Tax Rate Setup for eTIMS

Managing tax rates across stock items, groups, ledgers, and other masters is now easier than ever with the eTIMS Tax Rate Setup report. With a single report, you can efficiently view, update, and manage tax rate details, enforce changes across multiple masters, and track missing tax information in just a few steps—ensuring your business stays compliant with the latest regulations without missing a detail. Whether you’re handling numerous stock items or just a few, this report ensures everything stays in sync with the latest requirements.

View and Update Tax Rate Setup

The Tax Rate Setup report provides a clear and comprehensive view of all tax rate details, making it effortless to manage and update them. With options to customise the report by hiding or showing specific columns, you can tailor it to suit your needs. Additionally, you can seamlessly view masters with or without tax rate details and quickly make necessary updates.

In this section

View Tax Rate Setup

The eTIMS Tax Rate Setup report in TallyPrime gives you a clear view of all tax rate details, making it easy to manage and update them. You can also customise the view of the report such as hiding or showing specific columns, as required.

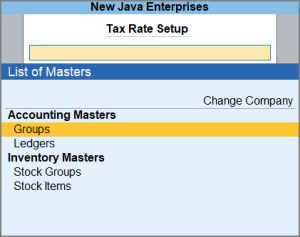

- Press Alt+G (Go To) > eTIMS Utilities > Tax Rate Setup.

Alternatively, Gateway of Tally > eTIMS Utilities > Tax Rate Setup.

- From the List of Masters, select the required master.

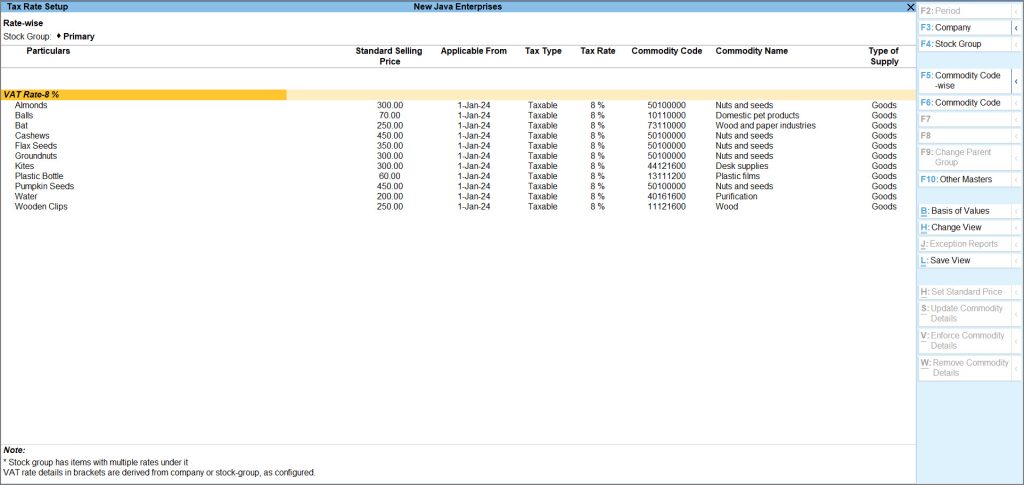

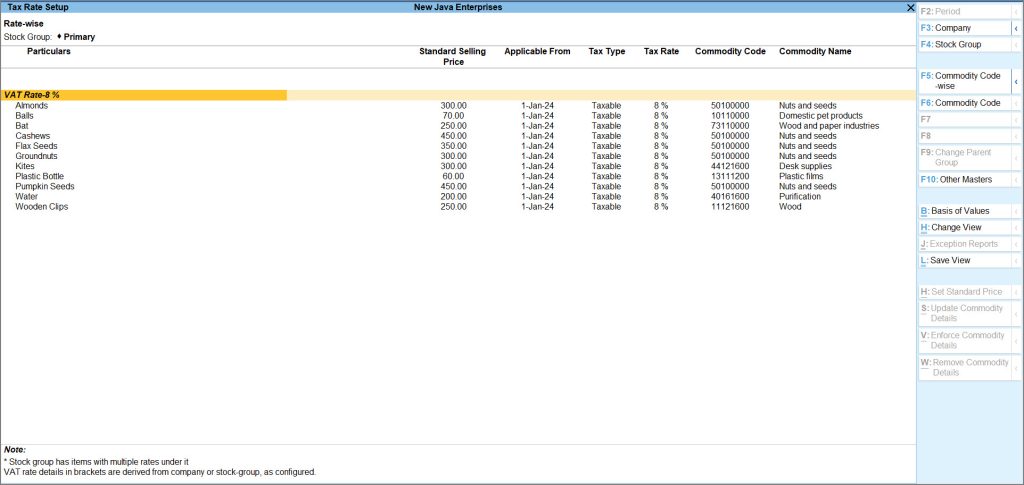

The Tax Rate Setup report appears, displaying the default columns such as Applicable From, Tax Type, Tax Rate, Commodity Name, and Commodity Code, as you scroll down.

By default, the report displays the stock items Rate-wise. However, you can configure how you want to view the report, as per your business requirement.

For example, if you want to exclude the Type of Supply option in the report

- Press F12 (Configure) > set Show Type of Supply to No.

The Type of Supply will then be excluded from the report.

Similarly, you can enable or disable additional options based on your needs.

Update masters with or without Tax Rate

You can quickly view masters with or without tax rate details and make the necessary updates.

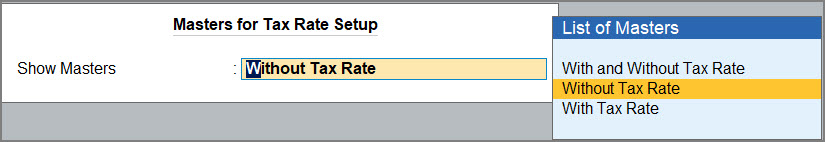

- In the Tax Rate Setup report, press Ctrl+B (Basis of Values) > and select Method of showing masters.

- Under Show Masters:, select the method in which you want to view the masters. In this case, let us select Without Tax Rate.

- Press Ctrl+A to save the setting.

The Tax Rate Setup report displays the all the masters without the Tax Rate details.

Specify eTIMS Details for Masters using Tax Rate Setup Report

Managing eTIMS details in TallyPrime ensures accurate VAT reporting. You can update commodity details, tax rates, and other eTIMS information for individual masters or multiple masters at once.

In this section

Update Commodity Details

Easily update eTIMS commodity details for stock items and other masters in TallyPrime.

- Press Alt+G (Go To) > eTIMS Utilities > Tax Rate Setup.

Alternatively, Gateway of Tally > eTIMS Utilities > Tax Rate Setup. - From the List of Masters, select the required Inventory Master.

The Tax Rate Setup report appears. - Select the stock item that you want to update and press Alt+S (Update Commodity Details).

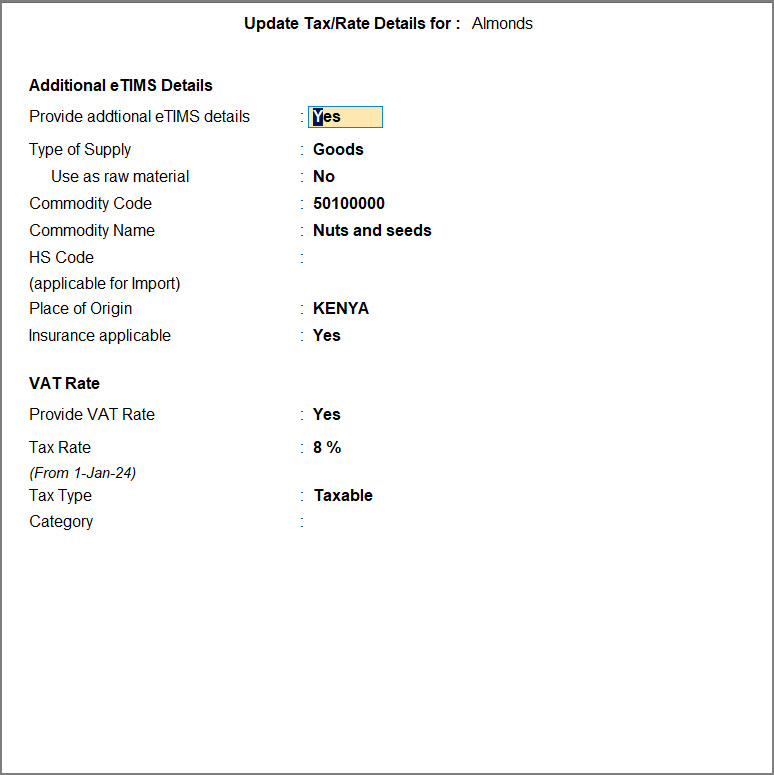

The VAT Details screen appears. - Under the Tax/Rate details for: subscreen, fill the details as applicable.

- Under Additional eTIMS Details,

- Set the option Provide additional eTIMS details as Yes.

If you enable this option but leave the subsequent fields blank, the existing details will be applied to the selected master.

- Select the Type of Supply for the stock item.

- Press Ctrl+H (Helper) to select the Commodity Code and Commodity Name.

- Enter the HS Code if the stock item is applicable for import.

The fields Place of Origin and Insurance applicable are prefilled as per your selection.

- Set the option Provide additional eTIMS details as Yes.

- Under VAT Rate,

- Under Additional eTIMS Details,

- Accept the screen. As always, you can press Ctrl+A to save.

You can also update the commodity details for masters in bulk, as required.

To update the commodity details for multiple masters:

- In the Tax Rate Setup report, press the Spacebar and select the required masters.

- Press Alt+S (Update Commodity Details).

Enforce Commodity Details

You can apply changes across all masters under a selected group. This will remove the existing commodity details in the masters under the group.

- Press Alt+G (Go To) > eTIMS Utilities > Tax Rate Setup.

Alternatively, Gateway of Tally > eTIMS Utilities > Tax Rate Setup. - From the List of Masters, select the required master.

The Tax Rate Setup report appears. - Select the group for which you want to enforce changes and press Alt+V (Enforce Commodity Details).

- Select Yes or press Enter to continue, when prompted.

The existing details in all masters under the selected group will be removed and be updated with the new details.

Remove Commodity Details

You can also quickly delete the commodity details for selected masters when they are no longer required.

- Press Alt+G (Go To) > eTIMS Utilities > Tax Rate Setup.

Alternatively, Gateway of Tally > eTIMS Utilities > Tax Rate Setup. - From the List of Masters, select the required master.

The Tax Rate Setup report appears. - Select the master for which you want to remove the commodity details and press Alt+W (Remove Commodity Details).

- Select Yes or press Enter to continue, when prompted.

The commodity details provided for the selected master will be removed.