Download IMS Inward Invoices

Using the IMS feature in TallyPrime, you can directly download your supplier’s purchase invoices from the GST portal. Once downloaded, invoices are automatically grouped in the IMS Inward Supplies report, based on the supplier’s filing status, reconciliation status, and action status. IMS in TallyPrime supports both single and multiple GST registrations, making it easy to manage reconciliation across businesses. You can also redownload invoices at any time, the latest data will seamlessly replace the previous one.

-

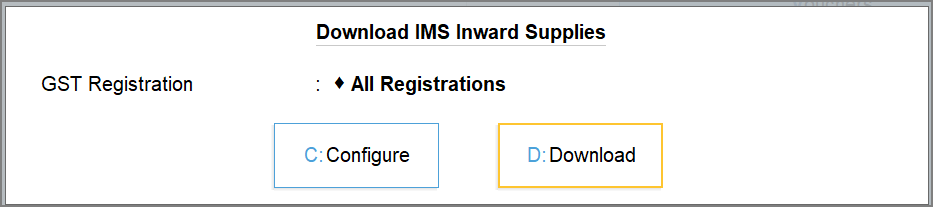

Press Alt+Z (Exchange) > All GST Options > Download IMS Inward Invoices.

The Download IMS Inward Invoices screen appears.

-

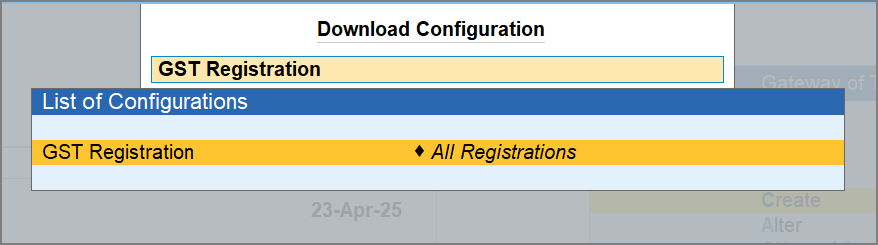

Press C (Configure) to select the required GST Registration, if needed.

By default, the GST registrations will be picked from Exchange > Configure > GST Registration for Download.

- In the Download IMS Inward Invoices screen, press D (Download).

-

Log in to your GST profile, if you have not already done so.

-

Enter your GST Username.

-

Enter the OTP received on your registered mobile number.

Once you have logged in, the session will be valid for six hours, which will ensure the safety and security of your activities.

-

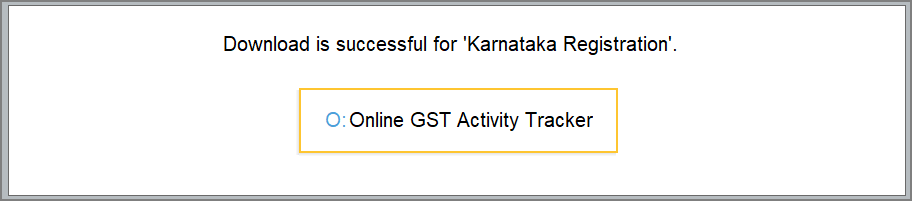

Once the download is successful, you will get a confirmation message.

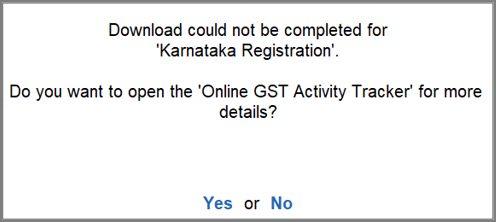

Sometimes, invoices may not download instantly due to server issues or high traffic on the GST portal. In such a case, you may check the progress of the download in the Online GST Activity Tracker.

-

Press Y to view the report.

You can refresh the GST status after a few minutes.

Once you have downloaded the invoices, you can open the IMS Inward Supplies report and set the IMS Action Status as required.

Automatically Accept Reconciled Vouchers in IMS

When you download invoices from the GST portal, many invoices are automatically reconciled by TallyPrime based on the matching details. To make things even easier, you can automatically mark reconciled vouchers after download as Accepted in the IMS Inward Supplies report. So, before downloading IMS Inwards invoices, you can enable this configuration and all your reconciled invoices in the IMS Inward Supplies report will be marked as accepted.

This saves time, especially when you’re dealing with large volumes of transactions. And don’t worry, if you’ve already marked a voucher as Pending or Rejected, your selection will stay as is. Only vouchers that are auto-reconciled will get Accepted when this configuration is enabled.

-

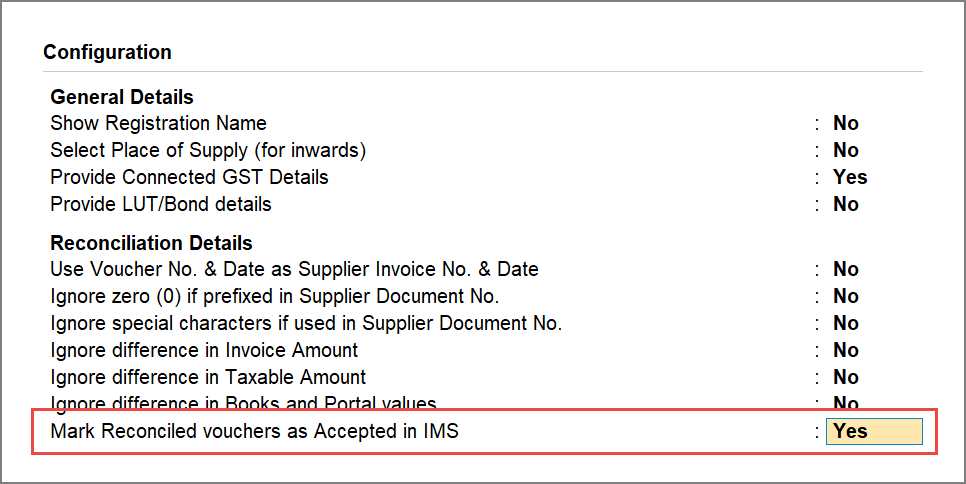

In the GST Details screen, press F12 (Configure) and enable the option Marked Reconciled Vouchers as Accepted in IMS.

Once you enable this configuration, the reconciled invoices after download will automatically move to the Accepted section of the IMS Inward Supplies report.