Where a registered person supplies both taxable and exempt supplies, he can deduct only the input tax attributable to the taxable supplies.

To record reversal of tax for non-deductible input

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal.

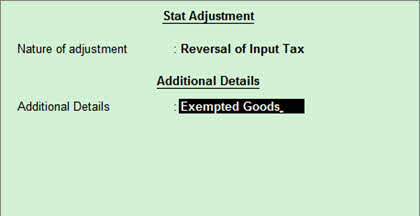

2. Click J: Stat Adjustment, to view the Stat Adjustment Details screen.

o Select Reversal of Input Tax as Nature of adjustments.

o Select the option Exempted Goods in the Additional Details field.

o Press Enter to return to voucher screen.

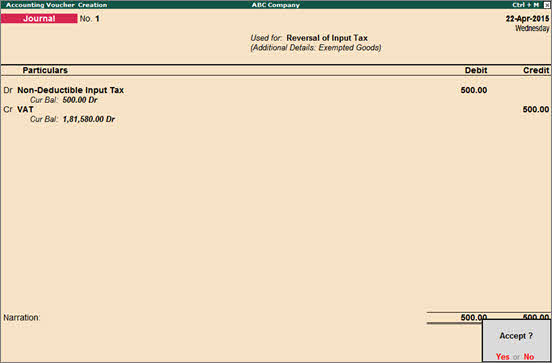

3. Debit expense ledger created for non-deductible tax expense and enter the amount in Debit column.

4. Credit the VAT ledger (created under Duties & Taxes with the Type of duty/tax as VAT).

The journal voucher appears as shown below:

5. Press Enter to accept and save.