The sales ledger is configured as additional ledger in the voucher class to allow recording of value against it during voucher entry, as there are no items involved.

To configure voucher class in sales voucher type for usage in accounting invoice mode

1. Go to Accounts Info. > Voucher Types > Alter > Sales .

2. Navigate to Name of Class field in Voucher Type Alteration screen.

3. Enter name for voucher class and press Enter to display Voucher Type Class field.

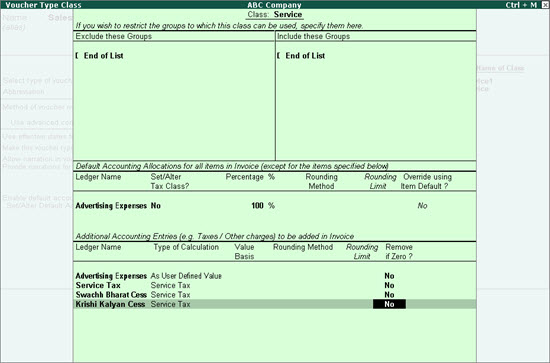

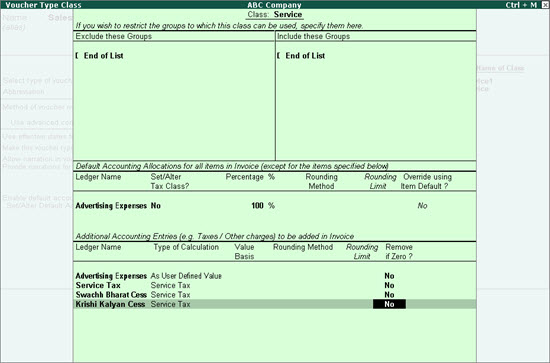

4. Select the sales ledger under Ledger Name in Default Accounting Allocations for all items in Invoice (except for the items specified below) section.

5. Disable the option Set/Alter Tax Class? .

6. Press Enter to move to next section.

7. Select the sales ledger under Ledger Name in Additional Accounting Entries (e.g. Taxes / Other charges) to be added in Invoice section.

8. Select the option As User Defined Value in the field Type of Calculation .

9. Select Service Tax duty ledger in the Ledger Name in Additional Accounting Entries (e.g. Taxes / Other charges) to be added in Invoice section.

10. Press Enter .

11. Select Swachh Bharat Cess ledger and press Enter .

12. Select Krishi Kalyan cess ledger and press Enter .

The Voucher Type Class screen appears as shown below:

13. Press Ctrl+A to accept.

14. Press Ctrl+A to accept and save the voucher type.

To record sales in item invoice mode using voucher class

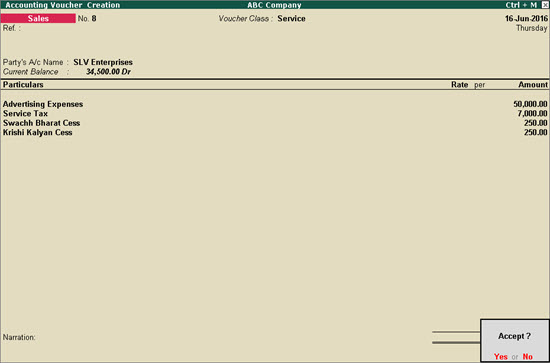

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales .

2. Select the voucher class created for sale of services in accounting invoice mode and press Enter .

3. Click I : Acct Invoice to change to accounting invoice mode.

4. Select the name of the buyer in the field Party’s A/c Name .

5. Enter the Amount against sales ledger appearing by default. Service tax, swachh bharat cess and krishi kalyan cess values appear against the predefined ledgers.

6. Enter the required details in Bill-wise Details screen and accept.

The sales invoice with voucher class appears as shown below:

7. Press Enter to save.