Upload and Submit UAE VAT 201 e-Return from TallyPrime

Nature View | Return View| FAQ | Troubleshooting

TallyPrime simplifies UAE VAT compliance by enabling you to upload and submit your UAE VAT 201 e-Return directly to the EmaraTax portal from TallyPrime. You can seamlessly log in using your Federal Tax Authority (FTA) credentials, view the return periods available on the portal, and submit accurate return with details derived from your TallyPrime data.

The integrated workflow ensures that your submission process is smooth, transparent, and aligned with the FTA guidelines.

Upload and Submit UAE VAT e-Return

Follow these simple steps to upload and submit your VAT 201 e-Return directly from TallyPrime using the EmaraTax portal.

Step 1: Log in to the EmaraTax Portal

-

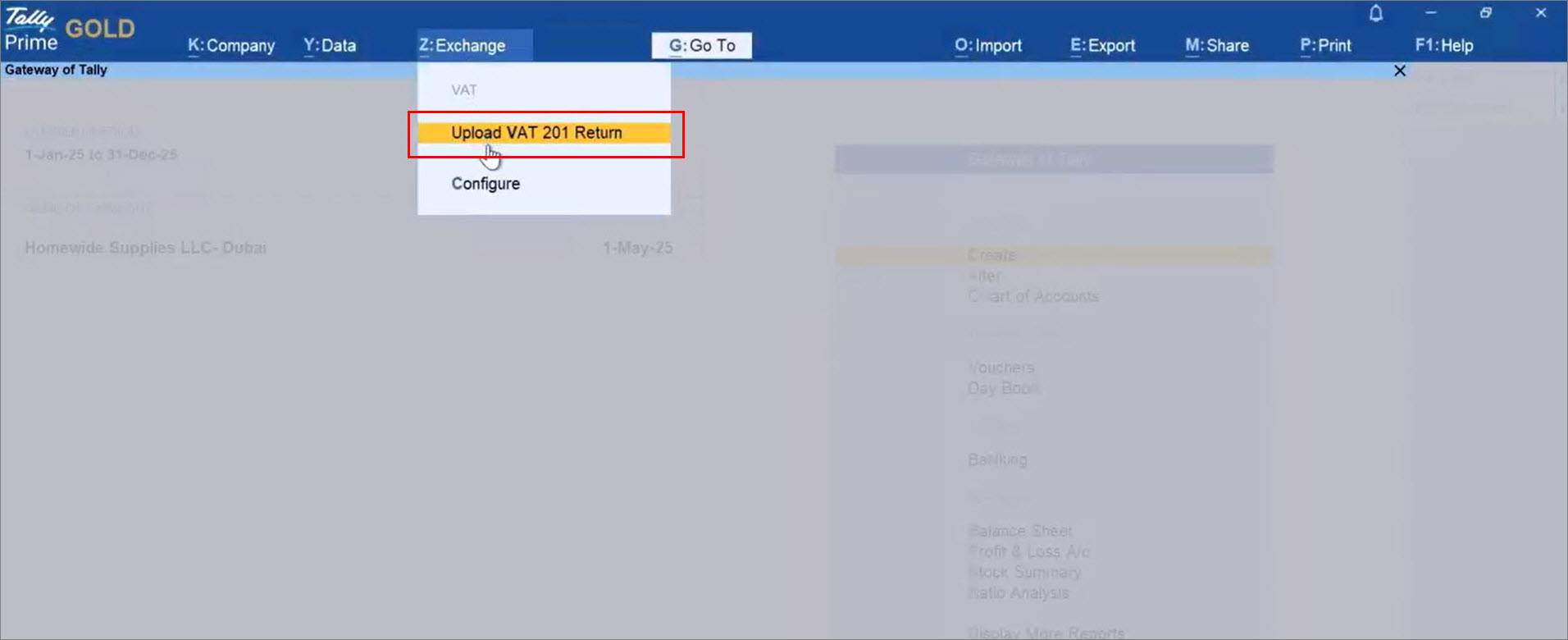

Press Alt+Z (Exchange) > Upload VAT 201 Return.

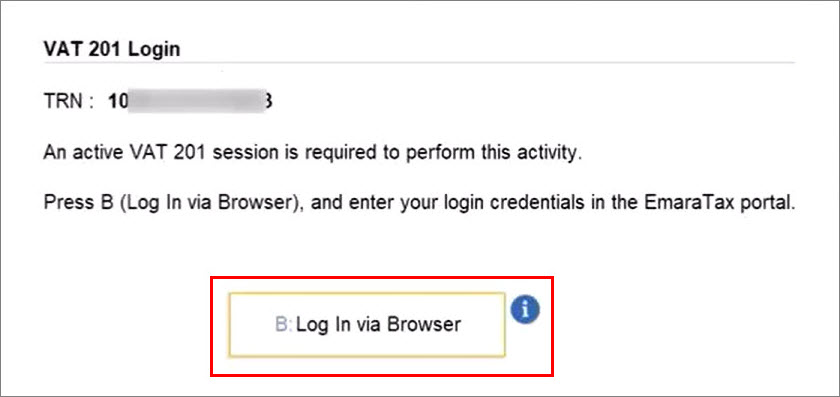

The VAT 201 Login screen appears. -

Press B (Log In via Browser).

You will be redirected to the official EmaraTax portal via your default web browser. -

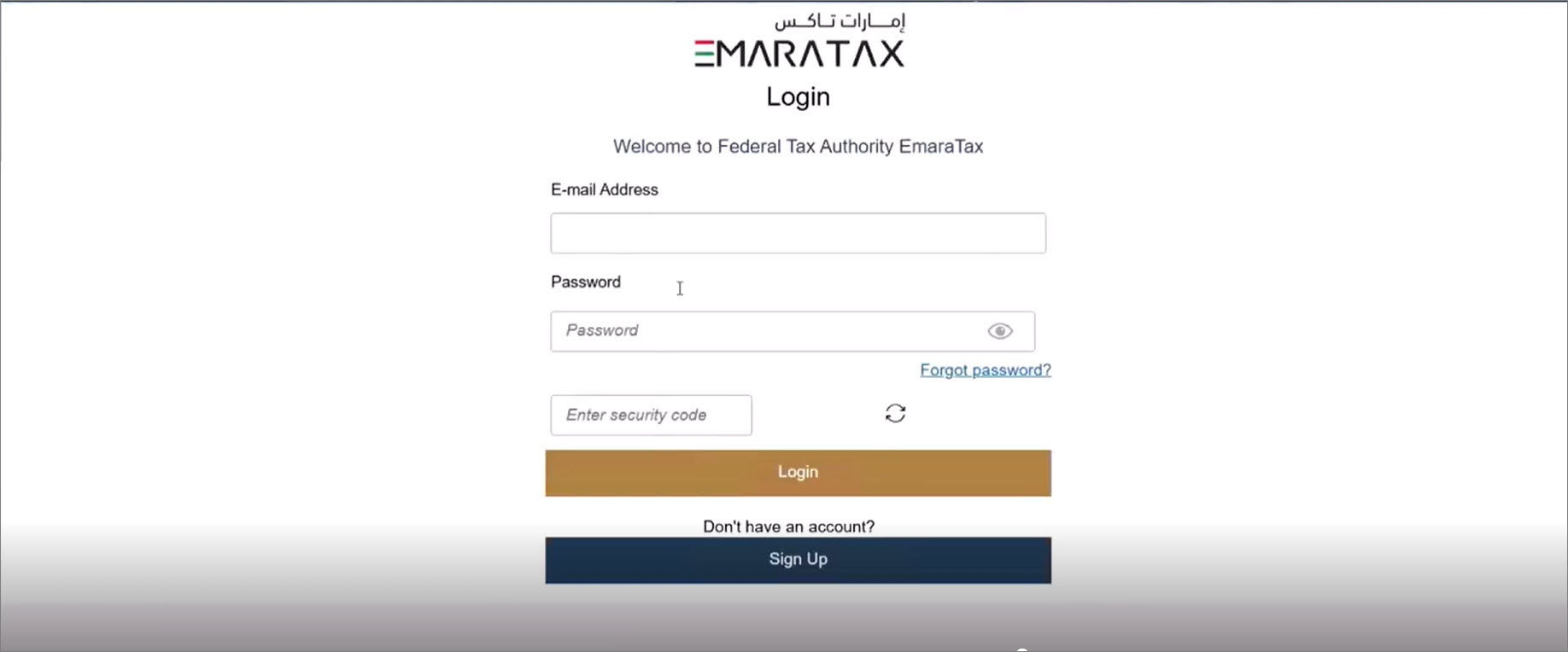

Enter the E-mail Address and Password registered with the FTA.

-

Click Login.

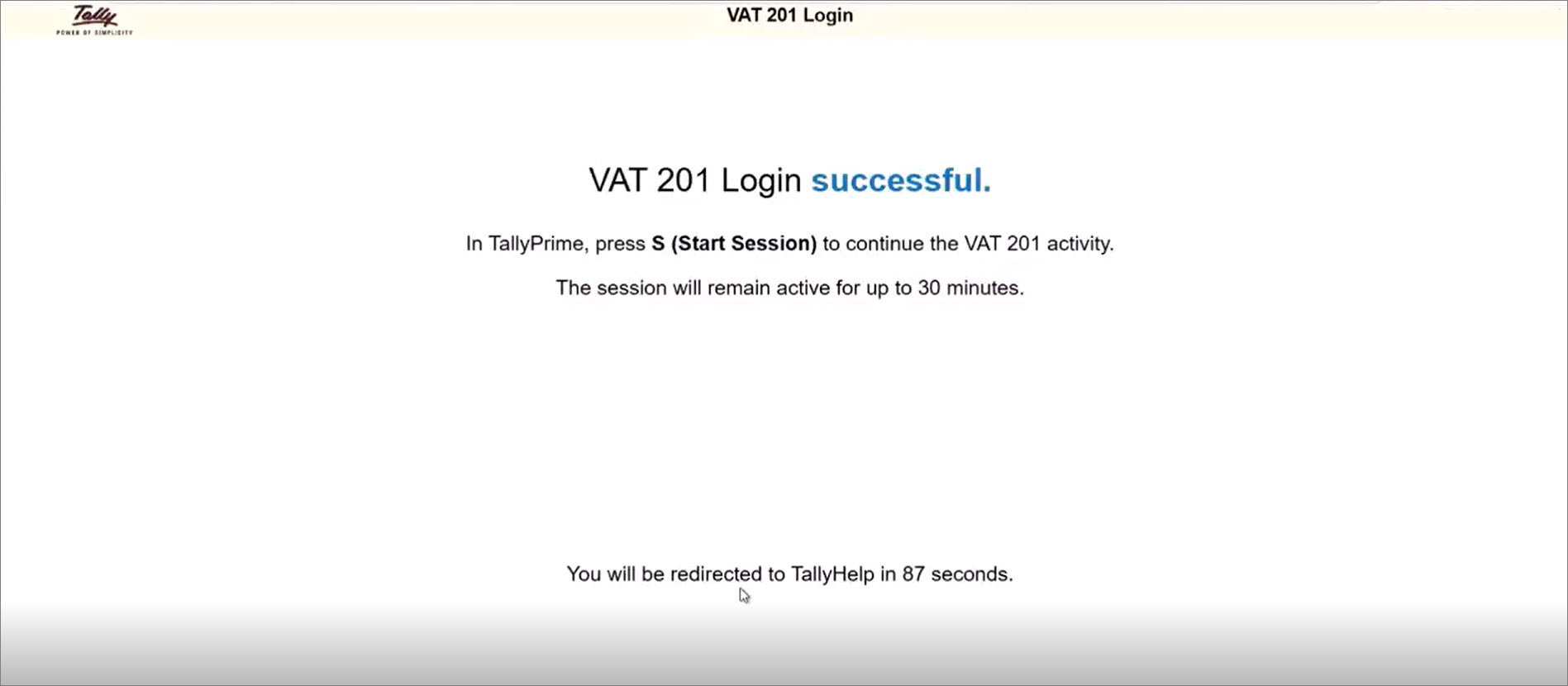

Once you have successfully logged in to the EmaraTax portal, you can return to TallyPrime and start the VAT session.

Step 2: Start VAT Session in TallyPrime

-

Return to TallyPrime.

-

In the VAT 201 Login screen, press S (Start Session).

The session will remain active for 30 minutes after a successful login. If a session already exists, you will be directed to the List of Return Statuses screen.

Step 3: Upload and Submit VAT 201 e-Return

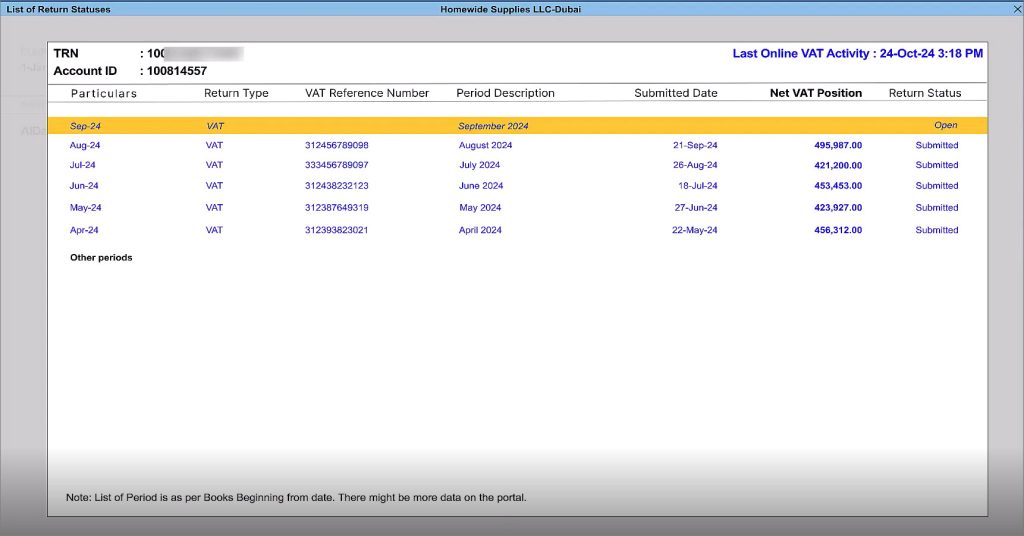

Once you have successfully logged in and started the VAT session, the List of Return Statuses screen appears, displaying the return periods available on the EmaraTax portal.

You can review the return details for each period:

-

Return Type

-

VAT Reference Number

-

Period Description

-

Submitted Date

-

Net VAT Position

-

Status

The values fetched from the EmaraTax portal will appear in blue.

-

Select the period for which you want to upload the return.

If there are overdue periods, you must first file the oldest overdue return.

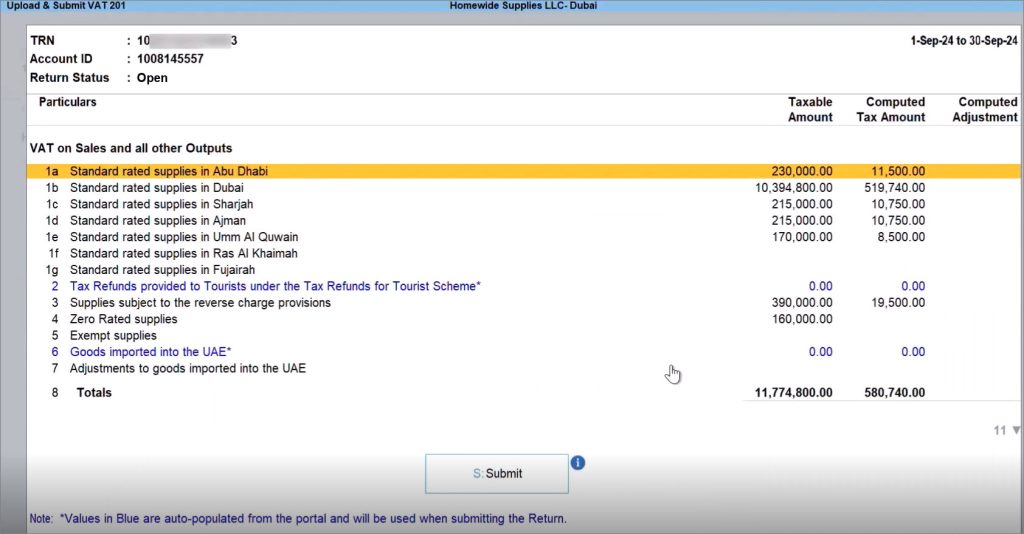

The Upload & Submit VAT 201 screen appears, displaying the return preview.

The following columns appear by default:

-

Taxable Amount

-

Computed Tax Amount

-

Computed Adjustment

These columns appear when filing the return for the first time from TallyPrime.

-

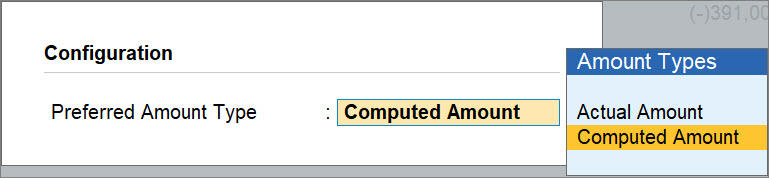

Press F12 (Configure) > Preferred Amount Type, and select the preferred option.

Once set, your preferred amount type will be retained for future submissions.

-

-

Press S (Submit) to submit the return.

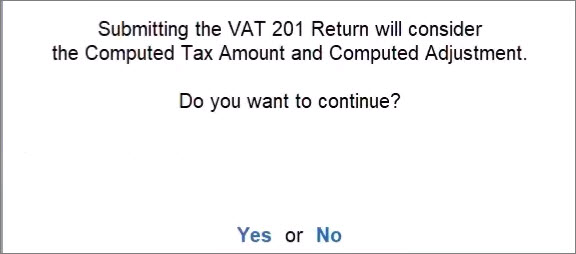

A confirmation message appears based on the selected amount type.

-

Select Yes to proceed.

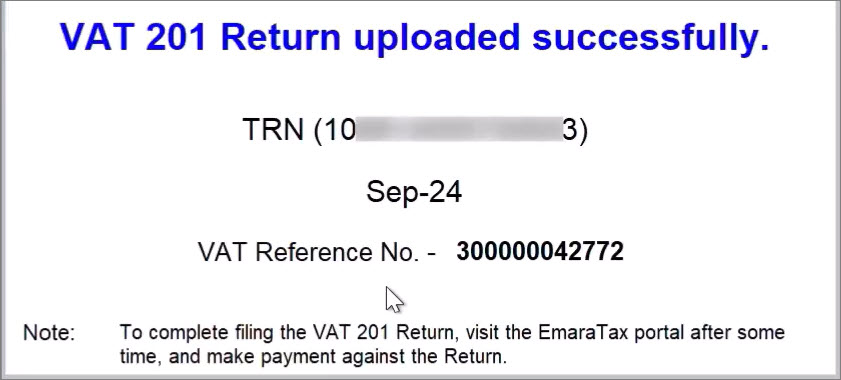

Once the return is uploaded successfully, you will get a confirmation message with the VAT Reference Number.

Submit Voluntary Disclosure, if applicable

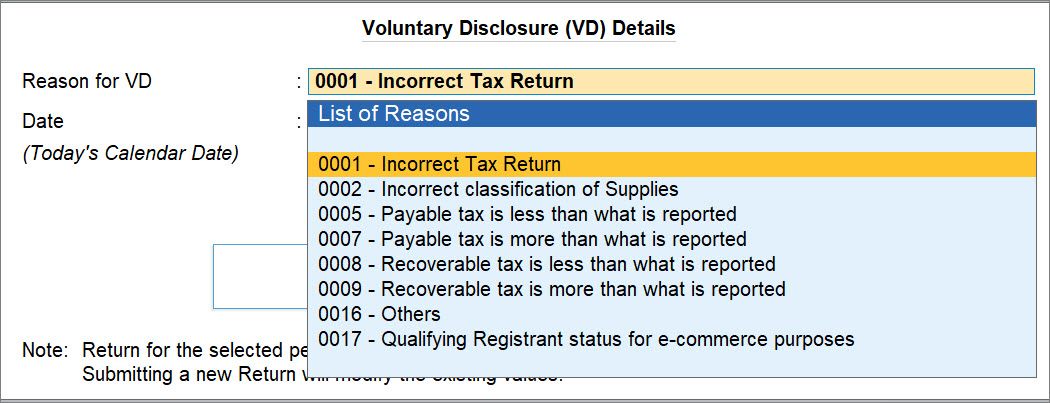

If the return for the selected period has already been submitted, the action is treated as a Voluntary Disclosure (VD).

The VD Details screen appears.

-

Enter the following:

-

Press C (Continue) to proceed.

Once the upload is successful, you will get a confirmation message.

Once the return is successfully uploaded, your UAE VAT 201 e-Return filing through TallyPrime is complete. You can now review the submission details anytime and proceed with other VAT activities as needed.

Step 4: Verify Submitted Return on EmaraTax Portal

-

Log in to the EmaraTax portal.

-

Select the account for which return was submitted from TallyPrime.

-

In the list of submissions, select the return with Status: Submitted.

-

Click the three dots (…) next to the return and select View.

You can view and verify the submitted return. -

To compare the values in TallyPrime, press Alt+G (Go To) > VAT 201 > Return View to view the return values from your books.

Resolve Mismatch in Values

While uploading the VAT e-Return, TallyPrime compares the values in your Books with the values fetched from the EmaraTax Portal. If any differences are identified for Goods imported into the UAE, a Mismatch in values for Goods imported into the UAE alert appears in red on the Upload & Submit VAT 201 screen.

Only specific sections display colour-coded differences on this screen:

- The differences in section 6 are highlighted in red.

- The values in section 2 appear in blue.

- All other fields appear in black, reflecting the values from your Books.

A mismatch in section 6 may occur when:

- The values for this section are fetched directly from the EmaraTax Portal.

- The computed values in your Books differ from the fetched values.

The EmaraTax Portal considers the tax component for section 6 as final, as the values are sourced from the Customs Portal. The values fetched from the Portal are compared with the values in your Books, and you can correct them as required, either in your Books or on the Portal.

For section 2, TallyPrime does not perform any comparison. The values fetched from the Portal are shown as is on the Upload & Submit VAT 201 screen.

A mismatch does not prevent you from uploading the Return. You can:

- Press S (Submit) to submit the VAT Return along with the mismatched values fetched from the Portal.

- Press V (View Recon Report) to view the reconciliation between Books and Portal values and identify the exact fields causing the mismatch.

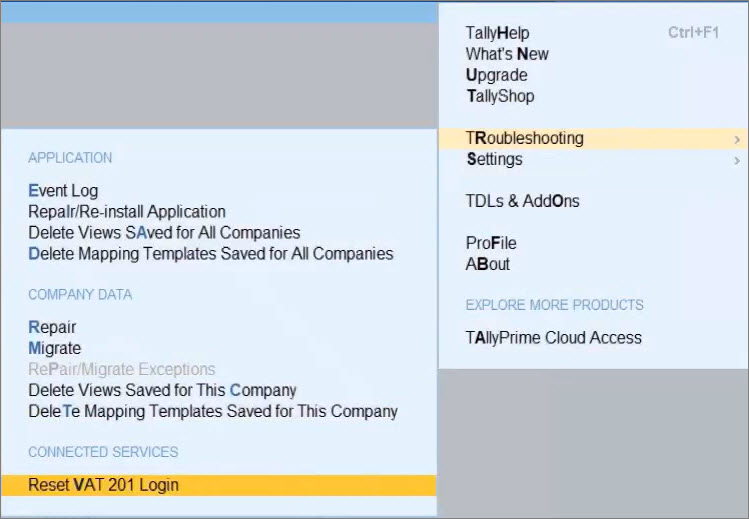

Reset VAT 201 Login

If you face login issues or need to reset your credentials, follow the steps below: