In VAT Act, zero rated supplies/goods are listed under Fifth Schedule.

For Example:

● Exercise books

● Floats for fishing nets

● Carding machines for preparing textile fibre and so on

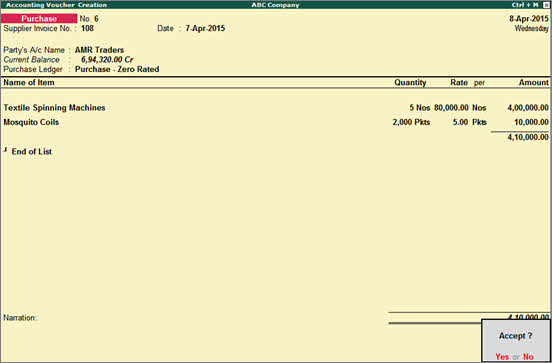

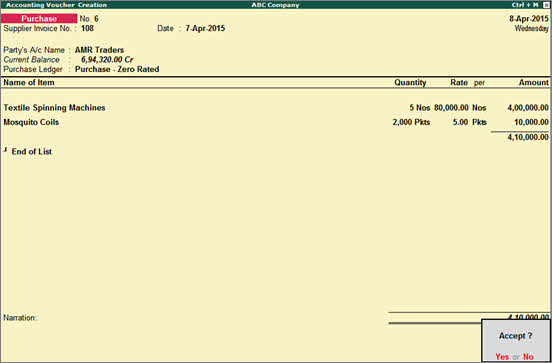

To record a zero rated purchase

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase .

2. Enter Supplier Invoice No. and Date .

3. Select the Party's A/c Name .

4. Select the purchase ledger created with Purchase - Zero Rated as the Nature of transaction .

Note: If purchase common ledger is being used:

1. Click F12: Configure in the invoice and set the option Allow modification of Tax Details for VAT? to Yes .

2. Select Purchase - Zero Rated in the VAT Classification Details screen displayed on selecting the common purchase ledger.

5. Select the stock item, enter the Quantity and Rate . Amount appears automatically.

The purchase invoice appears as shown below:

6. Press Enter to accept the invoice.