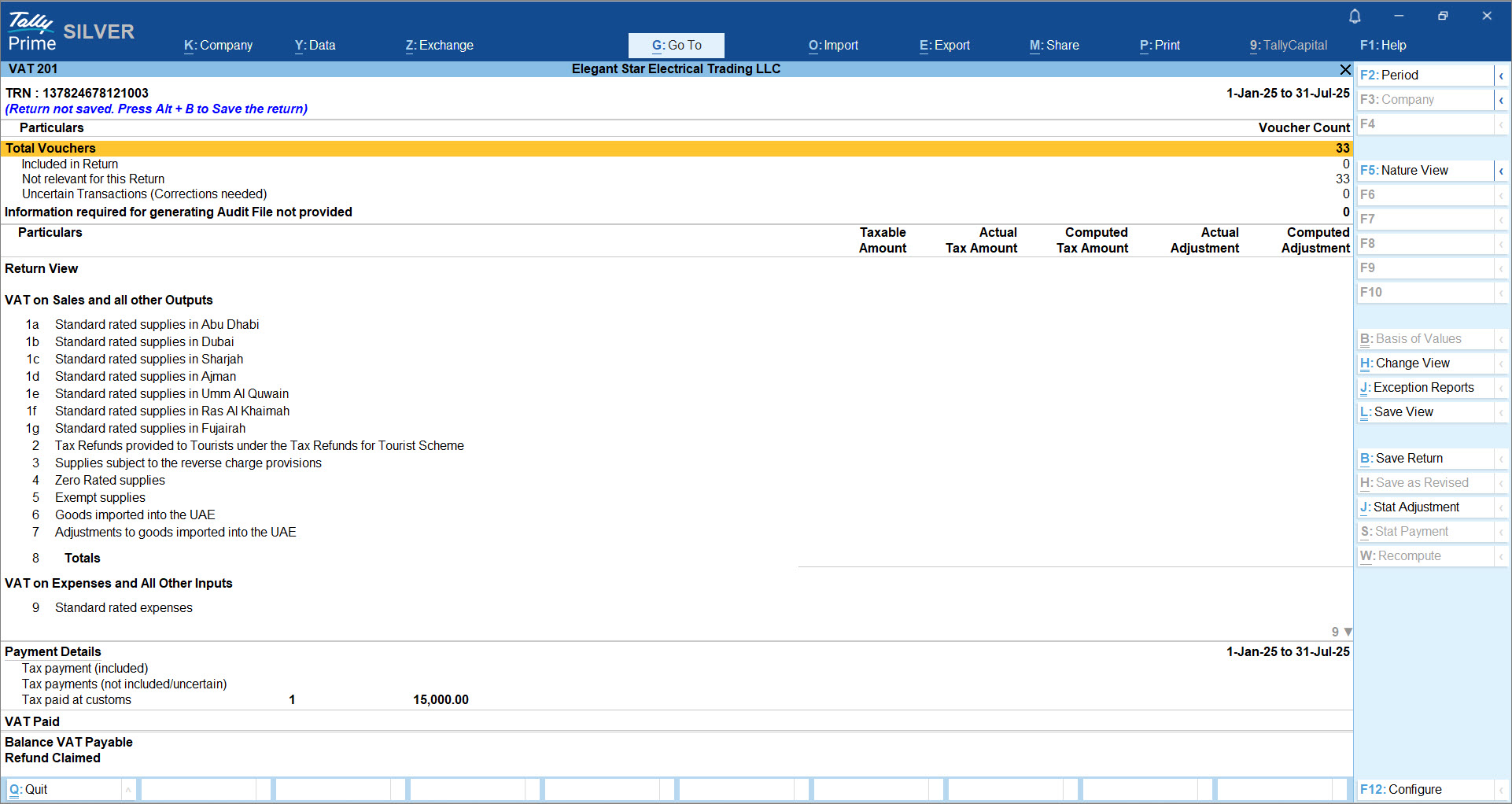

UAE VAT 201 Report – Return View

VAT returns must be filed by registered dealers with the VAT authorities at the end of each reporting period. In TallyPrime, you can generate the VAT 201 return form as per FTA guidelines.

Before filing, TallyPrime provides a VAT 201 report that displays the tax computation for the return period. This report helps you verify your tax liability, input credits, and adjustments, and also review all transactions — whether recorded correctly, incorrectly, or inadequately.

The report in Return View mirrors the official VAT 201 format as per FTA guidelines, so you can confidently review and prepare your return for filing. You can also use the report to identify and resolve exceptions, and then finalise the return. Once saved, if any changes are made to transactions or masters, the return can be revised or overwritten.

To open the report:

-

Press Alt + G (Go To) > type or select VAT 201 – Return View.

The VAT 201 report opens in the Return View by default, showing all details in the same structure as prescribed by the FTA.

The report in the Return View is organised into clear sections:-

VAT on Sales and All Other Outputs – Displays supplies across Emirates, zero-rated and exempt supplies, reverse charge transactions, and adjustments.

-

VAT on Expenses and All Other Inputs – Displays inward supplies such as standard-rated expenses and reverse charge supplies.

-

Net VAT Due – Summarises the VAT payable or refundable after adjusting recoverable tax, carried forward credits, or refunds.

-

Payment Details & VAT Paid – Displays tax already paid, uncertain or pending payments, and customs-related tax.

Each line in these sections displays important values across columns such as: -

Taxable Amount – Value of supplies/purchases on which VAT is calculated.

-

Actual Tax Amount – VAT recorded in vouchers.

-

Computed Tax Amount – VAT auto-calculated based on specified tax rate by TallyPrime.

-

Actual Adjustment – Manual adjustments entered.

-

Computed Adjustment – Adjustments calculated automatically based on specified tax rate.

-

-

If you wish to compare the values recorded in vouchers with those computed by TallyPrime, press F12 (Configure) > Show Computed Values > set to Yes.

This makes it easy to identify mismatches and correct them right away. -

Drill down from any line (for example, Standard rated supplies in Abu Dhabi) to view the list of contributing vouchers.

-

Further drill down into vouchers and press Ctrl+ Enter to check or edit details.

-

Once, you have made the necessary changes, press Alt+W (Recompute) to update the return with the revised values.

-

At any point, if you prefer to view the return based on the nature of transactions rather than the FTA format, press F5 (Nature View).

This shows the data grouped under Sales, Purchases, Imports, Exports, and so on, making it easier for internal analysis.

With these flexible options—structured Return View for filing, Nature View for analysis, drill-downs for accuracy, and configuration for comparisons—the VAT 201 report in TallyPrime ensures that you can review, reconcile, and finalise your return with complete confidence.