Unable to determine the Transaction Type

Applicable to Release 2.1 and earlier

Cause

When a ledger with GST applicability is used in a transaction, and it is unclear if the transaction is a Sale or Purchase.

Typically, the adjusted transactions that are passed for non-compliance purposes are detected as exceptions under this category; for example, Expense booking.

Resolution

These conflicts can be resolved in the following three ways:

- Exclude the voucher from GST return.

- Mark the ledger as ‘GST not Applicable’.

- Change the voucher into a Purchase or Sales voucher, as applicable by adding Party details and tax ledgers.

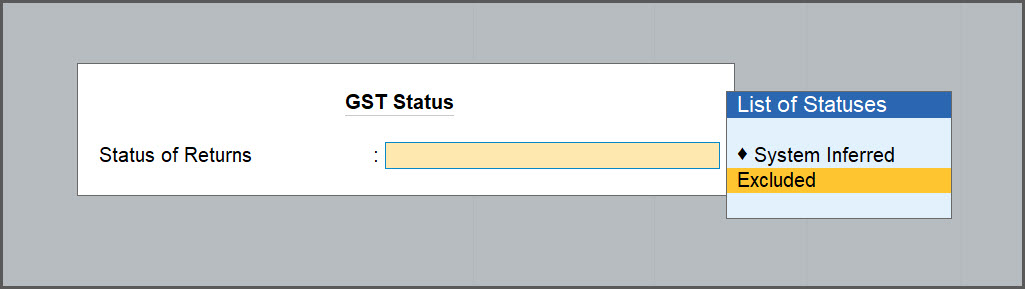

Exclude the voucher from GST return

- Open the GSTR-3B report.

- Select Uncertain Transactions (Corrections needed) > Unable to Determine Transaction and press Enter.

- Select the voucher for which you wish to determine the original sales value and press Enter.

- In the Update the GST status screen, set Status of Returns as Excluded.

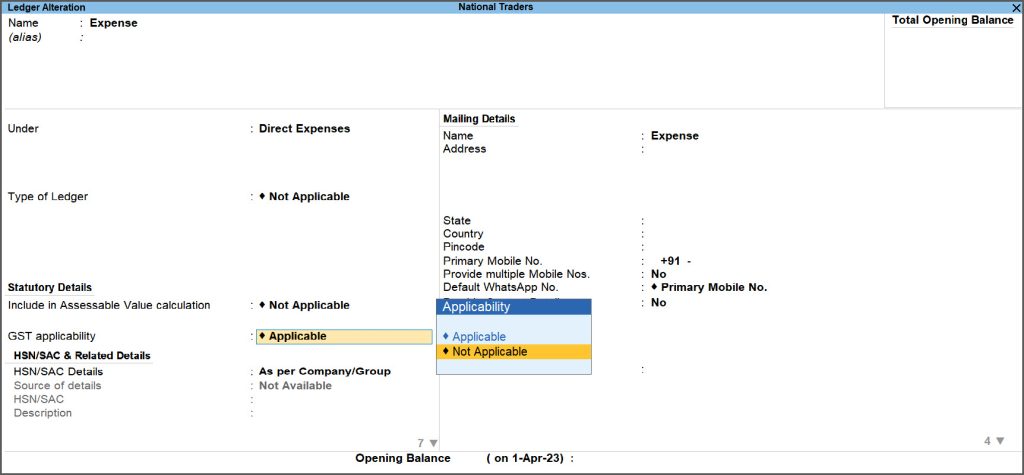

Mark the ledger as GST not Applicable

Open the particular ledger in the alteration mode and set the GST applicability as Not Applicable.

- Press Alt+G (Go To) > Alter Master > type or select Ledger and press Enter.

Alternatively, Gateway of Tally > Alter > type or select Ledger and press Enter. - Set the GST applicability as Not Applicable.

Change the voucher into a Purchase or Sale voucher

You can change the particular voucher into a Purchase or Sale by adding the necessary party details and tax ledgers.

- Open the GSTR-1 report.

- Select Uncertain Transactions (Corrections needed)> Unable to Determine Transaction and press Enter.

- Select the voucher you wish to change.

- Enter the party and duty details.

- Press Ctrl+A to save the voucher.