Set Up TallyPrime for Bank Reconciliation

You can choose to set up TallyPrime for either automatic or manual reconciliation, based on the method you follow in your business.

For users switching from manual to auto Bank Reconciliation

Consider that you use the manual reconciliation feature and based on the dates against bank entries in the bank statements, you reconcile transactions by entering bank date in bank reconciliation report.

Before you start auto-reconciling transactions using imported bank statements, it is recommended that all transactions up to a certain date are already reconciled. After that, you can begin importing statements and auto-reconciling new transactions.

This ensures a clean starting point to auto-reconciliation with no transaction pending for bank reconciliation.

For users performing Bank Reconciliation for the first time

- Configure your bank ledger for auto-reconciliation.

- Specify the Reconciliation Beginning Date, based on the date from which you want to start reconciling transactions.

The transactions before the Reconciliation Beginning Date can be added as Opening BRS – the unreconciled transactions before the Reconciliation Beginning Date.

Even though you can reconcile transactions manually, we recommend you to enable auto-reconciliation, which is simpler and quicker.

Enable Auto-reconciliation of transactions

Auto-reconciliation configuration helps you make default choices about:

- The voucher type for payment and receipts when you create vouchers automatically.

- Voucher numbering series for vouchers created from bank statement.

- Finding exact matches of bank entries to your corresponding book transactions at the time of importing a bank statement and even saving a voucher.

Once the configurations are set, you can start voucher creation or bank reconciliation exactly the way you want the features to function.

- In the Ledger Creation/Alteration screen, Set/Alter Bank configuration: Yes.

- In the Bank Configuration screen, Set/Alter Auto Reconciliation configuration: Yes.

Set Default Voucher Type for Voucher Creation from Bank Statement

- In the Auto Reconciliation Configuration screen, Deposits: Receipt.

- Withdrawals: Payment.

- Voucher numbering series: Specify the voucher numbering series for recording transactions, if needed.

- Select Voucher Type for Interbank/Cash transactions, if needed.

- Use a different Voucher Type for Interbank/Cash transactions: Yes.

- Interbank/Cash Transactions: Contra or Journal.

Identify Exact Matches for Reconciliation

- While Importing statement: Yes.

TallyPrime identifies a voucher in the Books, which exactly matches the transaction in the Bank Statement, at the time of import.- While Importing statement as well as Saving Voucher: Yes.

If you are a voucher manually or automatically after importing a bank statement, then TallyPrime identifies the bank entry matching the voucher at the time of saving the voucher.

- While Importing statement as well as Saving Voucher: Yes.

- Automatically Reconcile Exact Matches found: Yes.

Henceforth, if there are any exact matches found while importing statements and saving vouchers, then they will get automatically reconciled with the transactions available in the books. - Press Ctrl+A to save the configuration.

Set Reconciliation Beginning Date

Applicable to auto-reconciliation, by default, the Reconciliation Beginning Date is set as the first date of your financial year. However, if you are starting the reconciliation from a different date, then you can set a Reconciliation Beginning Date.

- In the bank Ledger Creation/Alteration screen, Set/Alter Bank configuration: Yes.

- Reconciliation Beginning date: Enter the date.

Reconciliation starts from this date.

You can also set the Reconciliation Beginning Date from Banking Activities.

- In the Banking Activities screen, press Alt+H (Opening BRS).

- Select the Bank ledger from the List of Bank Ledgers.

- Press Alt+R (Set Recon Beginning Date).

- In the Set Recon Beginning Date screen, enter the date.

Any transactions left unreconciled prior to this date will remain unreconciled until you include them in your Opening BRS report. You can set/alter Opening BRS to include the unreconciled transactions. Once included, you can see the Opening BRS transactions in the Bank Reconciliation report as ready to be reconciled.

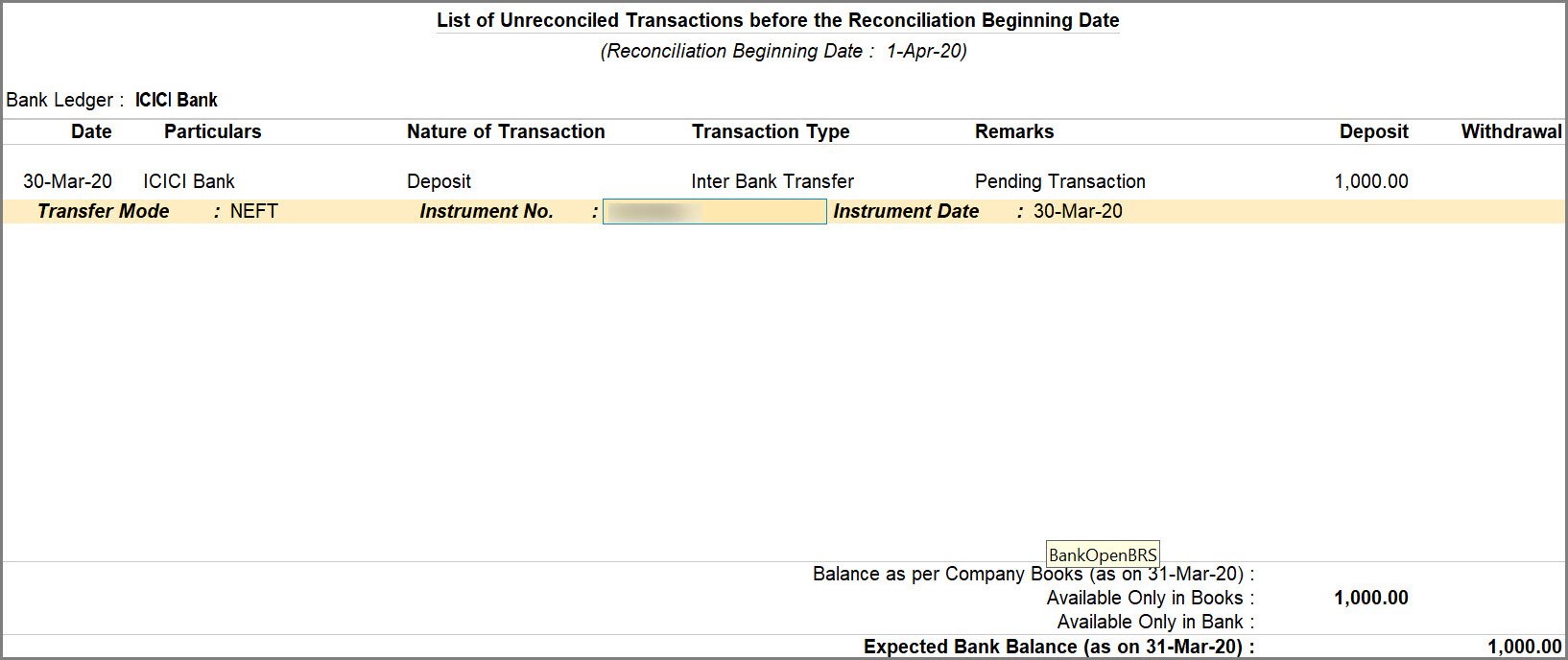

Set/Alter Opening BRS

Opening BRS transactions are the unreconciled transactions recorded before the Reconciliation Beginning Date. Adding these transactions allows you to add unreconciled transactions to your Company data.

- In the Ledger Creation/Alteration screen, Set/Alter Bank configuration: Yes.

- Set/Alter Opening BRS: Yes.

This option is available only during ledger alteration. - Press Alt+L (Update Opening BRS).

- Enter the details of the transaction.

- Date: Enter the date of transaction.

This date should be before the Reconciliation Beginning date. - Particulars: Enter the ledger name.

- Nature of Transaction: Select Deposit or Withdrawal, as applicable.

- Transaction Type: Select the relevant transaction type.

For example, Inter Bank Transfer or Same Bank Transfer. - Remarks: Enter the remark, if needed.

- Deposit/Withdrawal: Enter the Amount.

- Instrument No.: Enter the Instrument No., as applicable.

- Instrument Date: By default, this is prefilled, based on the date entered in the transaction.

- Date: Enter the date of transaction.

- Press Ctrl+A to save the configuration.

When you split a company, the unreconciled transactions, including those from books and bank, appear as Opening BRS of the company created after the split date.

Set Manual Bank Reconciliation as the Default Mode

If you prefer manual as the default Bank Reconciliation mode in your business, then you can set it as the default mode.

- Press Alt+G (Go To) > type or select Banking Activities.

Alternatively, Gateway of Tally > Banking > Banking Activities. - Press F12 (Configure).

- Use Manual Reconciliation as the default mode: Yes.

Ensure No Difference in Balance in Bank Reconciliation Summary

After migrating to TallyPrime Release 6.0 or later, if you see a difference in the balance in the Bank Reconciliation Summary, there refer to the following.

Reason 1: Opening BRS transactions are missing

After migrating to Release 6.0, the reconciliation starts with the most relevant and recent transactions. Any unreconciled transactions older than six months are not considered for bank reconciliation.

Solution: Add the missing opening BRS transactions.

Reason 2: Some Unreconciled Book Transactions/ Vouchers exist prior to the Previous Period

In the Bank Reconciliation Summary, in F12 (Configure), the default option for Default Period to show unreconciled transactions is Previous Financial Period. If there are any unreconciled transactions before the previous period, then a difference in the balance appears.

Solution:

In the Bank Reconciliation Summary, press F12 (Configure) and set Default Period for Unreconciled transactions as As per Reconciliation Beginning Date.

Alternatively, you can manually reconcile all the unreconciled transactions that were recorded prior to the previous financial period.

Reason 3: There are Unreconciled Book Transactions/ Vouchers prior to the Reconciliation Beginning Date

If unreconciled transactions exist in the company books before the reconciliation beginning date, a difference appears, as these transactions are not considered while calculating the expected balance.

Solution:

There are three ways to solve this:

-

Reconcile transactions before the Reconciliation beginning date.

-

Update the Opening BRS with unreconciled transactions prior to Reconciliation Beginning Date.

-

Change the Reconciliation Beginning Date, so that there are no unreconciled transactions available before the Reconciliation Beginning Date.

Reason 4: A Bank transaction exists in the Company Data and its corresponding Book Transaction /Voucher is Reconciled manually

Consider that you have reconciled a transaction manually in TallyPrime, as per your previous method of reconciliation.

Now, you have switched to auto-reconciliation. You import a Bank Statement which contains the same reconciled.

However, TallyPrime will identify the bank entries as new and unreconciled, thereby showing a difference in balance.

Solution:

Reconcile the bank entry manually by entering the bank date.

Alternatively, mark the book transaction that you had reconciled manually prior to importing the bank statement as Unreconciled. Thereafter, you can link the book transaction with the bank entry.

Reason 5: Some Book Transactions/ Vouchers or Bank Transactions are missing

This happens when a voucher created in the Company is not available in the bank statement OR the bank transaction imported to TallyPrime has not been created in the Company.

Solution:

- If there are any bank transactions pending for reconciliation, then create vouchers for those in the Company.

- If there are any book transactions pending for reconciliation, then wait till the transactions are a part of the bank statement.

As a result, the transactions get reconciled with no discrepancy.

Reason 6: Vouchers are recorded but not available in Bank Reconciliation Summary

At times, vouchers get created but do not become a part of the Bank Reconciliation Summary.

This might be because the Bank Allocation is not provided in the voucher, especially after the voucher is imported through MS Excel.

Solution:

- Open the voucher, and ensure that Bank Allocation is provided.

- Press Ctrl+A to save the vouchers.

Check if the voucher is displayed in the Bank Reconciliation Summary.