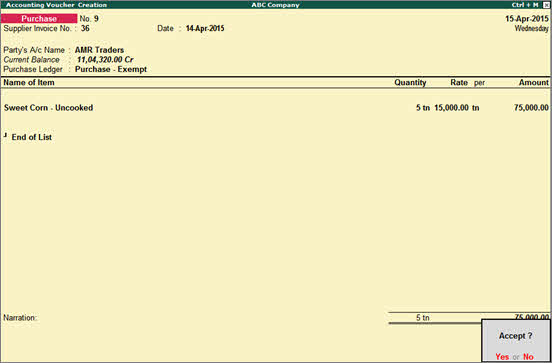

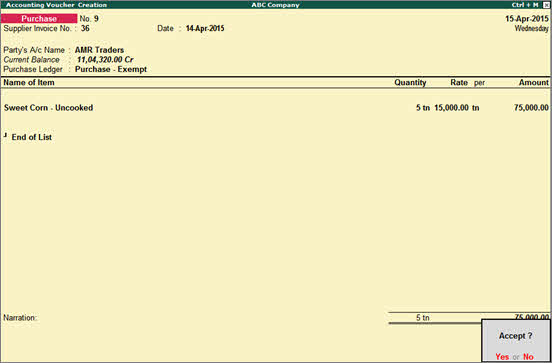

Using Tally.ERP 9, you can record a transaction for the purchase of exempted goods.

To record a works contract transaction

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase .

2. Enter Supplier Invoice No. and Date .

3. Select the supplier ledger in Party's A/c Name option.

4. Select the purchase ledger with Purchase Exempt as the Nature of transaction .

Note: If purchase common ledger is being used:

1. Click F12: Configure in the invoice and set the option Allow Modification of Tax Details for VAT? to Yes .

2. Select Purchase Exempt in the VAT Classification Details screen displayed on selecting the common purchase ledger.

5. Select the stock item, enter the Quantity and Rate . The amount appears automatically.

The purchase invoice appears as shown below:

6. Press Enter to accept the invoice.