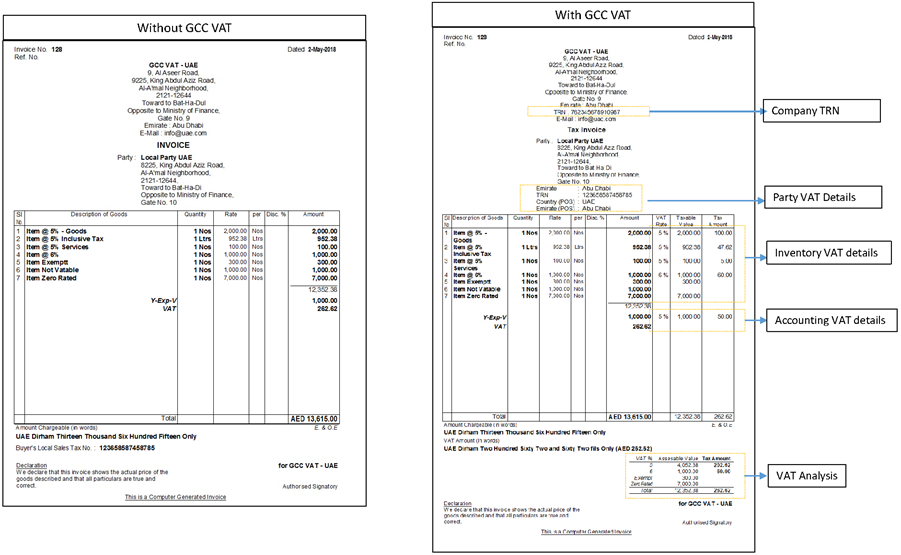

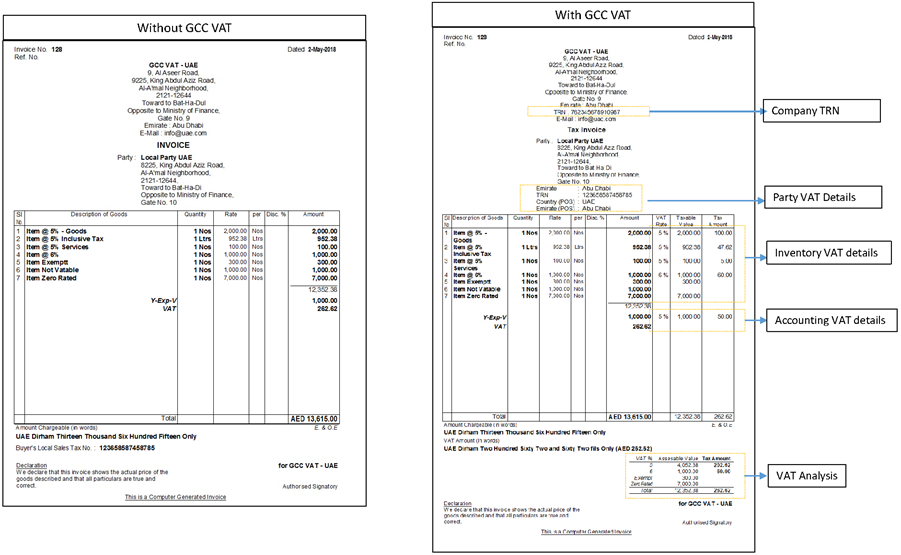

This page includes the changes in the Simple Printed Invoice format with respect to GCC VAT.

Simple Printed Invoice - Sales Voucher in Item Invoice mode

|

Information |

Invoice Snapshot |

TDL Changes |

||||||||||||||||

|

TDL Element |

Value/Method |

|||||||||||||||||

|

Company TRN |

|

Collection:CompanyTINTRNNumber in Part: XPSMPCompanyAddress |

$VATTINNumber:Company:##SVCurrentCompany |

|||||||||||||||

|

Party VAT details - Emirate |

|

Line: EXPSMP BuyersVatGCC State |

1. $PlaceofSupplyState of Voucher Object 2. $StateName of Voucher Object 3. $LedStateName of party ledger object ($LedStateName:Ledger:@@PartyLedgerName ) Logic:If 1 is empty the 2 , if 2 is empty then 3 |

|||||||||||||||

|

Party VAT details - TRN |

|

Line: EXPSMP BuyersVatGCC Tin

|

1. $BasicBuyersSalesTaxNo of Voucher Object 2. $VATTINNumber of party Ledger ($VATTINNumber:Ledger:@@PartyLedgerName) Logic: If 1 is empty then 2 |

|||||||||||||||

|

Party VAT details - Country (POS) |

|

Line: EXPSMP BuyersVATGCC CountryPOS |

$PlaceofSupplyCountry of Voucher Object |

|||||||||||||||

|

Party VAT details - State (POS) |

|

Line:EXPSMP BuyersVATGCC StatePOS |

$PlaceofSupplyState of Voucher Object |

|||||||||||||||

|

Inventory VAT Details Accounting VAT Details |

|

Inventory Details - Line : EXPSMP VATGCC InvDetails Accounting Details - Line: EXPSMP VATGCC AccDetails

|

|

|||||||||||||||

|

VAT Analysis |

|

Line: EXPINV VATGCC TaxAnalysisDetails |

|

|||||||||||||||