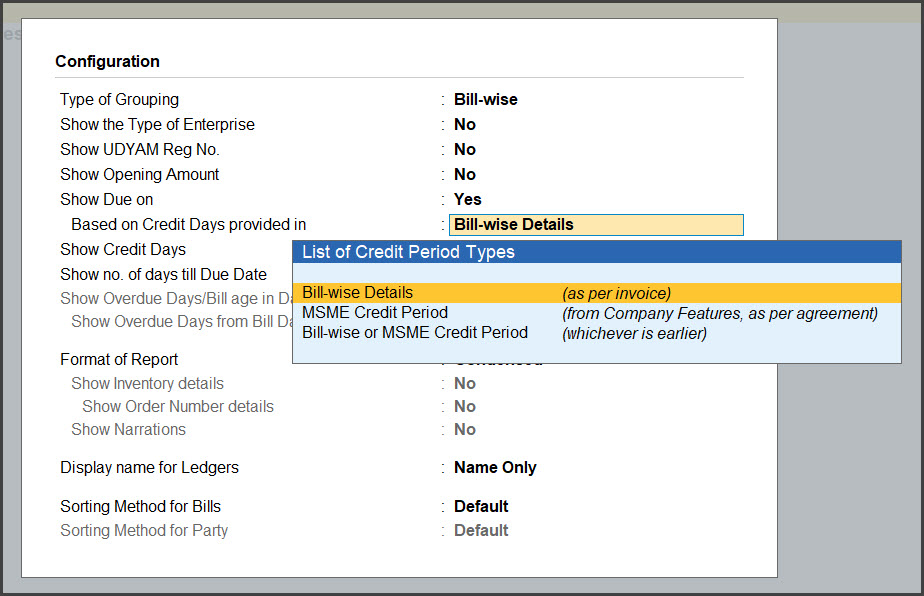

Configuration

You can add further details to the report using the configuration options.

- Show Due on: Set this option to Yes, to view the date on which a bill becomes due for payment. The due date is considered based on the credit days set for the party. It can be the credit days specified in the invoice or in Credit Days Allowed for Micro & Small Parties under F11.

Note: The No. of Credit Days Allowed for MSMEs can be of two types, a. where there is an agreement with the MSME and b. where there is no agreement. Both type of credit days can be set. The due date will be calculated on the type of credit days configured.

- Show no. of days till Due Date: Set this option to Yes to view number of days until the due date for each bill in Days till Due Date column.

- Show Overdue Days/Bill age in Days: Set this option to Yes to view the number of overview days in Overdue by Days column.

- Show Overdue days from Bill Date: Set this option to Yes to view the number of days since the day of billing in the Age of Bill in Days column.

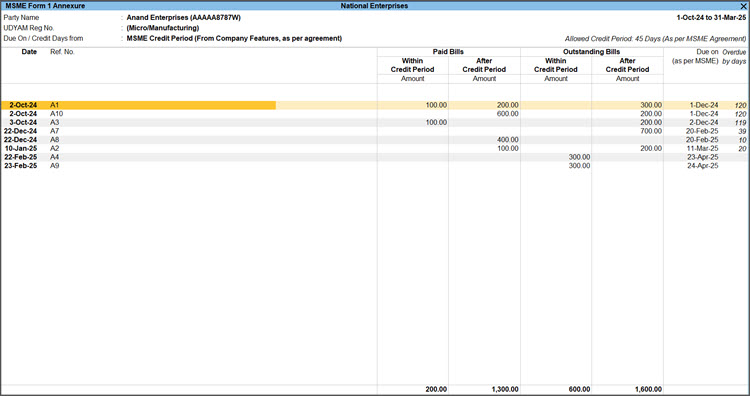

View and Upload MSME Form 1 Annexure

From 15th July 2024, companies must use the revised MCA webform to file the MSME Form 1 Annexure by uploading data through a specified Excel template. The new format summarizes each supplier and shows both overdue and paid bills for the allowed credit period. As per the new format, you have to download an Excel template, specify the required data, and upload the same on the revised portal.

If you are using TallyPrime Release 6.0 or an earlier version, the MSME Form 1 Annexure will not be available. To file your MSME returns successfully using TallyPrime or TallyPrime Edit Log, it is recommended that you upgrade to Release 6.1.

In this section:

-

View MSME Form 1 Annexure

-

Export and Upload MSME Form 1 Annexure

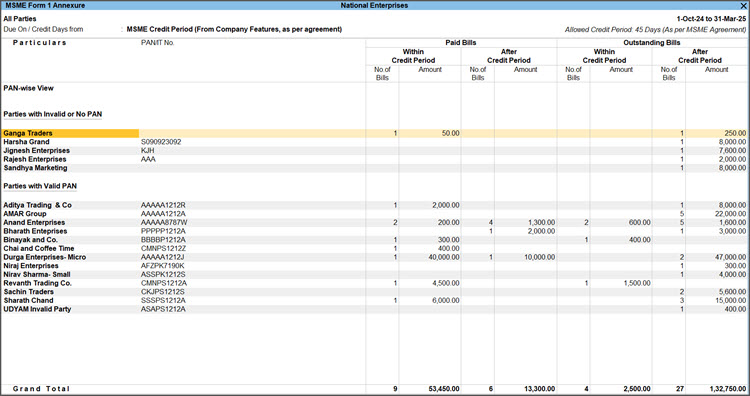

View MSME Form 1 Annexure

- Press Alt+G (Go To) > type or select MSME Form 1 Annexure.

Alternatively, Gateway of Tally > Display More Reports > Statutory Reports > MSME Reports > MSME Form 1 Annexure.

- Select a MSME party and drill down to view the party details along with the paid bills, outstanding bills, due date and overdue period (in days).

Report details

-

Due On / Credit Days from: You can configure the MSME Credit Period based on the Configured Credit Period in the Company Feature, Bill-wise Details, or whichever is earlier from the Basis of Values. This helps configure the report data as per credit terms defined in Company Features or individual transactions, ensuring compliance with the MSME norms.

-

Allowed Credit Period: The Allowed Credit Period for any party is 45 days, as set by the Govt. You can update the same in your F11 (Company Feature) > More Details > Credit Days Allowed for Micro & Small Parties. However, you can set any number of days as per your business requirement.

-

Paid Bills and Outstanding Bills: The Paid Bills and Outstanding Bills columns highlight the no. of Bills and the amount already paid or pending to be paid. All these values will appear with respect to the credit period that you have set.

-

Parties with Invalid or No PAN/Valid PAN: The MSME Form 1 Annexure displays all the MSME parties in PAN-wise View as default. In the PAN-wise view, the parties are divided in two groups based on the availability and validity of their PAN. In the PAN-wise view, the MSME suppliers with same PAN are merged and displayed as single PAN Supplier. You can drill down to view the different MSME suppliers listed under each PAN.

Configure additional details

By default, the MSME Form 1 Annexure report in TallyPrime appears PAN-wise. However, you can configure the report as per your business needs.

-

Press F8 to view the report with Ledger-wise bills or Bill-wise, as needed.

You can switch to these views even from Change View. -

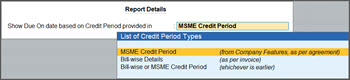

Press Ctrl+B (Basis of Value) to configure the report with specific values.

-

-

All Parties: Displays all the parties, with or without PAN, based on which you can view your overall cash flow within the credit period. You can track your pending and paid bills for all of your parties.

-

Parties with Valid PAN: Displays the MSME Parties with Valid PAN, so that, you can export the MSME Form 1 Annexure with valid PAN details.

-

Parties with Invalid or No PAN: Displays the MSME Parties with Invalid or No PAN, so that, if necessary, you can update the parties with valid PAN details.

-

-

Show Due On date based on Credit Period provided in:

-

MSME Credit Period (from Company Features, as per agreement): Configures the data in the report as per the credit period mentioned in the F11 (Company Features). As per the Government norms or MCA Department norms, the Credit days Allowed for Micro & Small Parties should be of 45 days and you can set it from the F11 (Company Features) screen.

-

Bill-wise Details (as per invoice): Configures the data as per the credit period mentioned in the Bill-wise Details screen while passing a transaction.

-

Bill-wise or MSME Credit Period (Whichever is earlier): Configures the data either according to the MSME Credit Period or Bill-wise Details, whichever day is earlier.

-

- Exclude Bills Paid & Outstanding within Credit Period: Yes, to remove the bills that are already paid and pending within the credit period.

- Exclude Parties having only Bills Paid & Outstanding within Credit Period: Yes, to remove the parties having only bills, both paid and pending, not exceeding the credit period.

-

-

Press F12 to configure the report based on your business requirements.

-

Show Type of Enterprise: To see the activities the parties are engaged in or the domain of the parties, for example, manufacturing, services, and so on.

-

Show UDYAM Reg No.: To see the UDYAM Reg No. of each party.

-

Default period on opening the report: Default period on opening the report: By default this option is set to Earlier period. You can select either Earlier Period or Current Period option to configure the report to display the transactions based on your Current date. Say, your data is in between the period of April to September. By default, the report will display transactions from October of last year to March of the current year.

-

Export and Upload MSME Form 1 Annexure

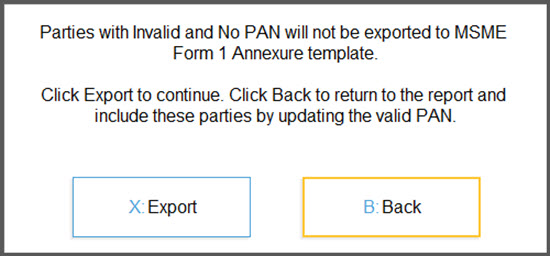

The export of the MSME Form 1 Annexure report is supported only in PAN-wise Summary View. MSME parties only with Valid PAN are sent to the MCA excel template. If you have parties with Invalid or No PAN, you should update the party details with correct PAN to include such parties.

-

Export the MSME Form 1 Annexure report.

-

Press Alt+E (Export) > MSME Form 1 Annexure.

If you have a party with invalid/No PAN, an information screen will pop up highlighting that the parties with invalid or no PAN will not be exported to MSME Form 1 Annexure template.

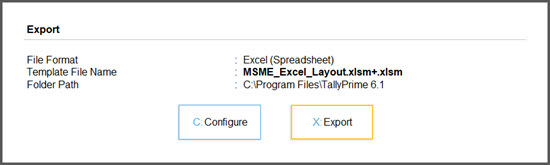

You can press B (Back) to go back to the MSME Form 1 Annexure report and update the PAN details for the parties. - Press C (Configure) to configure the MCA Template File Name and Folder Path.

- Press E (Export).

After export, a message will prompt you to update the reasons for delay in payment to MSME parties. If a payment is made or pending beyond 45 days, providing a reason in the MCA template is mandatory.

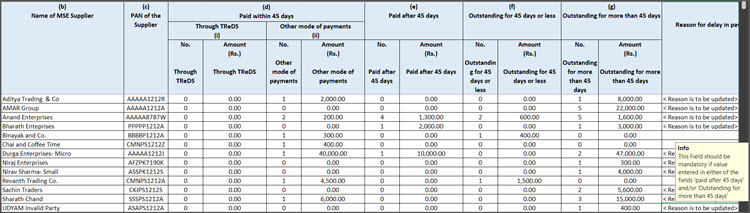

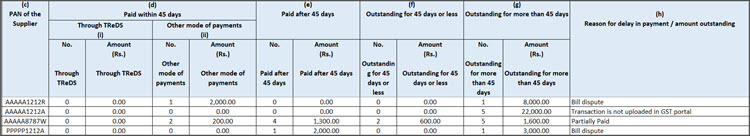

As the message gets displayed in TallyPrime, you will see the MCA template opening on your screen by default with the pre-filled details. In the template, you have to verify if there is any value under the Paid after 45 days or Outstanding for more than 45 days columns.

In case you have any values in these columns, you can see the text <Reason to be updated> appearing under the Reason for delay in payment/amount outstanding column.

-

- Update the reasons under the Reason for delay in payment/amount outstanding column, as applicable against each MSME party.

-

Press Ctrl+S to save the file.

-

Log in to the MCA portal and upload the MSME Form 1 Annexure template.

A message confirming the successful upload of the file will be displayed.

If there are no values existing under the Paid after 45 days or Outstanding for more than 45 days columns, a message appears in TallyPrime, informing the successful export of the MSME Form 1 Annexure report.

You can use the sample data to test this feature in TallyPrime, without affecting your company data. On downloading the Data folder, you will have the Sample data, Excel file, and ReadMe file.

The ReadMe file has the instructions on using the sample data.

Export Form 1 as per Latest MCA Notification (Workaround for S.O. 2751(E))

As per the latest MCA notification, buyers from MSMEs now have to upload the details and summaries of their bills. This includes the bills that were paid in time as well as the ones that were delayed. You can easily fill in these details using TallyPrime.

In the earlier format, only the bills unpaid beyond 45 days had to be uploaded on the MCA portal. However, as per MCA notification S.O. 2751(E), dated 15th July 2024, the summary of your parties (Sundry Creditors) has to be captured under the following categories, with the total number and amount of bills:

- Paid within 45 days

- Paid after 45 days

- Outstanding for 45 days or less

- Outstanding for 45 days or more

Follow these three simple steps to accurately upload and file your half-yearly returns:

I. Download MS Excel template from MCA portal

II. Export Details of MSME Bills from TallyPrime

III. Prepare the Excel template for filing

I. Download MS Excel template from MCA portal

In the first step, you have to download the Excel template from the MCA portal.

- Log in to the MCA portal, and go to MCA Services > Company e-Filing > Compliance Services > MSME Half yearly return of Micro or Small Enterprise.

- Scroll to the bottom of the page, and click Download Excel Template.

The MS Excel template will be downloaded, where you can update the details of your MSME bills.

II. Export Details of MSME Bills from TallyPrime

In TallyPrime, you can easily configure Outstanding MSME Bills as per the latest MCA notification, and then export the details.

- Press Alt+G (Go To) > Outstanding MSME Bills.

- Press F2 (Period) to set the required period, that is, 1-Apr to 30-Sep or 1-Oct to 31-Mar.

- Press F12 (Configure) to set the required options.

-

Enable the Show Opening Amount option.

-

Enable the Show due on option.

-

Set Based on Credit Days provided in as MSME Credit Period.

-

Enable the Show no. of days till Due Date to option.

- Set Sorting Method for Bills as Party (A – Z) or Party (Z – A), which will help you in creating the summary of your parties.

-

- Press Ctrl+B (Basis of Value), and set the Type of Bills as All Bills.

Now you can easily view the pending amount as per the due dates, as well as the overdue bills.

- Press Ctrl+E to export the details in MS Excel format.

- Press E (Export) to proceed to export.

An MS Excel file will be exported with the details of your MSME bills.

III. Prepare the Excel template for filing

After exporting the Excel sheet from TallyPrime, you can further configure the PAN details of your MSME bills. This will help you in preparing the MS Excel template for filing on the MCA portal.

- In the exported Excel sheet, add the PAN of the parties using Tally ODBC.

- Select the Ledger table.

- Select the $Name and $IncomeTaxNumber columns.

The name and the PAN of the parties will be listed in the Excel sheet.

- Use VLOOKUP to link the party bills with the PAN.

- Filter the Pending Amount and Days till Due Date, as per the following values.

- Open the Excel Template that was downloaded from the MCA portal.

- Refer to (or copy) the values in the exported Excel and update the columns (d, e, f, and g) in the Excel template.

- Use COUNTIF and SUMIF to derive the summary for each party.

You can also choose to file the summary of only those creditors for whom payment was delayed.

Once the details are updated in the Excel template, it is ready to be uploaded on the MCA portal.

In the upcoming release of TallyPrime, you will be able to directly export the latest Form 1 details from TallyPrime, which will make the filing process even simpler.