In Tally.ERP 9, you can export data in the JSON format and upload it to the portal for filing the returns.

Ensure that all exceptions regarding incomplete/mismatch in information are resolved before printing or exporting the GSTR-3B report. File GSTR-3B in either of the following methods:

● By generating the JSON file from Tally.ERP 9

● By using the GSTR3B Excel Offline Utility Tool

● By filing your returns directly on the GST portal

To generate GSTR-3B returns in the JSON format

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

2. F2: Period - select the period for which returns need to be filed.

3. Press Ctrl+E .

4. Select JSON (Data Interchange) as the Format .

5. Press Enter to export.

Note: If you have made purchases attracting reverse charge from registered dealers outside the state, enter the values mentioned below in the JSON file:

♦ In 3.1.d of JSON file, under "isup_rev": { enter the taxable amount in "txval" and integrated tax amount in "iamt" .

♦ In 4 a 3 of JSON file, under "ty": "ISRC", enter the integrated tax amount in "iamt" .

For further details, refer to calculating integrated tax on reverse charge purchases from registered dealers .

Upload the JSON file to the portal for filing returns.

To submit and file GSTR-3B returns

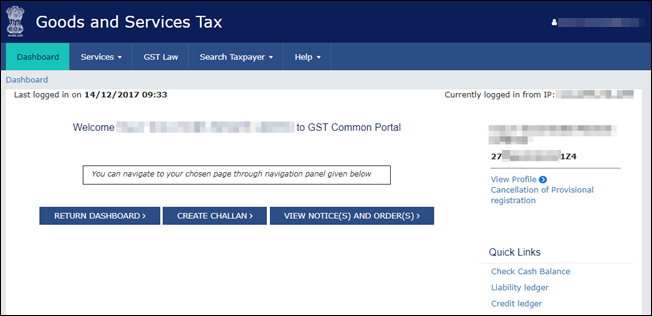

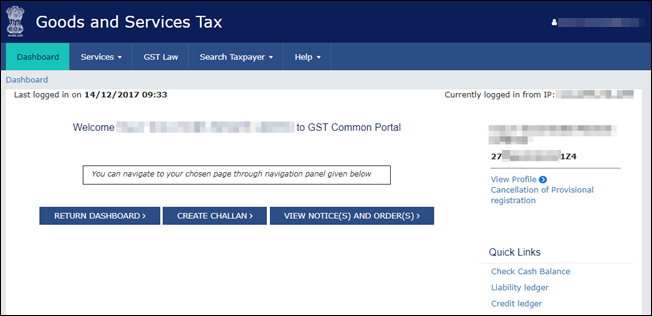

1. Log in to the GST portal .

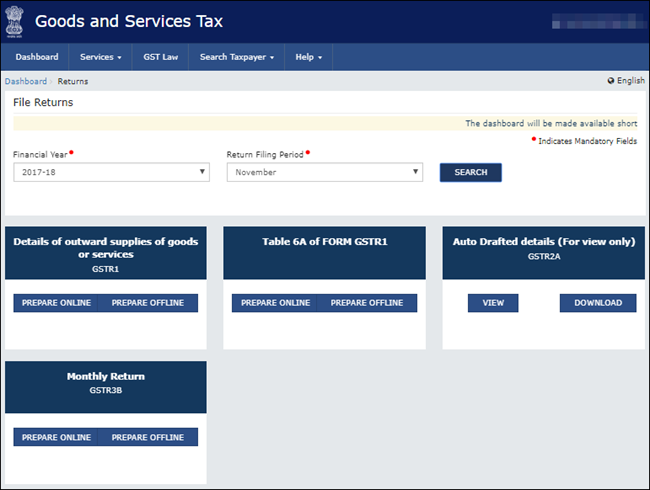

2. Go to Dashboard > RETURN DASHBOARD .

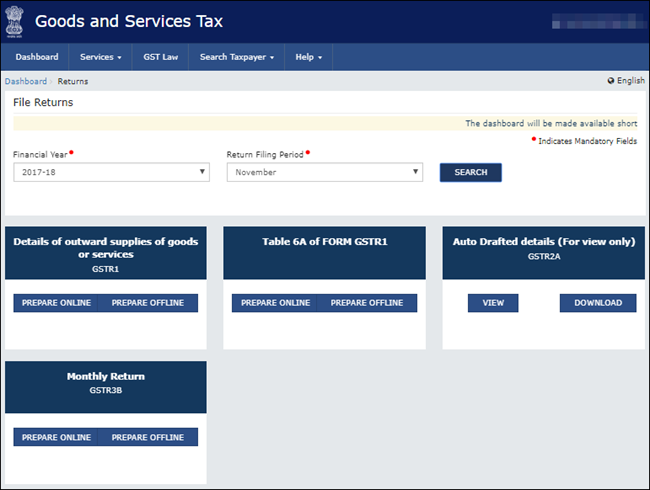

3. Select the Return Filing Period , and click Search .

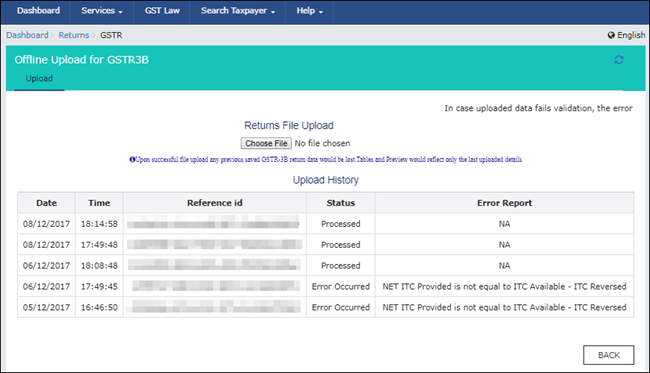

4. Under Monthly Return GSTR3B , click PREPARE OFFLINE > UPLOAD tab > click CHOOSE FILE to import the GSTR-3B JSON file generated from Tally.ERP 9. Once your JSON files are uploaded successfully, you will be notified with a message. Once the file is successfully uploaded the Error Report displays NA .

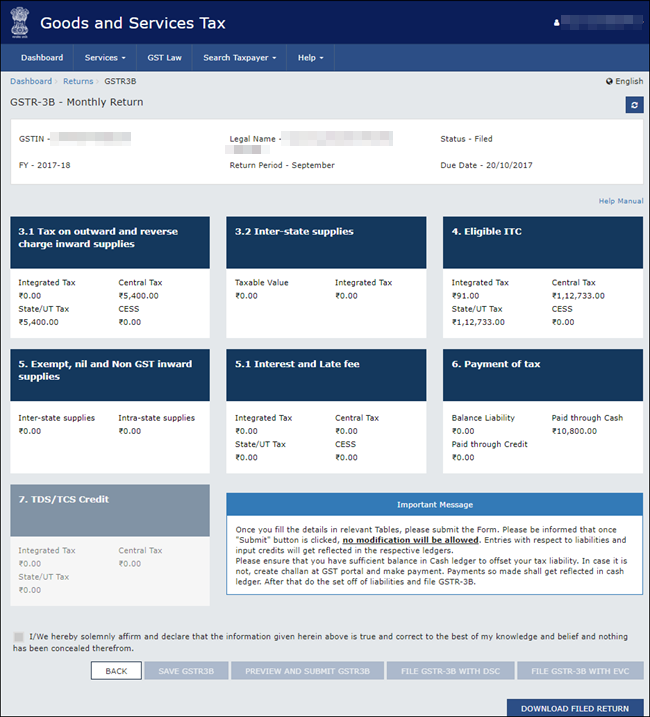

5. Click BACK > Monthly Return GSTR3B , click PREPARE ONLINE . The values get posted in the relevant tables of GSTR-3B.

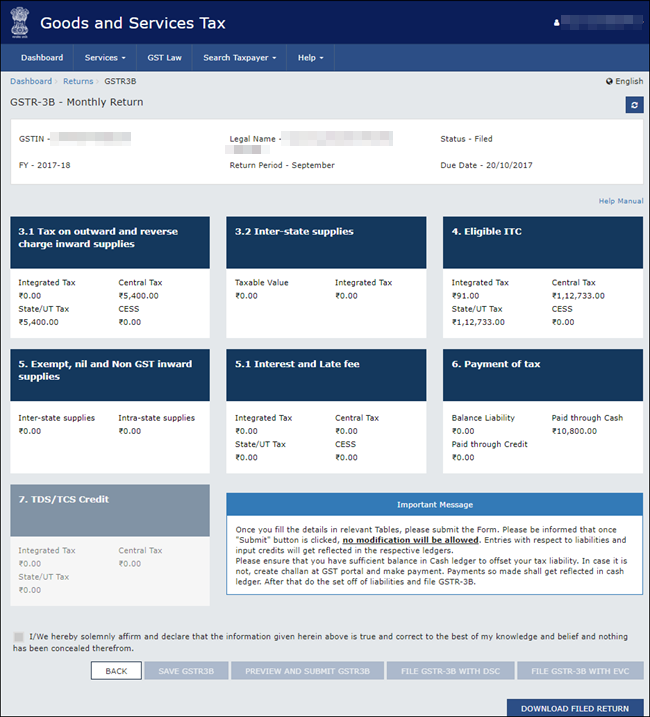

6. Click the declaration check box and click SAVE GSTR3B .

7. Make payments towards GSTR-3B to file your GSTR-3B returns.

8. Click PREVIEW AND SUBMIT GSTR3B to submit GSTR-3B returns.

9. Click FILE GSTR-3B WITH DSC or FILE GSTR-3B WITH EVC based on the mode you prefer to sign the returns.

Note : Once you click the Submit button, GSTR-3B cannot be revised.

To download the tool

1. Go to the GST portal .

2. Click Downloads > Offline Tools > GSTR3B Offline Utility.

3. Click Download .

4. Click PROCEED . A .zip file containing the GST Excel Utility will be downloaded. Some important information about the tool, and the system requirements for using the tool are also available on the download page .

5. Extract the file GSTR3B_Excel_Utility_V3.0.xlsm from the .zip file and copy it to the location where Tally.ERP 9 is installed.

To export GSTR-3B returns to the MS Excel template

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

Note: Ensure to use a fresh template each time before exporting the GSTR-3B data.

2. F2: Period - Select the period for which returns need to be filed.

3. Press Ctrl+E .

4. Select Excel (Spreadsheet) as the Format . If the template GSTR3B_Excel_Utility_V3.0.xlsm is not available in the Export Location , the message appears as shown:

5. Ensure the template GSTR3B_Excel_Utility_V3.0.xlsm is available in the Export Location . Press Enter to export the data.

The Microsoft Excel template opens with the data updated in the relevant fields.

Note: If you have made purchases attracting reverse charge from registered dealers outside the state, refer to calculating integrated tax on reverse charge purchases from registered dealers .

6. In the template:

● Click Validate to view the status of the sheet.

● Click Generate File . The JSON file gets generated in the folder GSTR on the desktop.

7. Upload this JSON file on the GST portal. Click here for the procedure of submitting and filing GSTR-3B.

Note: If the status is Validation Failed , correct the errors mentioned in the template, and then click Validate .

For more details on the information captured in each column of the e-return template, click here .

To print GSTR-3B

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

2. Press Ctrl+P to print the form.

Note: Ensure the MS Word application is available in your computer to view the form.

3. In the Print Report screen, press Enter . GSTR-3B is created in the word format.

4. Press Ctrl+S to save the word file.

You can print the word file and use the hard copy to fill information online or directly copy and paste the values from the MS Word file to the online form.

To file GSTR-3B

1. Log in to the GST portal.

2. Go to Dashboard > RETURN DASHBOARD .

3. Under Monthly Return GSTR-3B , click PREPARE ONLINE .

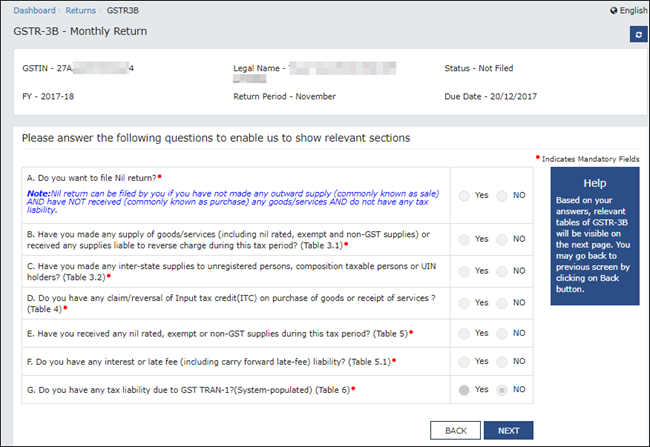

4. Select the required options in the GSTR-3B dashboard to view the relevant sections of GSTR-3B in the next screen. Click NEXT to proceed.

5. Click each table and manually fill the details by referring to the GSTR-3B printed from Tally.ERP 9 in the MS Word format. Click CONFIRM in each table after providing the details.

6. Click the declaration check box and click SAVE GSTR3B .

7. Make payments towards GSTR-3B to file your GSTR-3B returns.

8. Click PREVIEW AND SUBMIT GSTR3B to submit GSTR-3B returns.

9. Click FILE GSTR-3B WITH DSC or FILE GSTR-3B WITH EVC based on the mode you prefer to sign the returns.

Note : Once you click the Submit button, GSTR-3B cannot be revised.

If you have made purchases attracting reverse charge from registered dealers outside the state, you need to manually enter the integrated tax amount in the JSON or MS Excel file generated from Tally.ERP 9 before filing your returns.

To identify the values and enter it in the JSON or MS Excel file

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

2. Under Reverse Charge Liability to be booked , press Enter on Reverse Charge Inward Supplies .

3. Click E : Export from Purchase of Reverse Charge Supplies – Reverse Charge Liability report.

4. Select the Format as Excel (Spreadsheet) , and export the data.

5. Filter for all the transactions on which Integrated Tax has been charged, and arrive at the total tax amount.

6. Manually add this tax amount to the value of Table 3.1 d. Inward Supplies (liable to reverse charge) and 4A (3) Inward supplies liable to reverse charge (other than 1 & 2 above) in the data exported in JSON or MS Excel format from Tally.ERP 9.

After successfully filing GSTR-3B, you can easily make payments to GST by creating a challan. The GST ITC amount will be updated in the credit ledger in the GST portal, and will be carried forward to the subsequent month.

To match the GST amount payable with your books of accounts, you can adjust the GST liability with the tax credit. Refer to Recording Journal Vouchers for Adjustments Against Tax Credit under GST for the procedure to record the transaction.

If the above example is taken, GST payable is as shown below:

To make payments towards GSTR-3B

1. Log in to the GST portal .

2. Go to Services > Payments > Create Challan .

3. Under Tax Liability , enter the required values.

4. Under Payment Modes , select the required method of payment. If you have chosen NEFT/RTGS as the mode of payment, you also have to select your preferred Remitting Bank .

5. Click GENERATE CHALLAN .

The Beneficiary Details appear according to the Remitting Bank selected.

6. Click DOWNLOAD to generate the challan. Using this challan, you can make the payment through net banking or cash/cheque payment in the bank. When you complete the payment, money gets transferred to your e-Cash ledger.

Note: If the tax amount is less than Rs. 10,000 you can make cash payment in the bank with the challan.

7. Log in to the GST portal and make the tax payment.

8. After the payment, submit your GSTR-3B returns.

This completes your GSTR-3B filing.