Scenarios

Resolutions

You have entered GST rates at one level and HSN code at a different level.

When recording a transaction, Tally.ERP 9 looks for GST details (HSN code and GST rates) in the following order: Ledger > Group > Stock item > Stock group > Company.

Therefore, if the GST details are defined at any one level, do not specify the same at other levels.

You have defined the GST rates and HSN code at the item level and only the HSN code at the sales ledger level.

Alter your sales ledger.

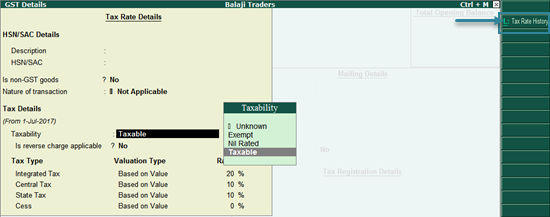

1. In the Ledger Alteration screen, enable Set/alter GST Details? to open the GST Details screen, and press Alt+L.

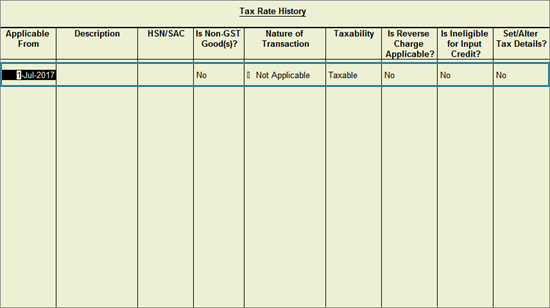

2. Under the Applicable From column, press Spacebar + Enter to delete all the row entries.

You have enabled reverse charge at the stock item level, along with the GST details.

Set the Is reverse charge applicable? option to Yes in the applicable ledger master, and not in the item master.

You have not selected the state of the party in the party master or in the Party Details screen while recording a transaction.

Select the state of the party in the party master or in the Party Details screen.