Where a registered person supplies both taxable and exempt supplies, he can deduct only the input tax attributable to the taxable supplies.

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal .

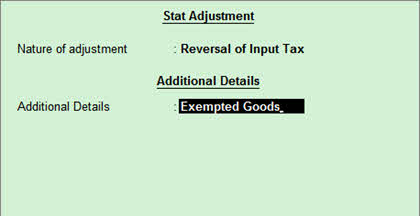

2. Click J : Stat Adjustment , to view the Stat Adjustment Details screen.

3. Select Reversal of Input Tax as Nature of adjustments .

4. Select the option Exempted Goods in the Additional Details field.

5. Press Enter to return to voucher screen.

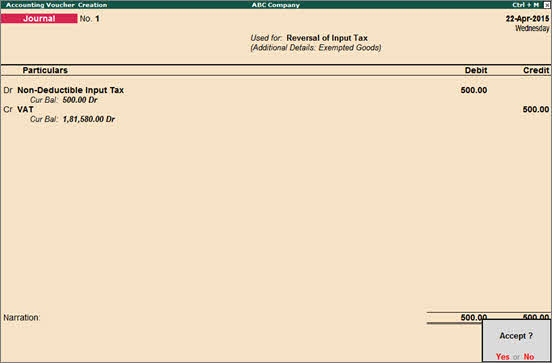

6. Debit expense ledger created for non-deductible tax expense and enter the amount in Debit column.

7. Credit the VAT ledger (created under Duties & Taxes with the Type of duty/tax as VAT ). The journal voucher appears as shown below:

8. Press Enter to accept and save.