View GST Reverse Charge Supplies Report in TallyPrime

For TallyPrime 3.0 & later

|For TallyPrime 2.1 & earlier|

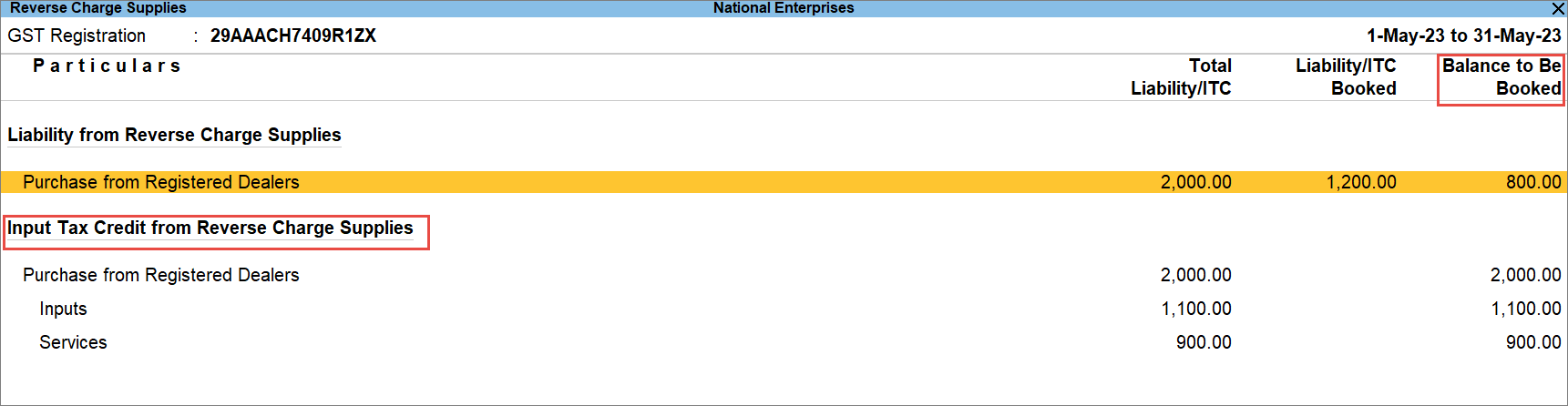

The Reverse Charge Supplies report in TallyPrime displays transactions of purchases and journal vouchers recorded for stock items under reverse charge. With this report, you can:

- Get a quick view of tax liability from reverse charge purchases.

- Record the adjustment entry to update liability and input tax credit in your books.

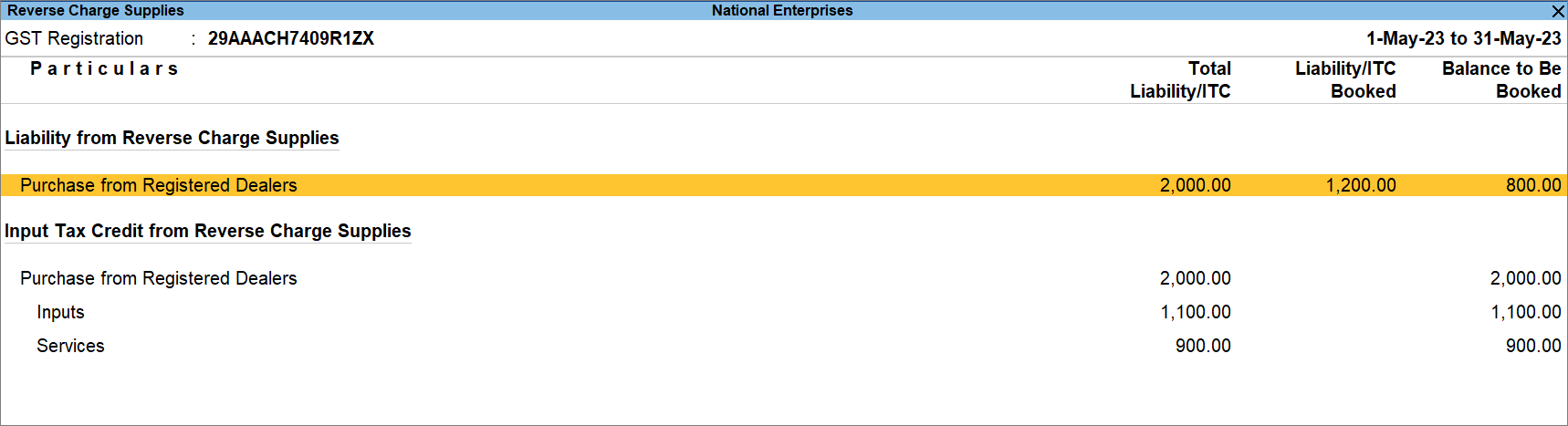

View Reverse Charge Supplies

In this report, you can view the liability and ITC booked from the reverse charge supplies. You can also manage stat adjustments using the report.

- Press Alt+G (Go To) > type and select Reverse Charge Supplies, and press Enter.

- Drill down further from Purchase from Registered Dealers or any other section.

You can also use the report record journal vouchers for booking the pending liability.

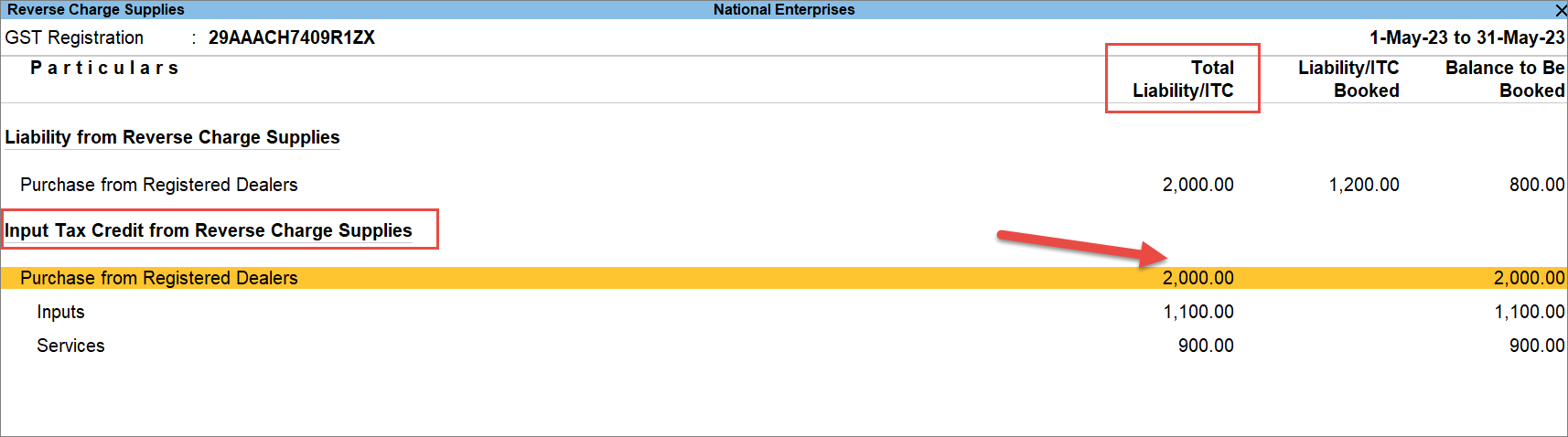

View Total Eligible Input Tax Credit (ITC)

Knowing the eligible ITC allows you to avoid:

- Experiencing loss by claiming less ITC.

- Attracting penalties by claiming excess ITC.

- Press Alt+G (Go To) > type and select Reverse Charge Supplies, and press Enter.

Under the column Total Liability/ITC, you get to know the eligible ITC that you can book. - Drill down further from a section under Input Tax Credit from Reverse Charge Supplies.

You can view the individual transactions and the Total Input Tax Credit from Reverse Charge Supplies.

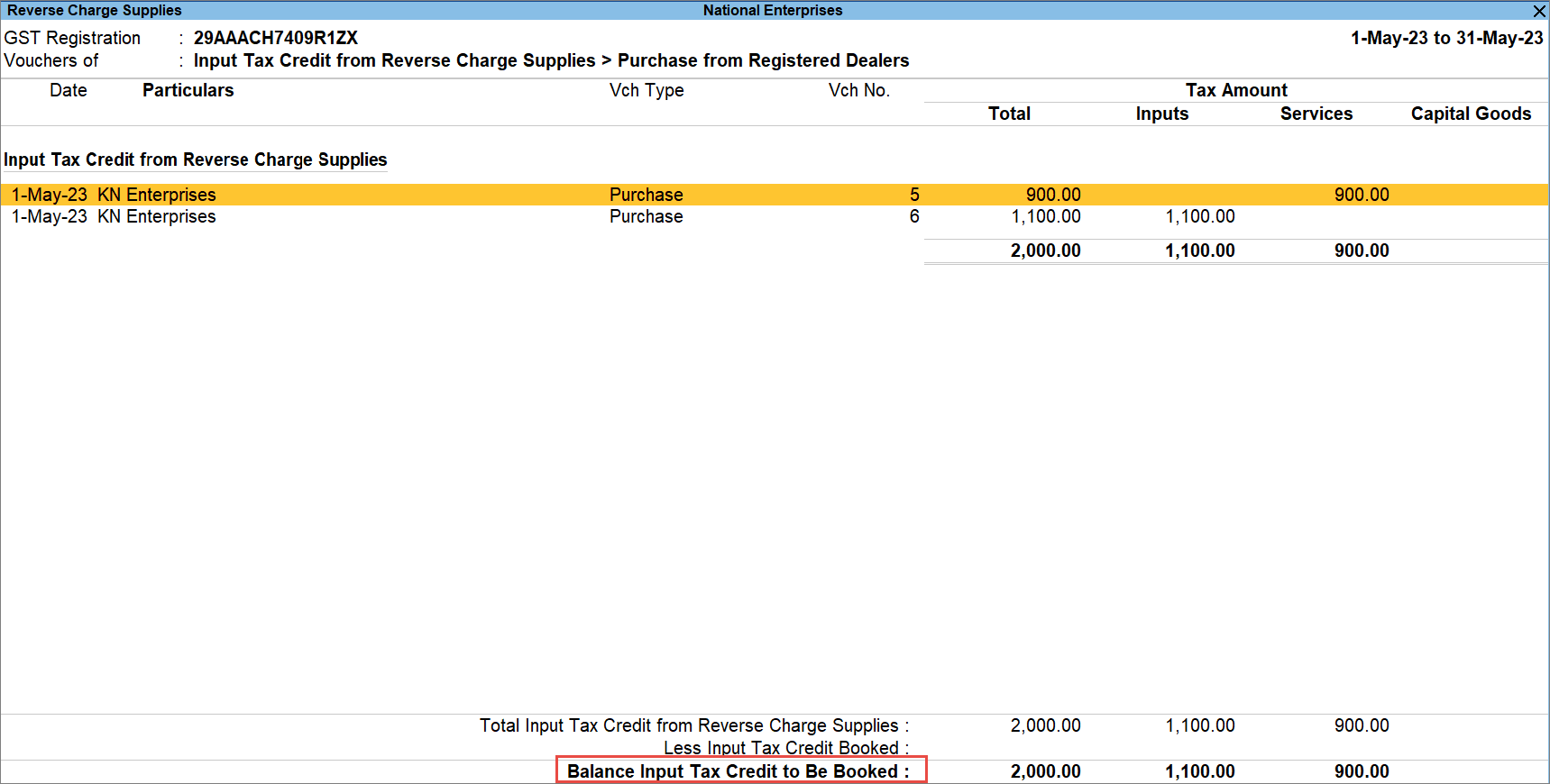

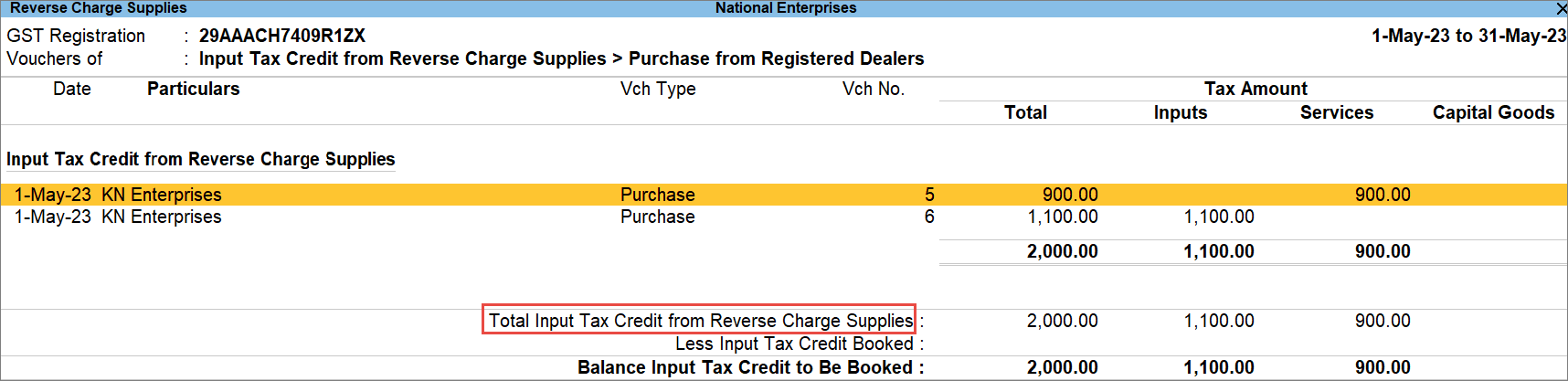

View Input Tax Credit (ITC) to be Booked

You would want to know the balance ITC to be booked and claim it in the selected period.

- Press Alt+G (Go To) > type and select Reverse Charge Supplies, and press Enter.

In this report, you can view the Balance to Be Booked. - Drill down further from a section under Input Tax Credit from Reverse Charge Supplies.

You will get to know the transactions against which ITC is to be booked and the Balance Input Tax Credit to be Booked.