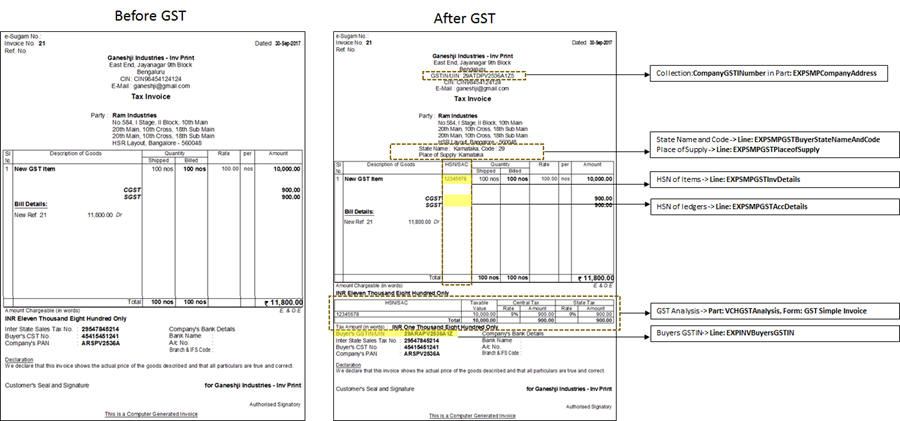

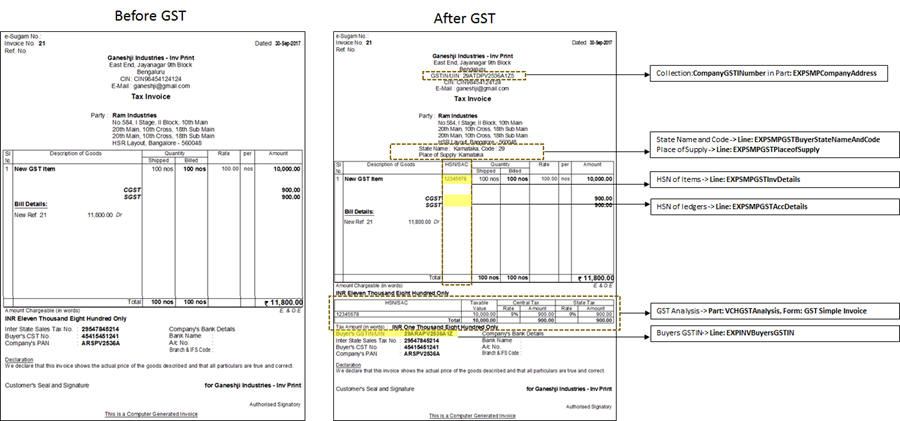

This page includes the changes in the Simple Printed Invoice format with respect to GST.

Simple Printed Invoice - Sales Voucher in Item Invoice mode

GST changes in detail - Form Simple Printed Invoice

|

Information |

Invoice Snapshot |

TDL Changes |

|||||||||||||||||||||||||||||

|

TDL Element |

Value/Method |

||||||||||||||||||||||||||||||

|

Company GSTIN |

|

Collection:CompanyGSTINumber in Part: EXPSMPCompanyAddress |

$GSTRegNumber:TaxUnit: ($ExciseUnitName:Company:##SVCurrentCompany) |

||||||||||||||||||||||||||||

|

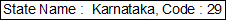

State Name and Code |

|

Line: EXPSMP GSTBuyerStateNameAndCode |

Statename - $StateName of voucher Object and $LedStateName of Ledger Code - $$getgststatecode:($StateName of voucher or $LedStateName of Ledger) |

||||||||||||||||||||||||||||

|

Place of Supply |

|

Line: EXPSMP GSTPlaceofSupply |

$StateName of voucher object |

||||||||||||||||||||||||||||

|

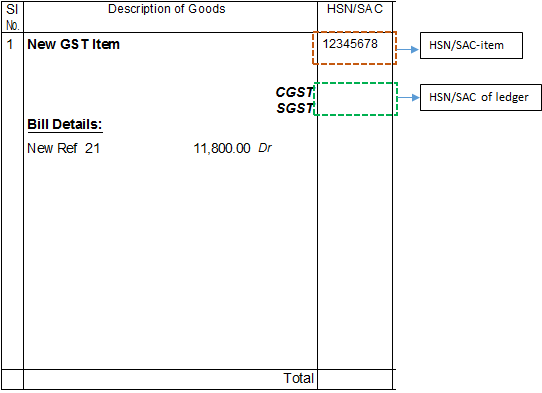

HSN/SAC Column |

|

HSN/SAC - Item Line EXPSMPGSTInvDetails HSN/SAC - Ledger Line EXPSMPGSTAccDetails |

HSN/SAC - Item $GSTItemHSNCodeEx of Inventory Entry HSN/SAC - Ledger $GSTItemHSNCodeEx of Ledger Entry |

||||||||||||||||||||||||||||

|

GST detailed analysis |

|

Form: GST Simple Invoice and Part VCHGSTAnalysis |

|

||||||||||||||||||||||||||||

|

Buyers GSTIN/UIN |

|

Line EXPINVBuyersGSTIN |

$PartyGSTIN of voucher object or $PartyGSTIN of party ledger. |

||||||||||||||||||||||||||||