Accounting allocations can be automated during voucher entry using voucher class. Further, additional accounting entries like tax, freight, and other expenses can be predefined. While recording sale of services, allocation of service tax and cess can be predefined using voucher class.

While creating voucher class to be used in accounting invoice mode, the sales ledger is configured in Additional Accounting Entries section, whereas for item invoice mode it is configured under default accounting allocation.

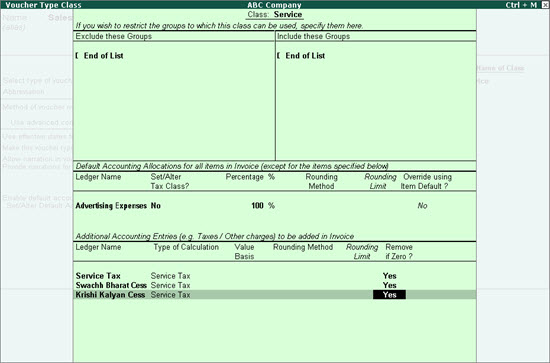

To configure voucher class in sales voucher type for usage in item invoice mode

1. Go to Accounts Info. > Voucher Types > Alter > Sales.

2. Navigate to Name of Class field in Voucher Type Alteration screen.

3. Enter name for voucher class and press Enter to display Voucher Type Class screen.

4. Select the sales ledger under Ledger Name in Default Accounting Allocations for all items in Invoice (except for the items specified below) section.

5. Set the option Set/Alter Tax Class? to No.

6. Press Enter to move to next section.

7. Select Service Tax ledger in the Additional Accounting Entries section.

8. Select Swachh Bharat cess ledger and press Enter.

9. Select Krishi Kalyan cess ledger and press Enter.

The Voucher Type Class screen appears as shown below:

10. Press Ctrl+A to accept.

11. Press Ctrl+A to accept and save the voucher type.

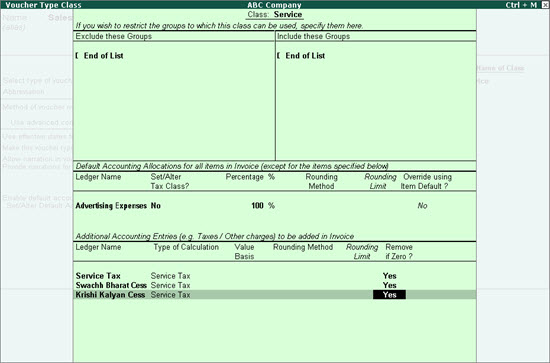

To record sales in item invoice mode using voucher class

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales.

2. Select the voucher class created for sale of services and press Enter.

3. Select the name of the buyer in the field Party’s A/c Name.

4. Select the item predefined with the name of service category under Name of Item.

5. Enter the Quantity and Rate, or Amount only in case of service. Service tax, swachh bharat cess and Krishi Kalyan cess appear against the predefined ledgers.

6. Enter the required details in Bill-wise Details screen and accept.

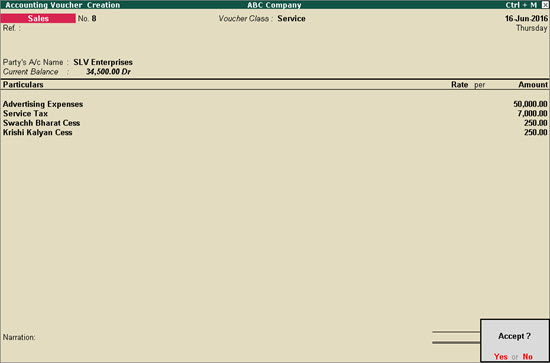

The item invoice with voucher class appears as shown below:

7. Press Enter to save.

The sales ledger is configured as additional ledger in the voucher class to allow recording of value against it during voucher entry, as there are no items involved.

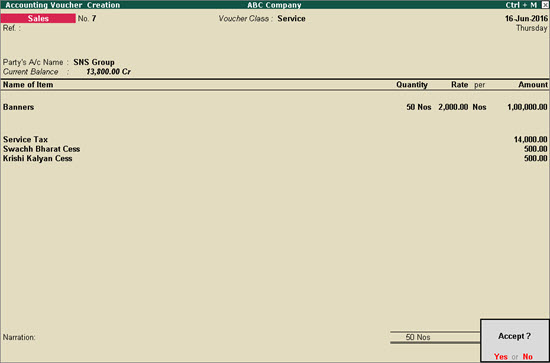

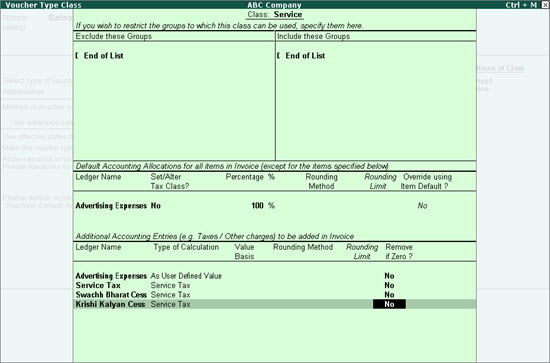

To configure voucher class in sales voucher type for usage in accounting invoice mode

1. Go to Accounts Info. > Voucher Types > Alter > Sales.

2. Navigate to Name of Class field in Voucher Type Alteration screen.

3. Enter name for voucher class and press Enter to display Voucher Type Class field.

4. Select the sales ledger under Ledger Name in Default Accounting Allocations for all items in Invoice (except for the items specified below) section.

5. Disable the option Set/Alter Tax Class?.

6. Press Enter to move to next section.

7. Select the sales ledger under Ledger Name in Additional Accounting Entries (e.g. Taxes / Other charges) to be added in Invoice section.

8. Select the option As User Defined Value in the field Type of Calculation.

9. Select Service Tax duty ledger in the Ledger Name in Additional Accounting Entries (e.g. Taxes / Other charges) to be added in Invoice section.

10. Press Enter.

11. Select Swachh Bharat Cess ledger and press Enter.

12. Select Krishi Kalyan cess ledger and press Enter.

The Voucher Type Class screen appears as shown below:

13. Press Ctrl+A to accept.

14. Press Ctrl+A to accept and save the voucher type.

To record sales in item invoice mode using voucher class

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales.

2. Select the voucher class created for sale of services in accounting invoice mode and press Enter.

3. Click I: Acct Invoice to change to accounting invoice mode.

4. Select the name of the buyer in the field Party’s A/c Name.

5. Enter the Amount against sales ledger appearing by default. Service tax, swachh bharat cess and krishi kalyan cess values appear against the predefined ledgers.

6. Enter the required details in Bill-wise Details screen and accept.

The sales invoice with voucher class appears as shown below:

7. Press Enter to save.