Prepare Financial Statements for Non Corporate Entities (NCE) Using TallyPrime Data and Excel Template

TallyPrime allows you to export financial data in XML format to help you prepare structured Financial Statements for Non-Corporate Entities (NCE). This data can be easily mapped into a smart Excel template, enabling you to meet regulatory compliance and generate professional financial statements outside TallyPrime.

ICAI’s Guidance Note is designed to improve the quality and comprehensiveness of financial reporting by non-corporates. This guidance applies to financial statements for periods starting on or after April 1, 2024.

This Add-on is available for both single Indian companies and group companies, provided that all member companies in the group and the group company itself are Indian companies. Access also depends on user rights.

Prerequisites

Before you begin, ensure the following:

- You’re using TallyPrime Release 6.0 and above.

- You have MS-Excel installed on Windows 2016 or higher versions.

- You have full access rights to view Balance Sheet, Profit & Loss A/c, and Trial Balance.

- The company’s Country is set to India.

- Selected years (Current Year or Previous Year) are on or after the Books Beginning From date.

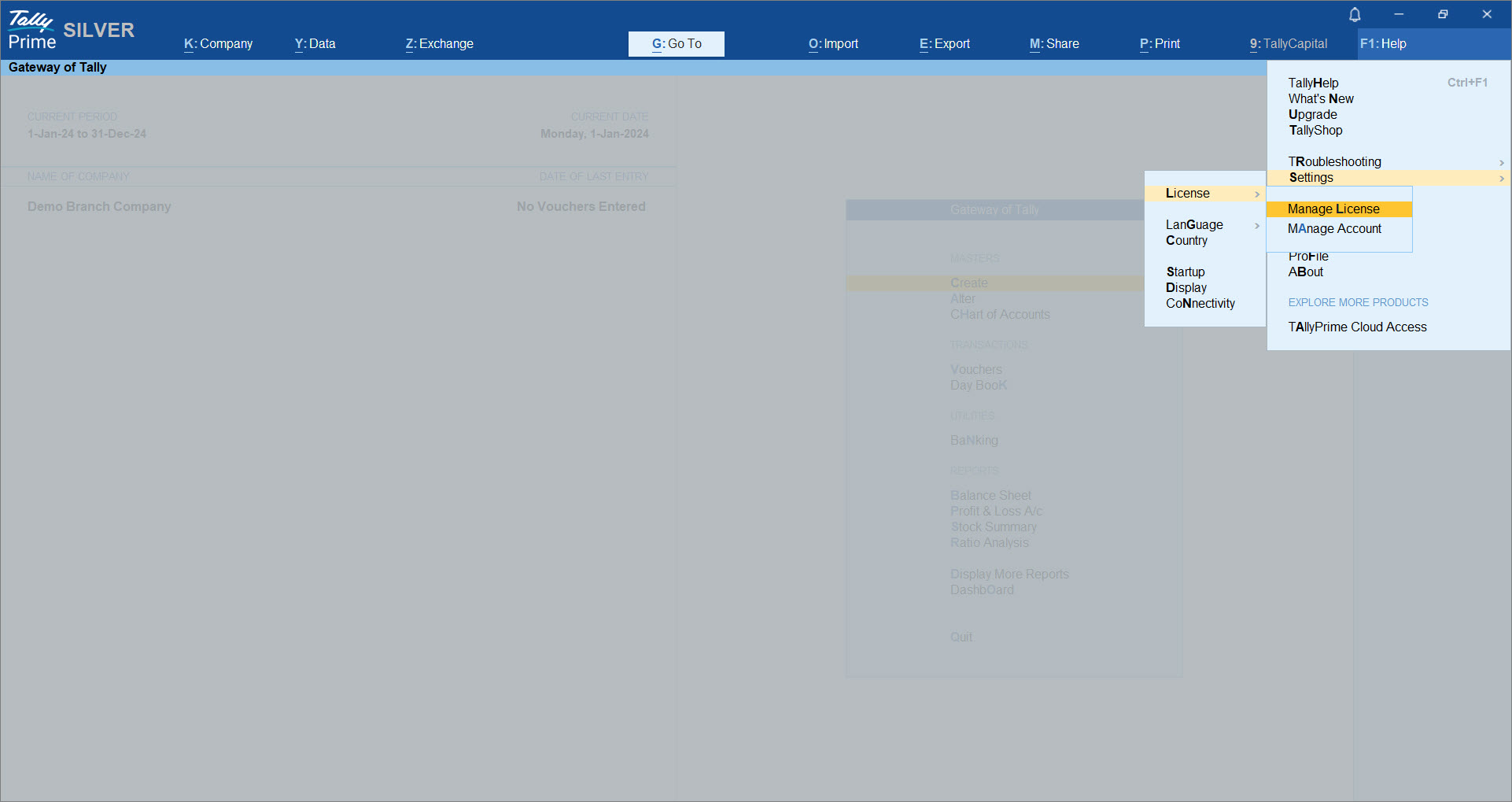

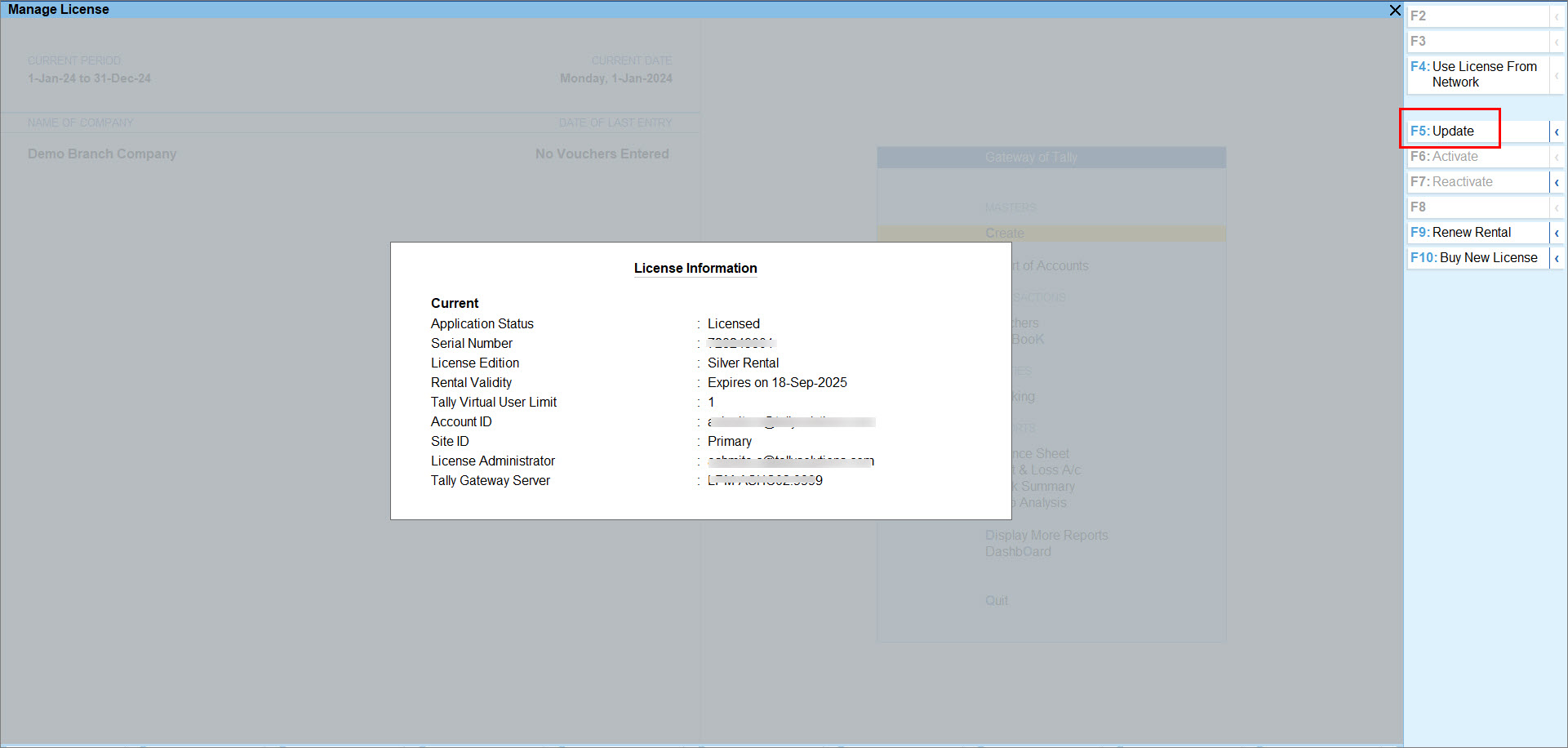

Step 1: Enable the Add-on for your license

You can enable the add-on from the webpage and update your license in TallyPrime. This links your serial number to the add-on feature and places the smart Excel template in your TallyPrime installation folder.

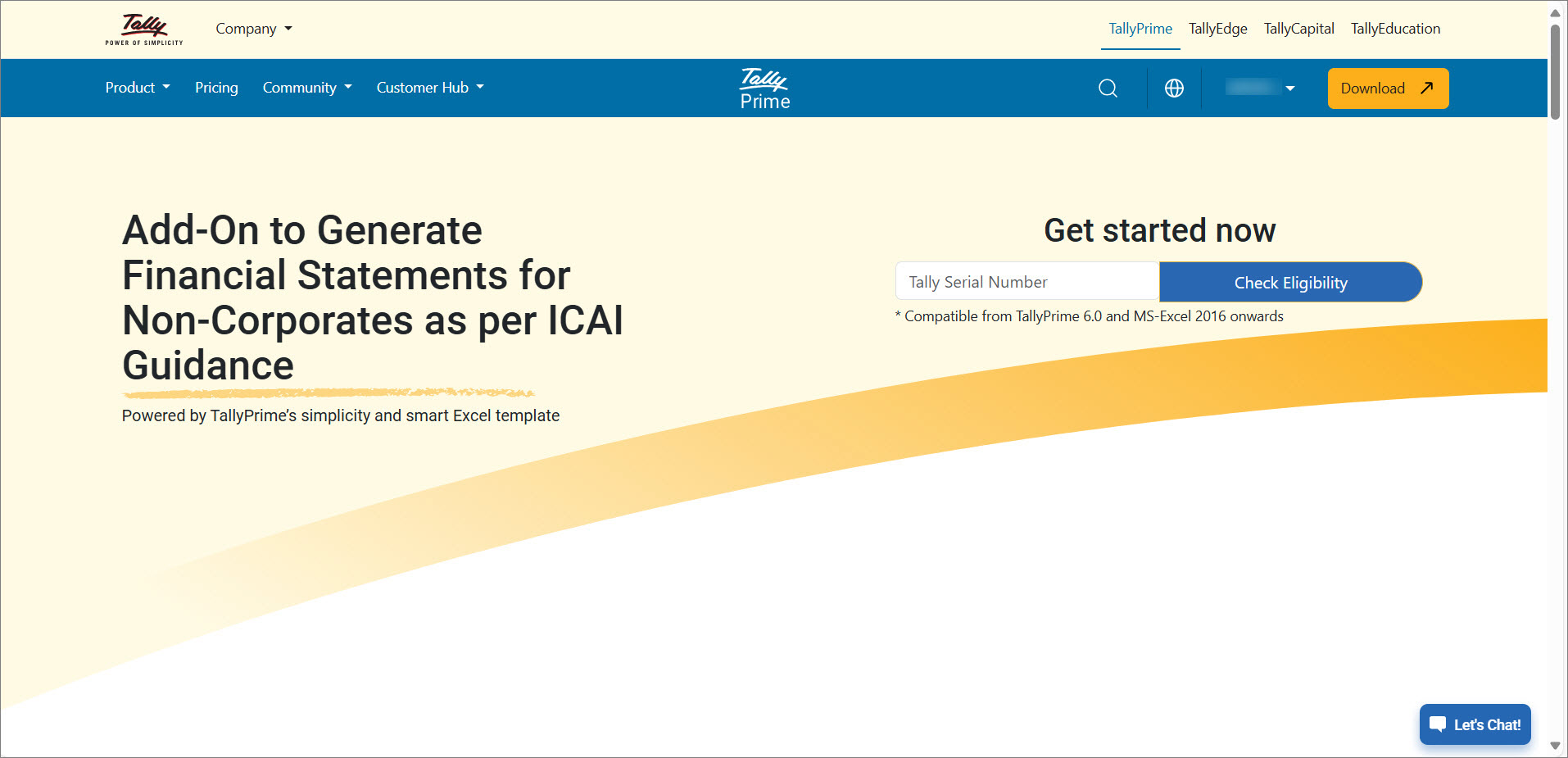

- Go to the webpage for enabling the Add-on for your TallyPrime license.

- Enter your Tally Serial Number and click Check Eligibility.

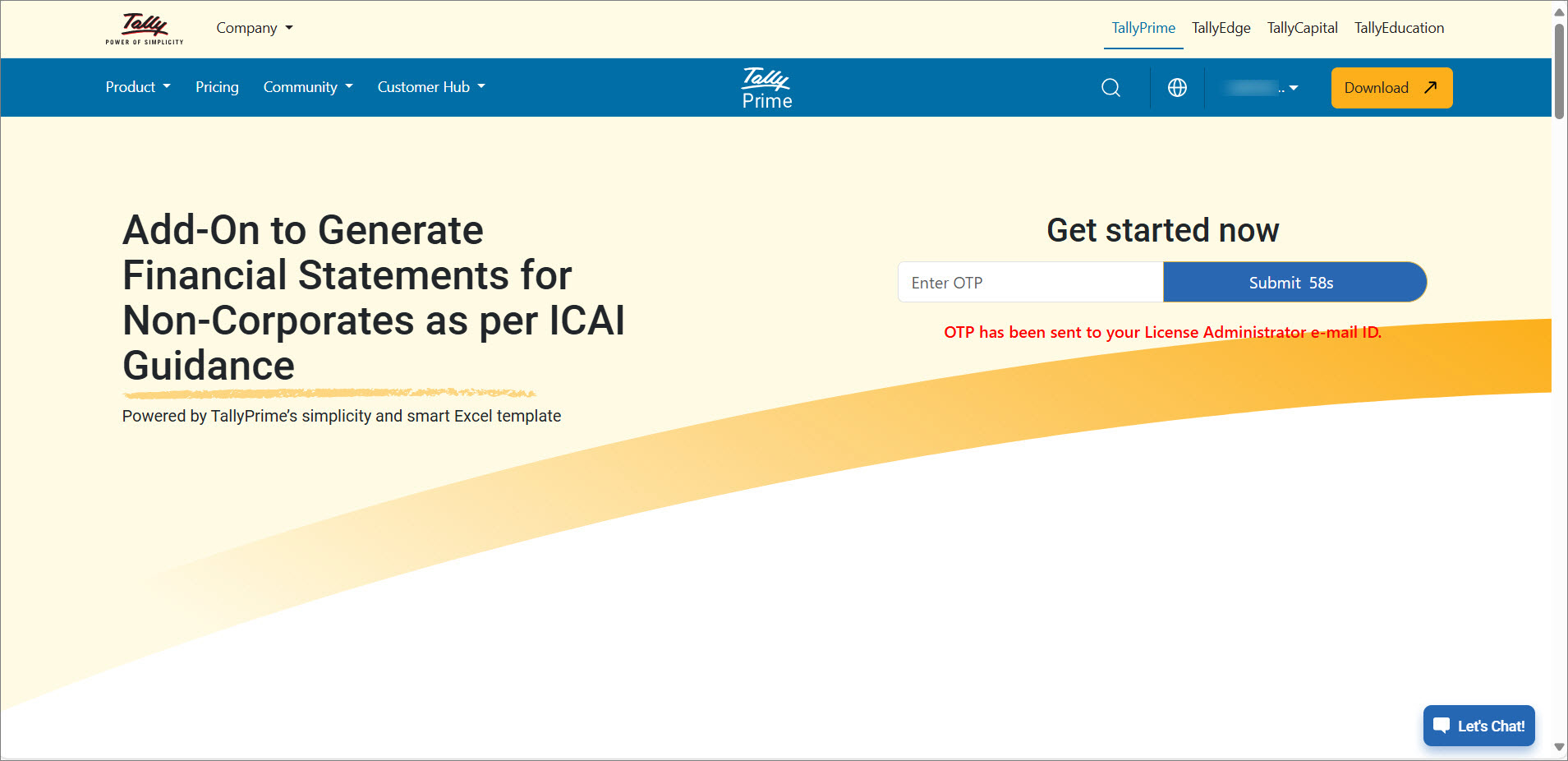

An OTP will be sent to your License Administrator e-mail ID.

- Enter the OTP and click Submit to enable Financial Statements for NCE.

A success message is displayed confirming the linking of your Tally Serial Number. A confirmation e-mail will also be sent to your registered e-mail ID. - Update your TallyPrime license.

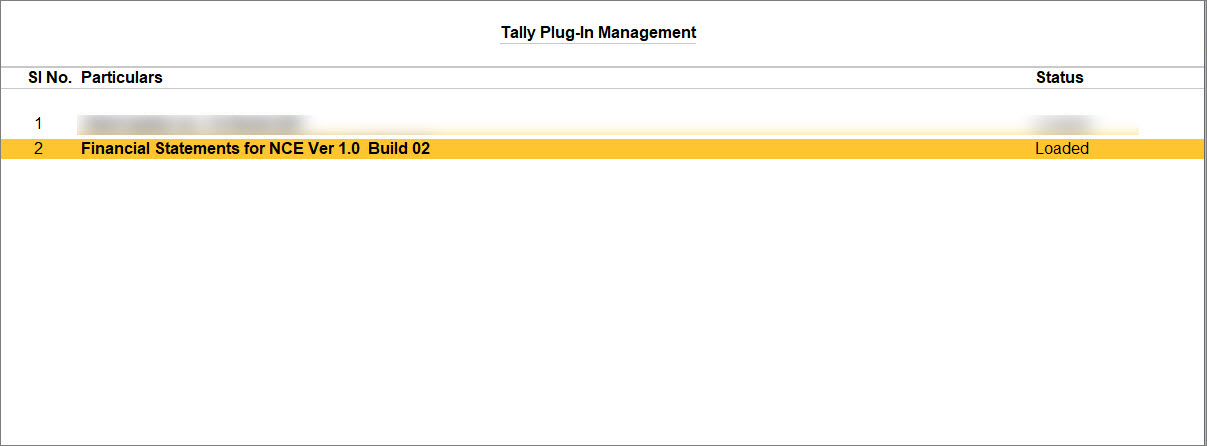

- Press F1 (Help) > Tally Plug-Ins and view the Add-on for Financial Statements for NCE.

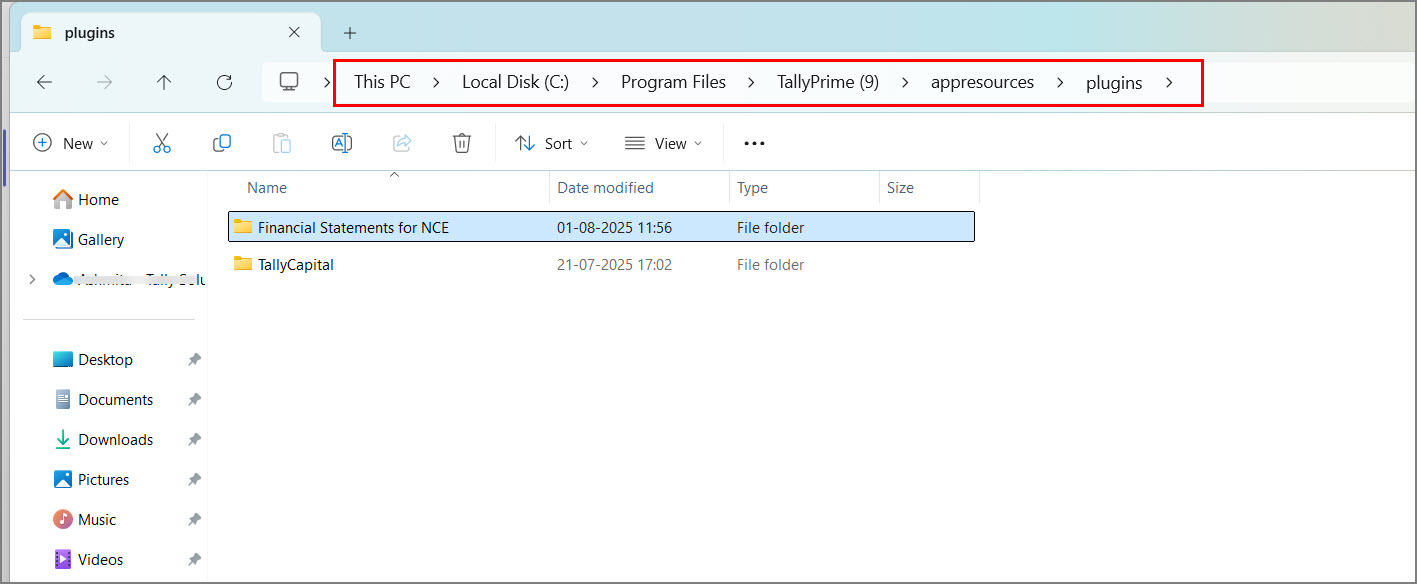

The Excel template will be automatically downloaded as a zipped file in your TallyPrime folder. - To view the template, open TallyPrime installation folder > Appresources > Plugins.

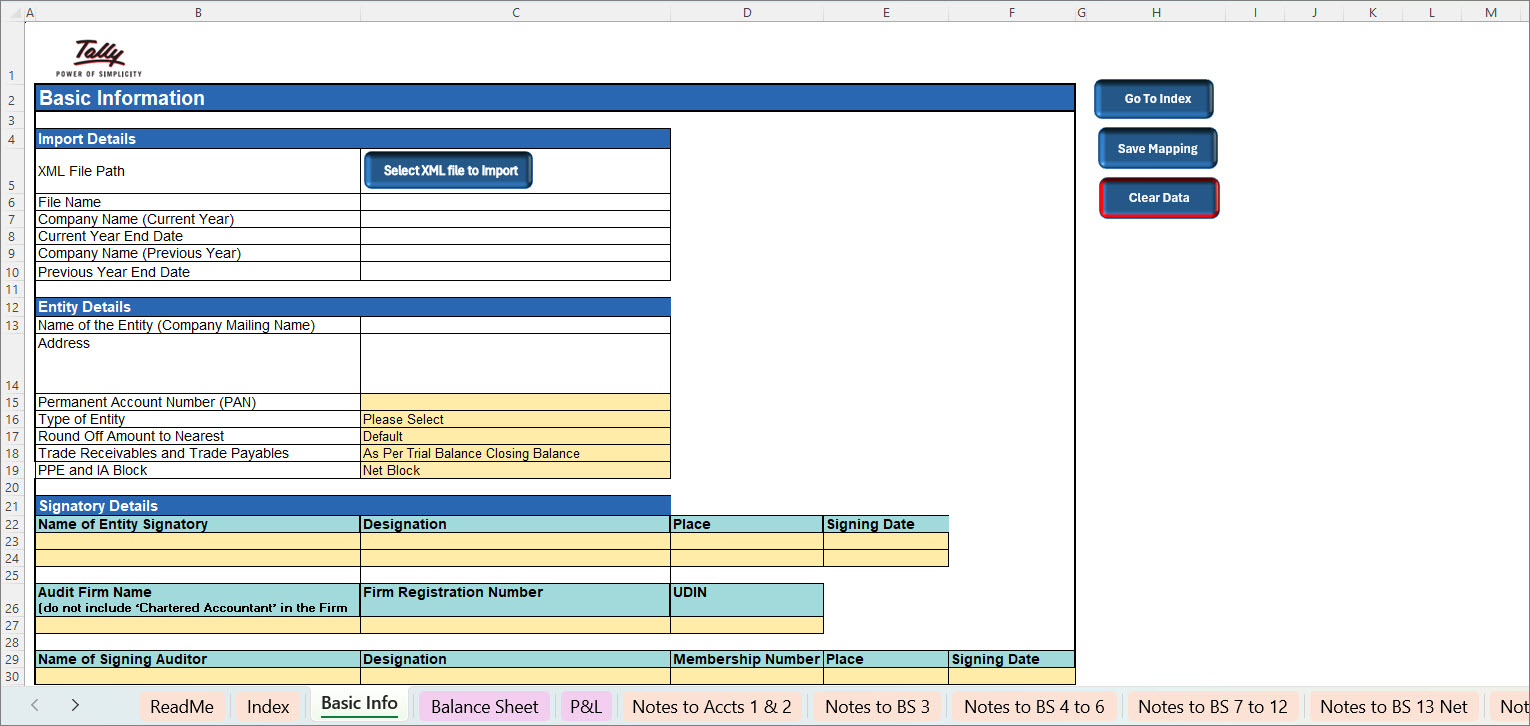

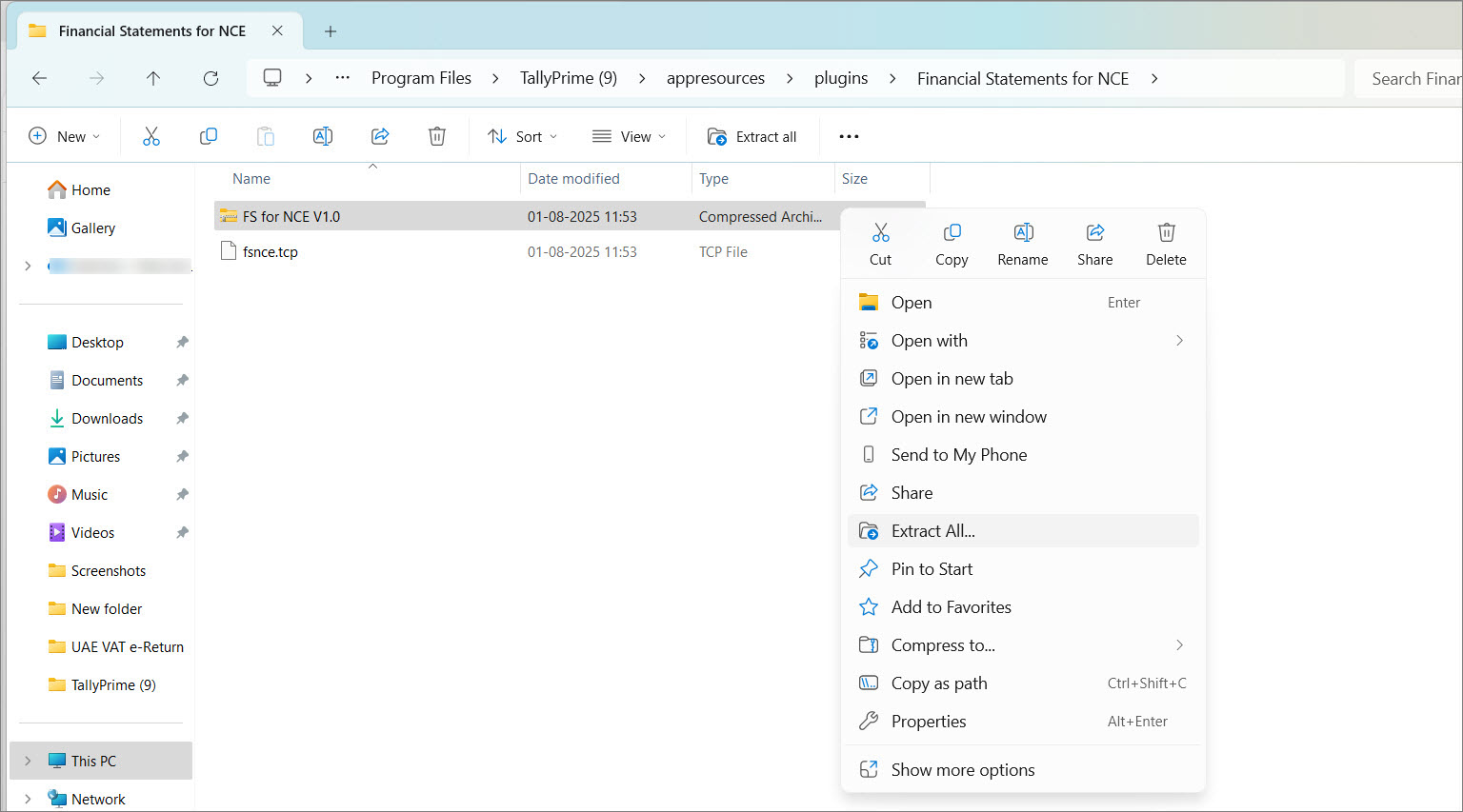

Step 2: Extract the Excel Template

The Excel template for preparing financial statements for NCE is downloaded as a zipped file and stored in your default TallyPrime folder.

To extract the template:

- Go to your TallyPrime installation folder > Appresources > Plugins.

- Locate the zipped file for the Excel template, right-click on it, and select Extract All.

- Choose a different folder if needed and complete the extraction.

If the template is not available in the TallyPrime installation folder, download the latest version from the TallySolutions website.

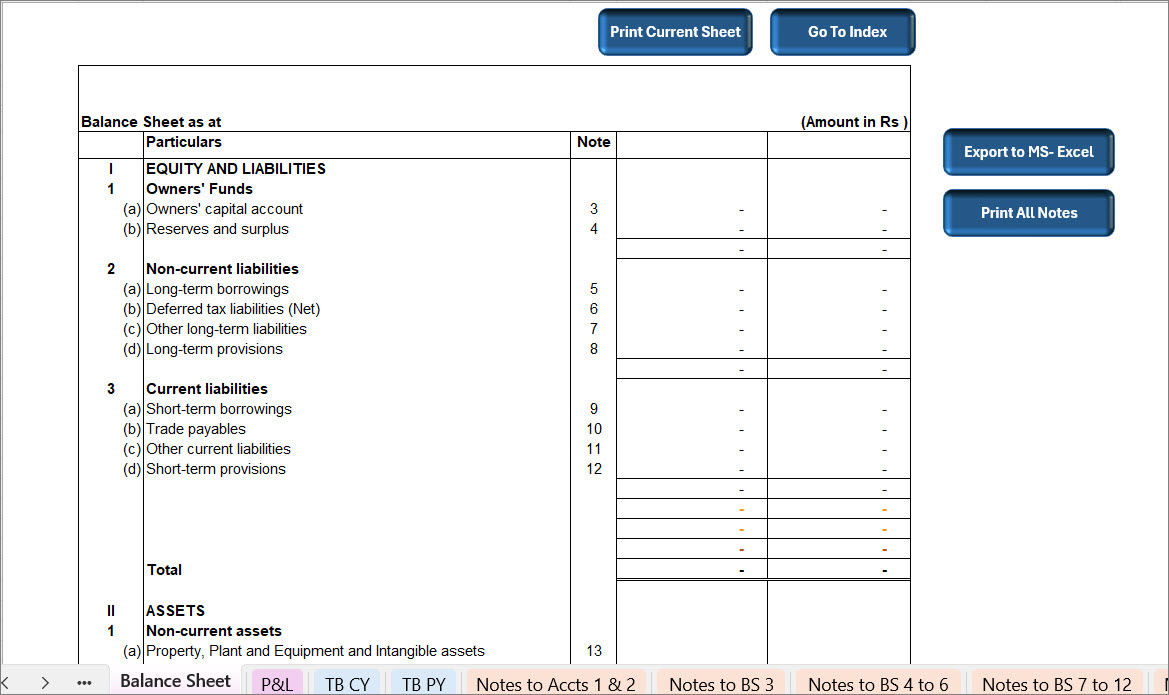

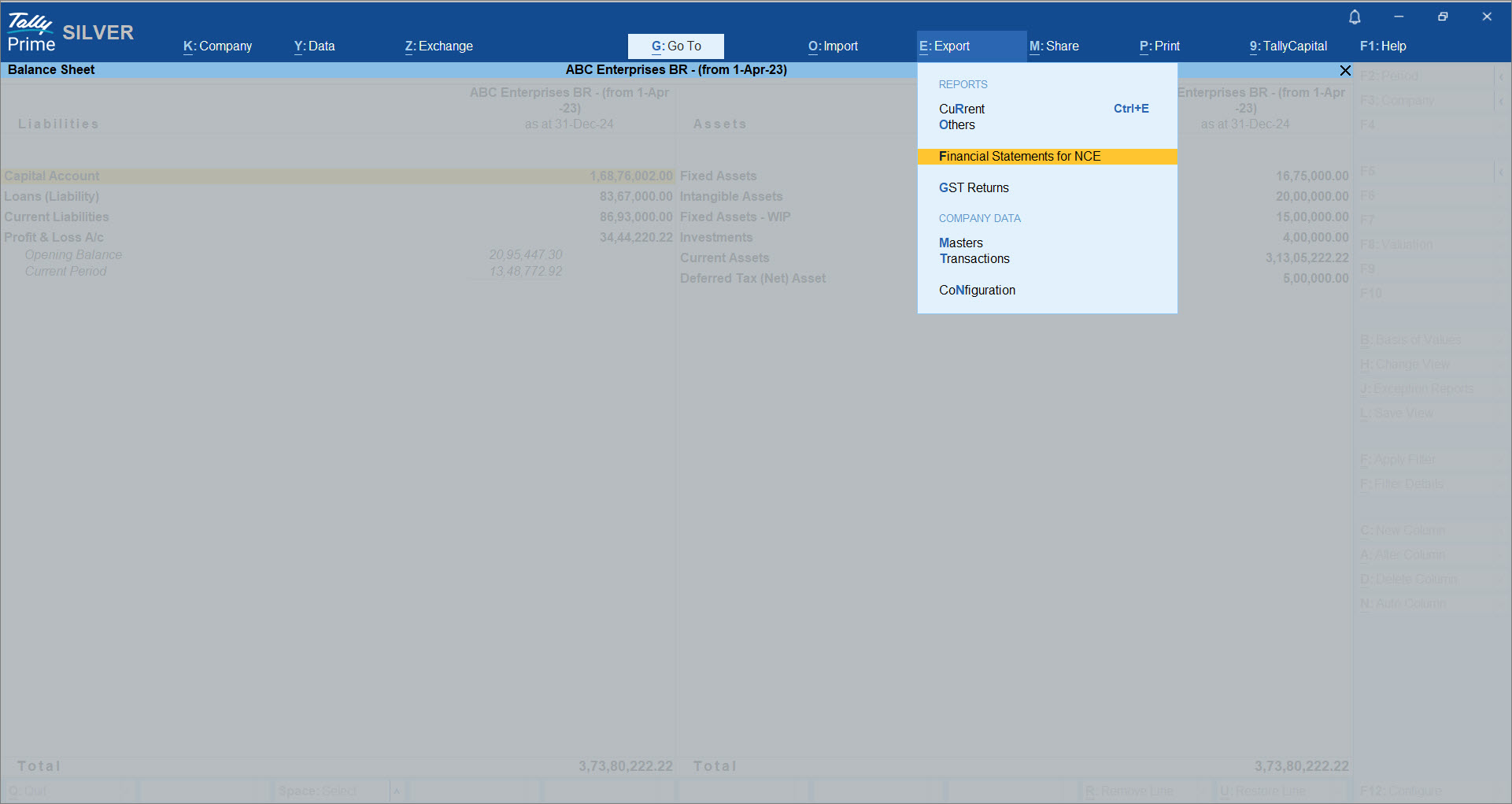

Step 3: Export Financial Data from TallyPrime

The Export option is available in the following reports:

- Balance Sheet

- Profit & Loss A/c

- Trial Balance

For Group Companies:

- Ensure that in F11, the options Maintain Inventory and Integrate Accounts with Inventory match between the member companies of a group. Else, the option Export > Financial Statement for NCE will not be available for the Group Company.

- The Chart of Accounts and Inventory of all member companies must also be the same otherwise, the exported data for the Group Company may be inaccurate.

To export:

- Open any of the above reports.

- Press Alt+E (Export) > Financial Statements for NCE.

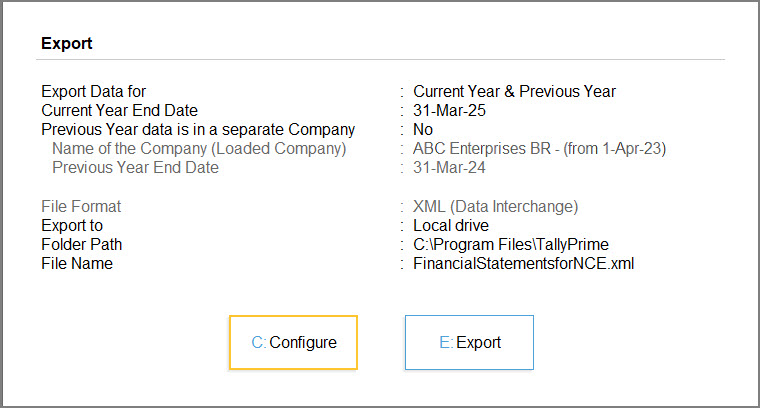

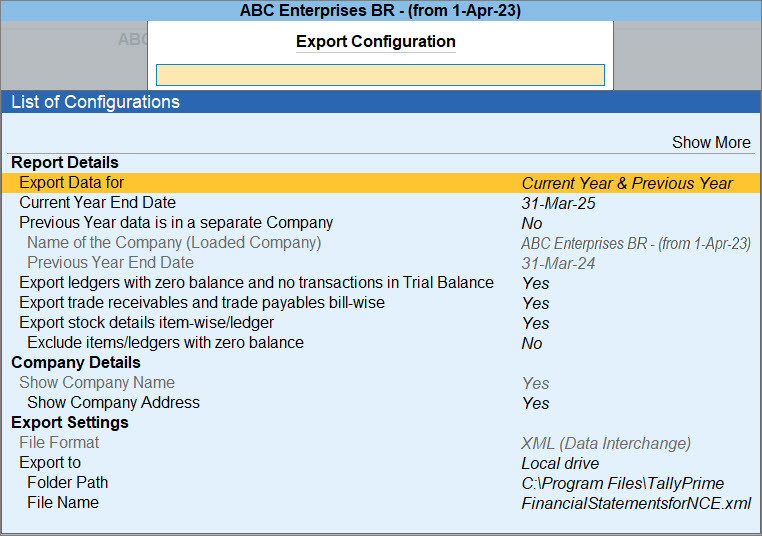

- Press C to configure export settings as needed.

- Export Data for: Select the required Current Year (CY) and/or Previous Year (PY).

Ensure that the companies containing data for the selected years are loaded in TallyPrime before configuring these details. Data can be exported for the Current Year if it is a single company and for the Previous Year if it is a Group Company, and vice versa.

- Current Year End Date: Change the date, as required.

If the selected year is before the company’s Books Beginning From date, the exported data will be blank. For Group companies, the Books Beginning From date must be equal to or later than the Period Beginning date of the member companies. If it is earlier, data will not be exported.

- Previous Year data is in a separate Company: This option is set to No, by default.

Set this to Yes, if you have the previous year’s data in a separate or split company. - By default, these options are set to Yes.

- Export ledgers with zero balance and no transactions in Trial Balance

- Export trade receivables and trade payables bill-wise

- Export stock details item-wise/ledger

Set these to No to ensure faster imports and prevent unnecessary mapping of ledgers or items in the Excel template.

- Name of the Company (Loaded Company): From the List of Companies, select the company that has the previous year’s data.

- Previous Year End Date: This option gets auto-updated when Current Year End Date is changed.

Data from the selected company will be imported into the PY worksheets, while data for the current year will be imported into the CY worksheets.

- Export Data for: Select the required Current Year (CY) and/or Previous Year (PY).

- Press E (Export).

The XML file will be saved in the default TallyPrime folder.

By default, the file is saved as FinancialStatementsforNCE.xml. It is recommended to change the file name to prevent any potential confusion.