Moving to the Next Financial Year (India) – Split or Create New Company with Import

You have finalised your books of accounts or books are audited. This means that you can quickly close the books of accounts for a financial year and move your company data to the next financial year using the split data option or by creating new books, where you can import masters and final opening balances. This helps to keep your tax liability and input tax credit intact when company data is split at the beginning of new financial year. This entire process is simplified in TallyPrime.

In case you are yet to finalise the books, we recommend using the change period process to move to the next financial year.

Ensure Restart Voucher Numbering is opted to have unique voucher number series for a new financial year.

You can do one of the following to move your data to the new financial year:

- Split company data, this will help you to:

- Reduce data size.

- Secure old data and start work in a different folder.

- Maintain separate folders for each financial year.

- Import the opening balances from the old company to a new company.

- Create new books of accounts to start the transactions afresh.

When you move your data from lower releases to the current release in the new financial year:

The VAT rates are migrated and updated in the stock item masters (Release 4.x or 5.x to current release). You need to configure GST rates and map the unit of measure to UQC in the current year.

The GST rates and mapping of unit of measure to UQC are carried forward to the new year (Release 6.0 to current release).

If you split the data, you can update the tax references.

Split Company Data

When you split the data, the original data is retained, and two new companies with unique names and dates are created. You can rename the split company as required, and save the original data in another location.

Before splitting the data:

- Ensure the analysis or audits of the books of the previous financial year are complete.

- Adjust all the unadjusted forex gains/loss displayed on the balance sheet for multi-currency transactions.

- Check the profit and loss account or inventory statements for pending purchase and sales bills, and adjust them to the respective accounts.

To split and move the data to the new financial year:

- Verify the data

- Split the data

- Take a backup of your data

- Update tax references for transactions

- Go to Gateway of Tally > press Alt+Y (Y: Data) > Split > Verify Data.

- Select the required company.

- Press Enter to view the Possible Errors screen.

- Rectify the errors before you proceed to split the data.

- Go to Gateway of Tally > press Alt+Y (Y: Data) > Split > Verify Data

- Select the required company for which the data has to be split.

- Enter or retain the Split from date.

- Press Enter to split the data. Data will split into two periods.

The synchronisation rules are carried forward in the split data, in both the server and client. The new company name is automatically updated in the Client Rule. If you have renamed the split company, update the same in the Client Rule on the server.

If you are splitting data having transactions of two or more years, with taxation transactions of pre-GST regime, the tax references are not carried forward in the split data. You need to record the transactions for the following:

TDS: Fourth quarter TDS payment transaction

Create New Company and Import the Opening Balances

If you have created a new company, export the closing balances of the ledgers and stock items of the old company, and import them as opening balances into the new company. You can also import the audited closing balance of the previous year, as the opening balance into the current year.

To export closing balances from old company

- Go to Gateway of Tally > Chart of Accounts > Ledgers > E: Export > Current.

- Click Configure.

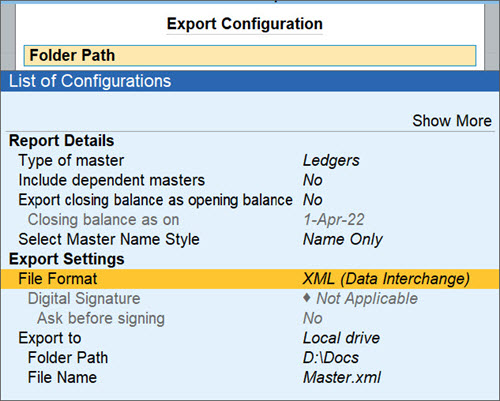

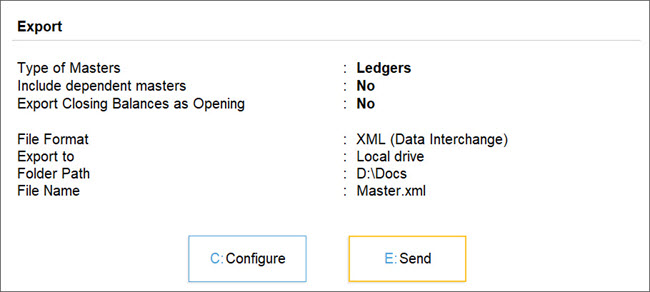

- Select the File Format as XML (Data Interchange) and provide details as shown below:

- Press Esc to close the configuration and return.

- Press Enter to export the data.

To import closing balances as opening balances in new company

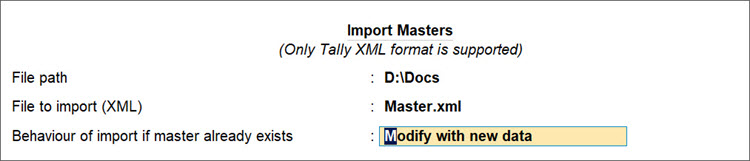

- Go to Gateway of Tally > O: Import Data > Masters.

- Enter the location of the file in the File Path field.

- Enter name of the file containing master data in the File to import (XML) field.

- Select the required option for Behaviour of import if master already exists.

- Press Enter to import.

Create New Books of Accounts

You can create a new company and start recording the transactions without any opening balances for the ledgers.

To create new books of accounts

Create the masters and record transactions.

Create the masters and record transactions.