It is recommended that HSN code/SAC and tax rate are specified at the same level (Ledger or Group or Stock item or Stock group or Company).

Note: In Release 6.0.2, you can calculate the tax rates and print HSN/SAC in your invoices easily, even if you have specified them at different levels.

When recording a transaction, Tally.ERP 9 looks for tax-related details in a predefined order .

If you have stock items attracting:

● A specific HSN/SAC and tax rate (say 12%) under a stock group - provide the HSN/SAC and tax rates at the stock group level.

● Other stock items attracting different HSN/SAC and tax rates - provide the HSN/SAC and tax rates at the stock item level.

If you have entered the HSN/SAC and tax rates in all the masters, you can remove it from the masters in which it is not required.

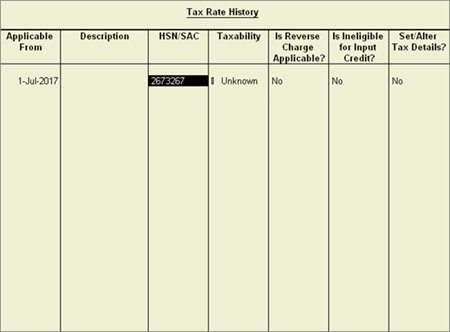

You can delete the HSN/SAC from the Tax Rate History screen of the GST Details screen.

To remove the HSN/SAC from the ledger

1. Go to Gateway of Tally > Accounts Info. > Ledgers > Alter .

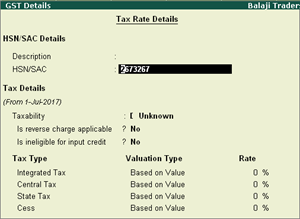

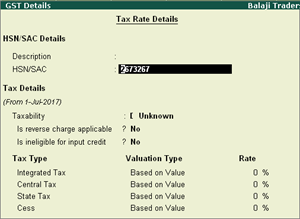

2. Enable the option Set/alter GST Details? .

3. Press Alt+L in the GST Details screen, and delete the HSN/SAC from the Tax Rate History screen.