GST on Inward Remittance of Service Value

You can pay GST on the inward remittance of service value and capture it in GSTR-3B.

Consider the scenario where 18% GST has to be charged on an inward remittance of Rs. 2,750 for the service value of Rs. 4,50,000. As the inward remittance is part of the service value, it should not affect the books of accounts, but the GST amount has to appear in GSTR-3B as eligible input tax credit.

Alter the Voucher Type

- Gateway of Tally > Alter > type or select Voucher Type > Payment.

Alternatively, press Alt+G (Go To) > Alter Master > type or select Voucher Type > Payment. - Enable Allow zero-valued transactions in voucher type alteration screen.

- Accept the screen. As always, you can press Ctrl+A to save.

Record Transaction

- Gateway of Tally > Vouchers > press F5 (Payment).

Alternatively, press Alt+G (Go To) > Create Voucher > press F5 (Payment). - Press F12 (Configure) > set Modify Tax Rate details of GST to Yes and save the settings.

- Select the bank ledger.

- Under Particulars, select the expense ledger defined with the options:

- Is GST Applicable to Applicable.

- Set/alter GST Details to No.

- Type of Supply to Service.

- In the GST Details screen, select Purchase Taxable as the Nature of Transaction, enter the tax Rate and the Taxable Value as shown:

- Do not enter the Amount for the expense ledger, as it is a zero valued transaction being made only to pay GST.

- Select the GST ledgers, and manually calculate and enter the tax amount. In this example, the total GST amount would be Rs. 495 (calculated as 2,750 * 18/100 = 495).

- Press O to override and save the voucher.

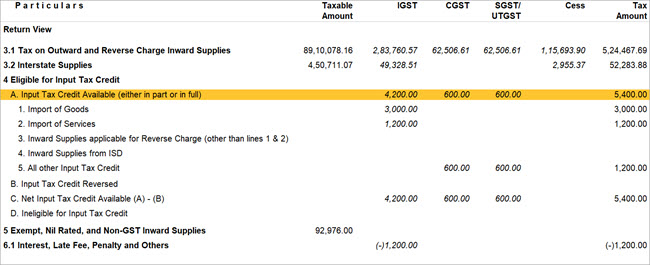

View Transaction in GSTR-3B

- Gateway of Tally > Display More Reports > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, Alt+G (Go to) > type or search GSTR-3B > Press Enter. - Press F2 and change the tax period as per the transaction date.

The transaction appears under Eligible ITC.