Under VAT Act, export of taxable goods and services are exempted from payment of VAT.

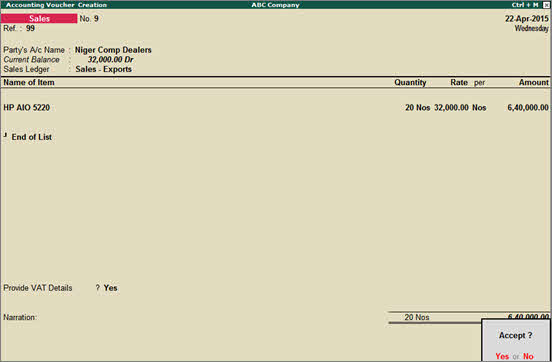

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales .

2. Enter the reference number in the Ref . field.

3. Select the Party’s A/c Name from the List of Ledger Accounts .

4. Select the s ales ledger with Exports as Nature of transaction .

5. Select the Name of Item from the List of Items. Enter the Quantity and Rate .

6. Enter the Rate of Exchange i n the Forex Rate of Exchange screen. The amount is automatically displayed in the Amount field.

7. Enable Provide VAT Details? .

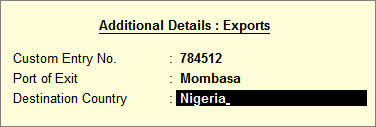

8. Enter Custom Entry No. , Port of Exit and Destination Country details in the Statutory Details screen.

9. Press Enter to return to invoice screen.

10. Press Enter . The sales invoice for export appears as shown below:

11. Press Enter to accept and save.