In VAT Act, under Part II of Second Schedule , the goods exempted from payment of VAT are listed.

For Example :

● Cut flowers and flower buds, fresh.

● Tomatoes, fresh or chilled.

● Potato, other than potato seed, fresh or chilled.

● Mushroom, Sweet Corn, etc.

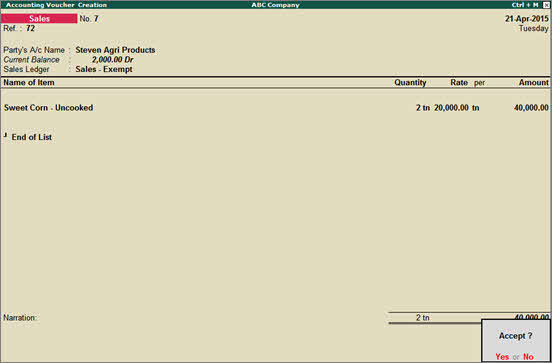

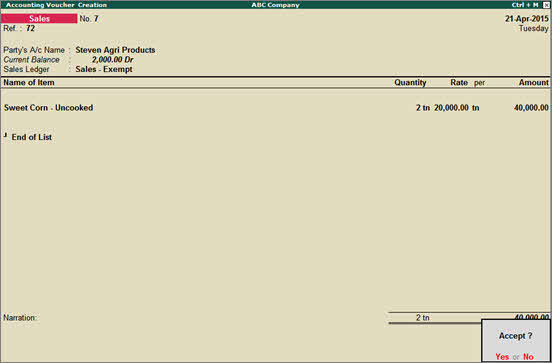

To create the sales voucher for exempt sales

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales .

2. Enter the reference number in Ref field, if required.

3. Select the customer ledger in Party’s A/c Name from the List of Ledger Accounts .

4. Press Ctrl+A to save.

5. Select the s ales ledger with Sales Exempt as Nature of transaction .

6. Select the stock item. E nter the Quantity and Rate . The amount is calculated automatically.

The sales invoice for exempt sales appears as shown below:

7. Press Enter to save.