In Tally.ERP 9 you can record the depreciation of fixed assets using a journal voucher. To do this, create a Depreciation ledger under Indirect Expenses .

1. Go to Gateway of Tally > Accounting Vouchers > F7: Journal .

2. Debit the depreciation ledger and enter the depreciation value in the Amount field.

3. Credit the fixed asset ledger for which depreciation is recorded. The credit amount appears automatically. The Accounting Voucher Creation screen appears as shown below:

4. Save the journal voucher.

You can have separate depreciation ledgers for each fixed asset or use a single ledger to record deprecation of all fixed assets.

The depreciation chart depicts period-wise break up of depreciation amount for one or all assets. This chart can be generated by maintaining Cost Categories and Cost Centres.

To get a period-wise depreciation chart

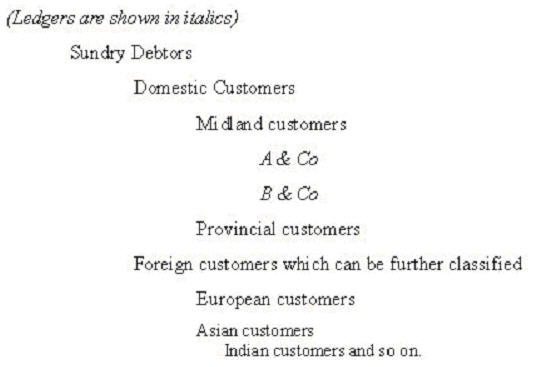

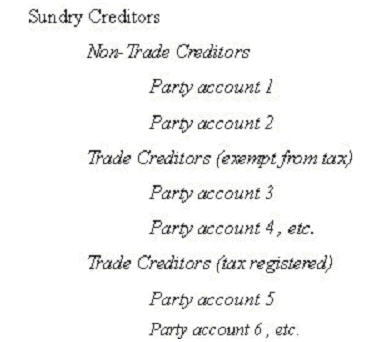

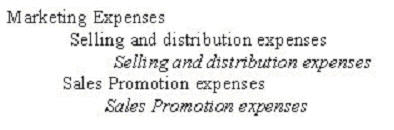

Create Cost Category and Cost Centres in the hierarchy as shown below.

|

Cost Category |

Under |

|

Depreciation |

Primary Cost Category |

|

Cost Centre |

Select Category |

Under |

|

Fixed Asset |

Depreciation |

Primary |

|

April |

Depreciation |

Fixed Assets |

|

May |

Depreciation |

Fixed Assets |

In the above example, fixed asset represents the asset for which depreciation has to be recorded. If you want to account depreciation of different assets separately, create separate cost centres representing each asset. The months represent the different periods.

With this hierarchy in place, allocate the depreciation value to the cost category (Depreciation) created and the cost centre for the respective period (July) in the journal voucher, as shown below.

This set of ledgers and cost centres created in a hierarchy will give you the Depreciation Chart.

Periodic Breakup of Deprecation

Go to Gateway of Tally > Display > Statement of Accounts > Cost Centres > Category Summary .