To record a purchase - imports taxable

1. Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

2. Enter Supplier Invoice No. and Date.

3. Select the Party's A/c Name.

4. Select the purchase ledger with Imports Taxable as the Nature of transaction.

Note: If purchase common ledger is being used:

§ Click F12: Configure in the invoice and set the option Allow modification of Tax Details for VAT? to Yes.

§ Select Imports Taxable in the VAT Classification Details screen displayed on selecting the common purchase ledger.

5. Select the stock item imported, enter the Quantity and Rate (in foreign currency).

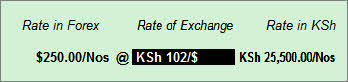

o Enter the Rate of Exchange in the Forex Rate of Exchange screen. The amount is automatically displayed in the Amount field.

o Press Enter.

6. Select the common VAT ledger.

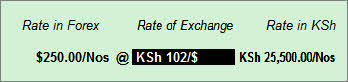

7. Click A: Tax Analysis button to display the Tax Analysis screen.

o Click F1: Detailed button to view the name of stock item. The Tax Analysis screen appears as shown below:

o Pres Esc to return to purchase invoice screen.

8. Enter Custom Entry No..

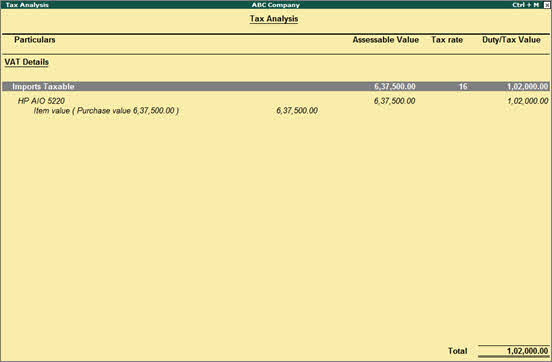

The purchase invoice appears as shown below:

9. Press Enter to save.