Withholding VAT was introduced in Kenya with effect from 1st October, 2003. It is not a new tax but a reinforcement measure to ensure that all the VAT charged reaches the Government.

It is a system which involves the declaration of VAT by both the supplier and his customer who has been appointed as a withholding VAT agent. Institutions appointed as withholding VAT agents are Government institutions, parastatals, banks, financial institutions, co-operative societies, insurance companies, and regular exporters.

How does withholding VAT system work?

When a taxpayer (trader) supplies and invoices an appointed withholding VAT agent the payment for supply is made less VAT charged or that which ought to have been charged. The agent withholds VAT irrespective of whether the supplier is registered for VAT or not. The agent issues a withholding VAT certificate to the supplier indicating the VAT withheld. This certificate entitles the trader to claim back the withheld VAT to avoid double taxation since the same tax is declared and paid by the trader through a VAT 3 return. Withholding VAT on taxable supplies not charged VAT is computed using the formula X - X/1.16 where X is the total value of the invoice or taxable supplies.

Supplies Liable to Withholding VAT

Only taxable goods and services are liable to withholding VAT. No VAT is withheld on exempt goods, exempt services and zero rated supplies.

A taxpayer is authorised to claim back the withheld VAT on subsequent VAT 3 return(s) provided he is in possession of withheld VAT certificate(s). Where the excess arising from the system becomes a perpetual feature, the taxpayer has a right to claim it from the commissioner by lodging a claim on form VAT 4.

To record the tax withheld transaction

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal.

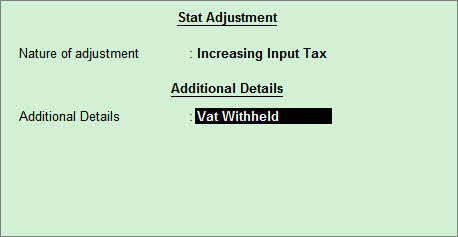

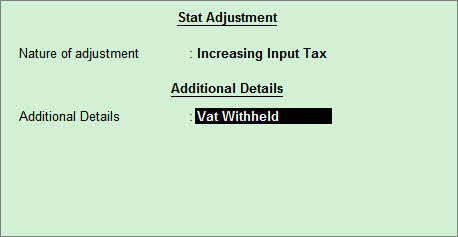

2. Click J: Stat Adjustment to enable the required options in the Stat Adjustment Details screen.

o Select Increasing Input Tax as the Nature of adjustment.

o Select the Vat Withheld in Additional Details field.

o Press Enter.

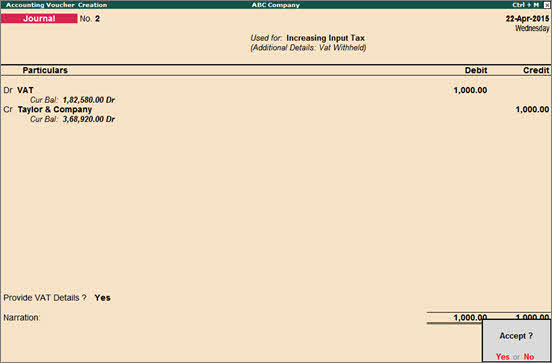

3. Debit VAT ledger and enter the amount in Debit column.

4. Credit the party ledger withholding the tax and enter the amount in Credit column.

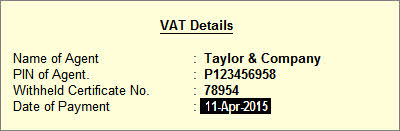

5. Set the option Provide VAT Details? to Yes to enter VAT withheld details.

o Enter Name of Agent, PIN of Agent., Withheld Certificate No., and Date of Payment details.

o Press Enter.

The journal voucher appears as shown below:

6. Press Enter to accept and save.