Service Tax returns can be filed with the new XML Schema (V1.4) from Release 5.1.1 onwards.

Given below is the detailed procedure to file the same:

Note:

♦ All customers who are eligible for Tally.ERP 9 Release 5.1 can upgrade to Release 5.1.1 with/ without valid Tally Net Subscription.

♦ If you are using Release 5.0 or below(Rel 4.9x), and have a valid Tally Net Subscription, it is suggested to upgrade to Release 5.1.1 and file the Service tax returns as per the new schema (V1.4).

♦ If you are using Release 4.93 or below and Tally. Net Subscription is expired, it is suggested to file Service tax returns manually by downloading ST3 Excel Template from ACES website (http://acesdownload.nic.in/) and fill the details and upload the returns.

There are three simple steps to complete the process:

Step 1 - Exporting ST3 Returns in XML format

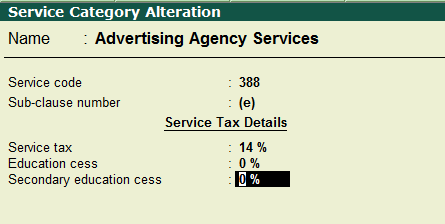

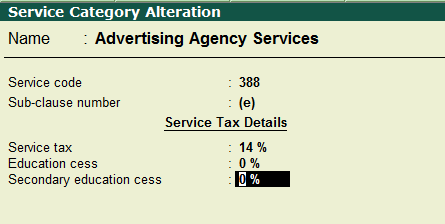

1. Check Category Code and Sub-clause number for all the categories used. For this, from Gateway of Tally, go to Accounts Info à statutory info Service Category Alter. Select the category and check for the codes.

In case the codes shown are different, click L: Details and make the changes for both the periods.

Note: - Sub-clause number should be within brackets

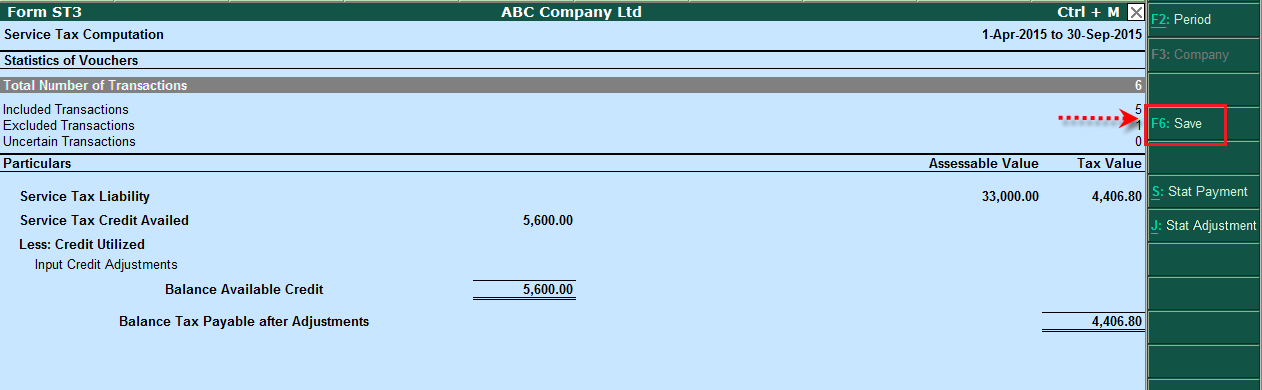

2. Go to Form ST3 Triangulation (Gateway of Tally > Display > Statutory reports > Service Tax reports à Form ST 3) and clear all Uncertain Vouchers.

3. Once after clearing all exceptions, save the return by clicking on F6: Save

4. Check Form ST3 Print preview (Click Control + P: print from Form ST3 triangulation report). If the details are correct, generate XML file. (Click Control + E: Export from Form ST3 triangulation report).

Step 2 - Validating ST3 XML returns

Before uploading ST3 returns it is possible to validate the schema. Steps for validation are given below:

1. Download the .xsd file from ACES website (www.aces.gov.in > click on Downloads > click on Click Here To Download The Utilities as shown below)

2. Click on Download XML Schema for ST3 Return (V1.4) and download the schema.

3. Unzip the downloaded ACES_ST3_Schema (V1.4) file.

Note: - Once you unzip ACES_ST3_Schema (V1.4) file, you will find self-supporting files & other documents.

4. Open the XML file exported from Tally in Slick edit tool or EditiX 2010 or Notepad ++(If the file opens in a single line, click Ctrl + Alt + Shift + B to get it in proper format)

5. Click on Validate.

6. Select the XSD file (ACES_ST3V4) from the schema folder which is unzipped (Downloaded in previous step) and click OK.

This should give the message as XML Schema Validation: XML is Valid or Your document is Correct.

1. After validating XML file, user needs to upload the returns in ACES portal.

2. Login to Application www.aces.gov.in as Service Excise Assessee.

3. Click on Menu RET > eFiling > Upload File

4. Fill required following details such as Return period and month of filing period

5. Click on browse and select the XML file.

6. Click on submit and Ok.

After uploading the returns in ACES portal, user needs to check the Return upload status and the Return acceptance status. Return upload status can be known immediately and Return acceptance status will be shown on the next day of returns being filed.