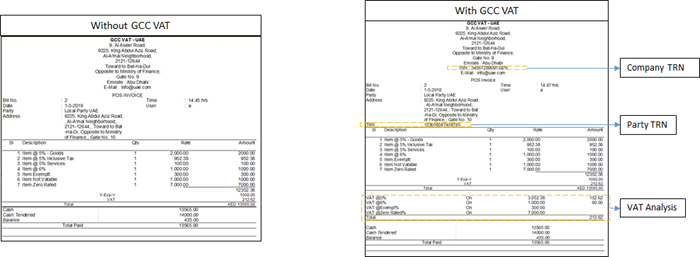

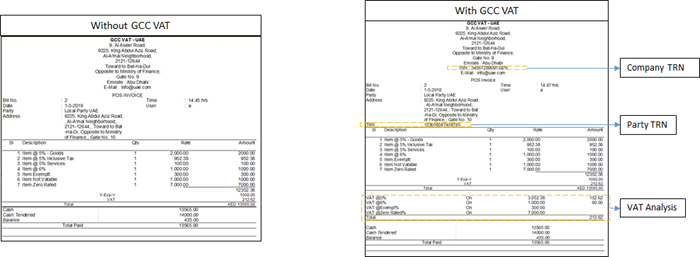

This page includes the changes in the POS Invoice print format with respect to GCC VAT.

|

Information |

Invoice Snapshot |

TDL Changes |

|||||||||||||

|

TDL Element |

Value/Method |

||||||||||||||

|

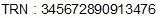

Company GSTIN |

|

Collection:CompanyTINTRNNumber in Part: POSCompanyDetails |

$VATTINNumber:Company:##SVCurrentCompany |

||||||||||||

|

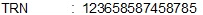

Buyer TRN |

|

Line: POS BuyerVATGCCTIN in Part: POS PartyName |

1. $BasicBuyersSalesTaxNo of Voucher Object 2. $VATTINNumber of party Ledger ($VATTINNumber:Ledger:@@PartyLedgerName) Logic: If 1 is empty then 2 |

||||||||||||

|

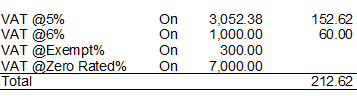

VAT Analysis |

|

Line: VCH GVAT POsAnlysisDet in Part: VCH GVAT POSAnalysisDetails |

|

||||||||||||